Yesterday, the US announced Tariffs on Steel and Aluminum, which prompted an outcry from various global leaders and an acceleration in the risk-off bias affecting markets this week. The White House signalled a 25% tariff on Steel and a 10% tariff on Aluminium, starting next week.

EU’s Junker said that he strongly regrets US restrictions on steel and aluminium affecting the EU, which will react firmly to defend interests with a proposal for WTO compatible countermeasures against the US within the next few days. The Canadian Trade Minister said any US tariff quota imposed on Canadian steel would be unacceptable. S&P 500 sold off to 2670.00, with the Dow Jones down to 24533.0, while Gold moved up to 1320.20. In FX, USD/JPY fell from 107.193 to a low of 106.161 but has continued overnight to reach 105.744. GBP/USD reached a high of 1.37846, while EUR/USD got up to 1.22726.

Polish Purchasing Manager Index (Feb) was 53.7 v an expected 54.1, from 54.6 previously.

Swiss Real Retail Sales (YoY) (Jan) was -1.4% v an expected 1.1%, from 0.6% previously, which was revised up to 0.7%.

German Markit Manufacturing PMI (Feb) was 60.6 v an expected 60.3, from 60.3 previously. EUR/USD moved lower from 1.22010 to 1.21797 after this data.

Italian Unemployment (Jan) data was released, coming in at 11.1% against an expected reading of 10.8%, from 10.8% previously, which was revised up to 10.9%.

Eurozone Markit Manufacturing PMI (Feb) was 58.6 v an expected 58.5, from 58.5 previously.

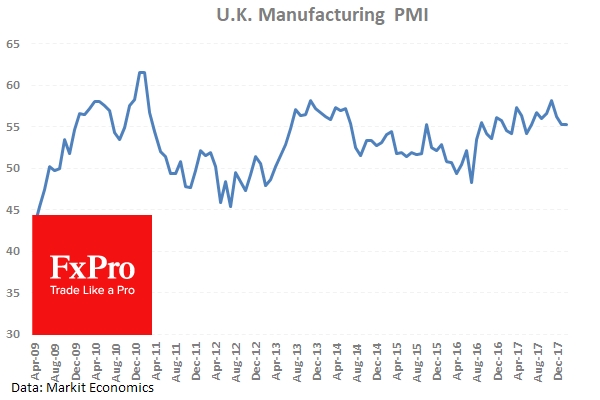

UK Markit Manufacturing PMI (Feb) was 55.2 v an expected 55.0, from 55.3 previously. Consumer Credit (Jan) was £1.357B v an expected £1.40B, from a prior £1.52B, which was revised up to £1.58B. Mortgage Approvals (Jan) were 67.478K v an expected 62.000K, from a previous 61.039K, which was revised up to 61.692K. GBP/USD initially moved higher to 1.37636 before selling off to 1.37272 after this release.

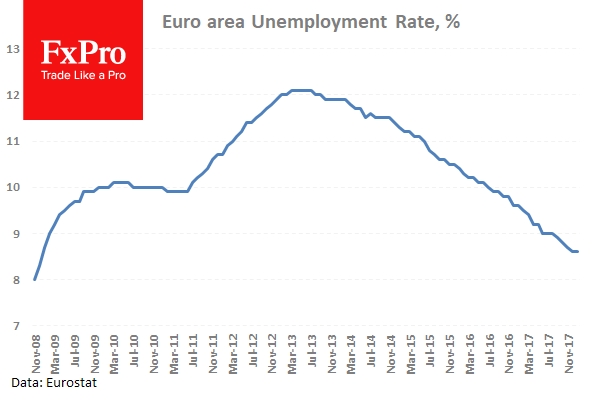

Eurozone Unemployment Rate (Jan) data was released as expected, with a reading of 8.6%, from 8.7% previously, which was revised down to 8.6%. This was the lowest level for this data since the highs of 12.2% in October 2013 and compares well with the 2003 to 2005 period. EUR/USD moved higher from 1.21796 to 1.21958, as the EUR gained strength from the positive data.

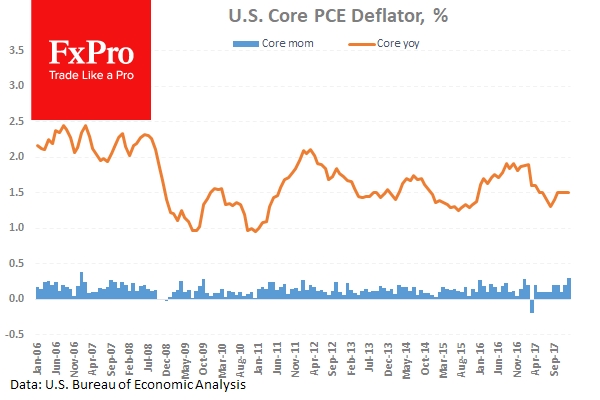

US Personal Consumption Expenditures – Price Index (YoY) (Jan) was 1.7% v an expected 1.6%, from 1.7% previously. Core Personal Consumption Expenditures – Price Index (MoM) (Jan) was as expected at 0.3%, from 0.2% previously. Personal Consumption Expenditures – Price Index (MoM) (Jan) was 0.4% v an expected 0.0% from 0.1% previously. Personal Income (MoM) (Jan) was 0.4% v an expected 0.3%, from 0.4% previously. Personal Spending (Jan) was as expected at 0.2%, from 0.4% previously.

Core Personal Consumption Expenditures – Price Index (YoY) (Jan) was as expected, unchanged at 1.5%. Continuing Jobless Claims (Feb16) were 1.931M v an expected 1.930M, from 1.875M previously, which was revised to 1.874M. Initial Jobless Claims (Feb 23) was 210K v an expected 226K, from 222K previously, which was revised down to 220K. USD/JPY moved higher from 106.755 to a high of 107.043 as a result of this data.

Canadian Current Account (Q4) was -16.35B v an expected -17.80B, from -19.35B prior. USD/CAD fell from 1.28638 to 1.28408 after this release. Canadian Markit Manufacturing PMI (Feb) was released at 55.6 against an expected 55.8, from 55.9 prior.

US Markit Manufacturing PMI (Feb) was 55.3 v an expected 55.9, from a prior read of 55.9.

US Fed Chairman Powell testified on the Semi-annual Monetary Policy Report before the House Financial Services Committee, in Washington DC. He made the following comments: The US economy is near full employment but force participation and wage growth still have some slack. “More strengthening can take place in the jobs market before wage inflation”. He said that there is “No evidence the economy is currently overheating” and he would expect to see more wage hikes adding “That’s what we’re waiting to see”. He said that, in order to prolong the recovery, we believe “gradual” hikes are the best course of action and 4 hikes would be considered “gradual”.

US ISM Prices Paid (Feb) was 74.2 against an expected of 70.5. The previous reading was 72.7. ISM Manufacturing PMI (Feb) was also out at this time, coming in at 60.8 against an expectation for a number of 58.7, from 59.1 prior. Finally, Construction Spending (MoM) (Jan) was 0.0% v an expected 0.3%, from the previous reading of 0.7%, which was revised up to 0.8%. USD/CAD dropped to 1.28124 but recovered to 1.28550 as a result of this data.

New Zealand Building Permits s.a. (MoM) (Jan) was released at 0.2%, from -9.6% previously, which was revised up to -9.5%.

Japanese Job/Applicants Ratio (Jan) was 1.59 v an expected 1.60, from 1.59 previously. Unemployment Rate (Jan) was 2.4% v an expected 2.7%, from 2.8% previously.

EUR/USD is unchanged overnight, trading around 1.22627.

USD/JPY is down -0.30% in early session trading at around 105.904.

GBP/USD is unchanged this morning, trading around 1.37781.

Gold is up 0.04% in early morning trading at around $1,317.10.

WTI is down -0.77% this morning, trading around $60.82.

Major data releases for today:

At 08:10 GMT, ECB’s Mersch is expected to deliver a speech, with any mention of monetary policy or an end to QE likely to influence EUR markets.

Tentative – UK PM May is expected to deliver a speech on Brexit progress and the ongoing negotiations with the EU. Of particular interest will be policy on trade regulations and the Northern Irish border. Her comments could impact GBP and EUR markets.

At 09.30 GMT, UK Construction PMI (Feb) will be released and is expected at 50.5 with a prior number of 50.2. GBP crosses may experience volatility if the number differs from the expected reading. This data is based on a survey of purchasing managers, with a reading above 50 indicating expansion and below 50 indicating contraction. This number has been trending down since a high of 64.7 in February 2014. Positioned close to 50, there is a danger that the trend is maintained and contraction is experienced, which would be negative for the GBP, as occurred in October 2017.

At 10:00 GMT, BOE Governor Mark Carney is due to speak about the evolution of money and the emergence of cryptocurrencies, in London.

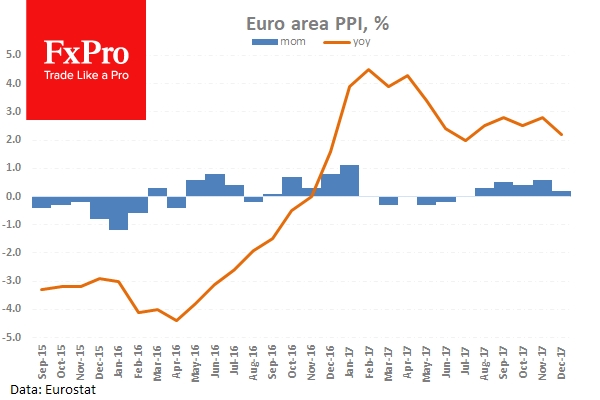

At 10:00 GMT, Eurozone Producer Price Index (YoY) (Feb) is expected to be 1.6% from 2.2% previously. EUR crosses could be moved by this data, with a positive reading greater than the consensus adding strength to the EUR.

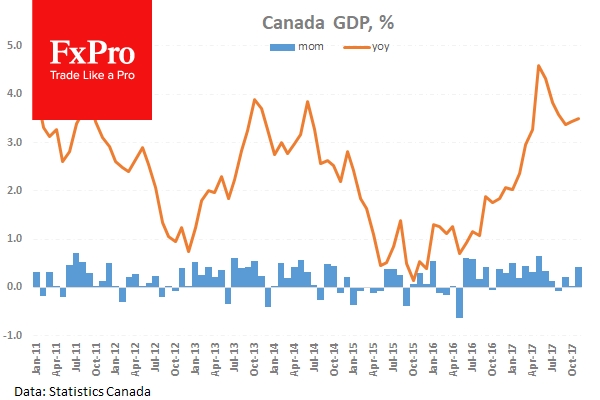

At 13:30 GMT, Canadian Gross Domestic Product (MoM) (Dec) is expected at 0.1%, with a prior reading of 0.4%. The range of this data point since 2010 has been between +0.6% and -0.6%, and a reading outside of this range would result in a larger market reaction. Gross Domestic Product Annualized (QoQ) (Q4) is expected at 2.0%, with a prior reading of 1.7%. CAD pairs could experience volatility before and after this data is released.

At 18:00 GMT, Baker Hughes US Rig Count numbers will be released. The prior number last Friday showed that there were 799 Oil rigs in operation. WTI oil traders will be paying close attention to this number as they look to the week ahead, with an increase from the prior week showing an expansion and indicating an increase in the volume of crude oil drilled. In the context of supply and demand, this would mean an increase in supply. The Number of operational rigs has not been at the 800 level since 2015.