Live entertainment ticketing and promotion giant Live Nation (NYSE:LYV) stock is still down (-24%) for the year despite having its best quarter ever. The promotion powerhouse has emerged from the pandemic stronger and more dominant than ever. Live Nation is widely known for operating Ticket Master, but it also owns and operates live events entertainment venues and performs talent management for many artists under its Artist Nation brand. The Company has been Teflon amidst anti-competitive practice, price fixing, and hidden fee lawsuits. Live Nation has consolidated the segmented live events market by acquiring promotions and events, very similar to how World Wrestling Entertainment (NYSE:WWE) consolidated the professional wrestling industry. The digital streaming trend and e-commerce migration have been tailwinds driving momentum for the Company.

Here’s What the Charts Say

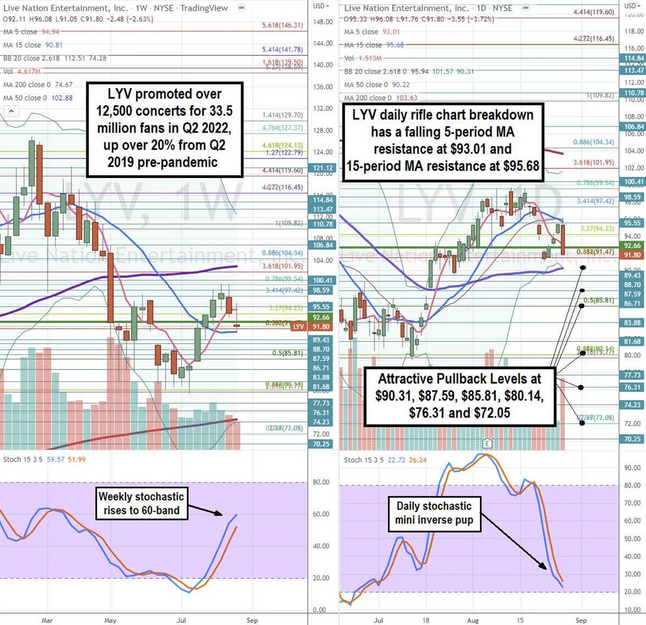

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for LYV stock. The weekly rifle chart downtrend has stalled as the 5-period moving average (MA) sloping up at $82.60. The weekly peaked out near the $94.32 Fibonacci (fib) level as the weekly stochastic slipped under the 80-band. The weekly stochastic is now crossing back up through the 40-band. The weekly market structure low (MSL) buy triggered above $82.26. The weekly upper Bollinger Bands (BBs) sit at $89.25. The daily rifle chart uptrend has a rising 5-period MA at $85.34 with a rising 15-period MA at $83.03. The daily stochastic is rising through the 80-band. Prudent investors can watch for opportunistic pullback levels at the $84.02 fib, $82.26 fib, $80.46, $79.47 fib, $77.96 fib, and the $76.27 fib level. The upside trajectories range from the $98.55 fib up to the $117.46 level.

Back to Growth

Live Nation has swung back into the green in a fierce way with blockbuster numbers and triple digit revenue growth. Live Nation promoted over 12,500 concerts for 33.5 million fans, up 20% over Q2 2019 pre-pandemic levels. Average ticket prices grew 10% over 2019 prices. Revenues grew over 40% higher than 2019 levels. Live Nation also added over 6 million fans in the second quarter, of which 5 million were from international markets as most global markets have re-opened for live events. The Company is has stated that demand for its largest pipeline of artists is stronger than ever. Major brands like Google (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) and Hulu became new sponsorship clients as they connect with fans (and their spending) globally. Fan spending grew by over 20% in June at all venues.

The Streaming Music Model is Driving Artists to Work Live Events

Most musical artists make very little if anything from actual music sales due to the streaming model. No one buys records, tapes or CDs any more. Everything is digital. For artists, this means the only real money comes from live performances at festivals and concert tours. Additional income comes from licensing, sponsorships, endorsements, and merchandise sales. Most artists see very little money for music sales. For example, a million streams on Apple Music (NASDAQ:AAPL) generates between $7,500 to $10,000 in total royalties, of which the artist may keep $1,500 to $2,500 based on a 20% to 30% royalty deal with the music label. On Spotify (NASDAQ:SPOT), one million streams can make $4,000 for an artist. These rates are steadily going down, which makes it more imperative for artists to find other ways to monetize their music.

Pent-Up Demand Driving Slingshot Rebound

The slingshot rebound surged Live Nation’s business through the roof as it promoted over 12,500 concerts for 33.5 million fans in Q2 2022 and added 6 million new fans. Double-digit venue increases at all venue types including stadiums to night clubs was driven by strong demand. On Aug. 4, 2022, Live Nation released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an earnings-per-share (EPS) profit of $0.66 beating consensus analyst estimates for a profit of $0.52, beating estimates by $0.14. Revenues rose 670% year-over-year (YOY) to $4.43 billion, smashing analyst estimates for $3.92 billion. International sales was responsible for 60% of its growth. This was the highest quarterly attendance ever. Ticketmaster had a record quarter with adjusted operating income (AOI) up over 86% and transacted gross transaction values (GTV) grew 76% YoY.

Live Nation CEO Michael Rapino commented:

"As we look forward to the second half of 2022 and into 2023, we have sold over 100 million tickets for our concerts this year, more than we sold for the entire year in 2019. Fan demand remains strong, with continued growth in ticket buying and on-site spending. And given the long-term nature of most of our sponsorship partnerships, our planned sponsorship for the year is now fully committed. As we prepare for 2023, everywhere globally is open for concerts, and we are actively routing into all markets with the largest artist pipeline we have ever seen at this point in the year.”