China has gotten tired of playing “tariff tag” with the Trump administration. It’s now playing a new game called the “devalue stock dump.” It consists of China aggressively devaluing the Yuan in an effort to crash the US stock market.

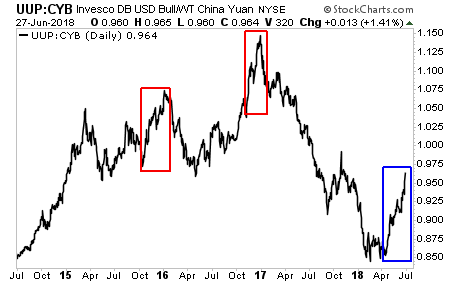

If you think I’m being overly dramatic here, have a look at the below chart. This current devaluation is already on par if not worse than those of August 2015 and January 2016.

PowerShares DB US Dollar Bullish Vs. WisdomTree Chinese Yuan Strategy

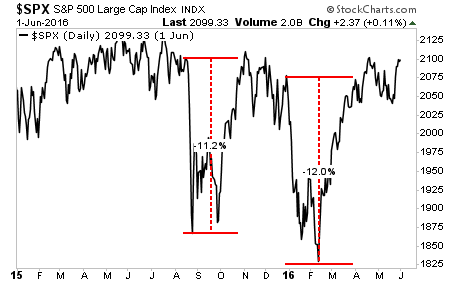

By the way, those last two devaluations (red boxes) resulted in the S&P 500 dropping 11% and 12% in less than one week.

Put simply, China is done messing around. It is actively trying to crash the US stock market to send a message to the Trump administration. China knows that President Trump views the stock market as a “report card” on his performance as Presidency.

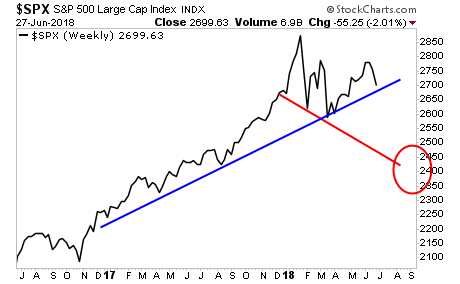

Bear in mind, most Emerging Markets (including China) are already in bear markets, having dropped ~20%. If the US stock market follows suit, we’re talking about the S&P 500 down in the 2,3-00-2,400 range.