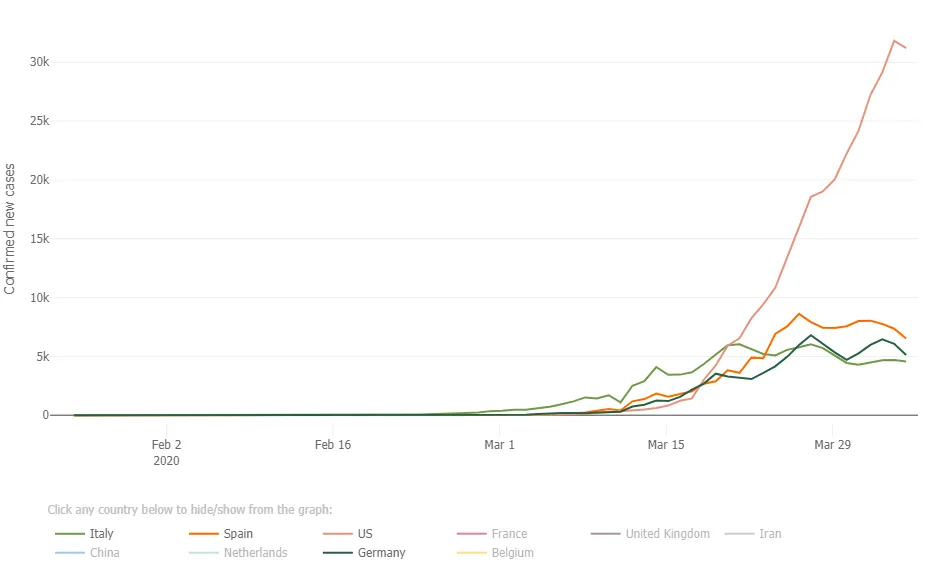

Stocks ran higher on April 6, with the S&P 500 jumping by about 7%, a significant gain. There seems to be some optimism that the curves are flattening. It appears to be happening in some parts of the world, like Italy, Germany, and Spain, it may be too early to get excited here in the US. The chart below clearly shows that the number of new cases is now falling in those three countries, but they are good 2 to 4 weeks ahead of the US. While I most want this to pass as soon as possible, I am cautiously optimistic and fear the market is getting ahead of itself.

The chart clearly shows that both Italy, Germany, and Spain had two waves in it. While I am most certainly not a Doctor or Statistician, I can read charts exceptionally well, and that seems clear as day to me, the double tops. So we can hope and pray, but let’s be careful still.

S&P 500 (SPY)

The S&P 500 was able to clear what I think was an essential level of resistance around the 2,630 regions, and that could suggest that we likely test 2,725. I’m not sticking my neck out here, though; we need to see confirmation that and follow through today. I was seeing a lot of bearish options betting on the S&P 500 and VIX.

On the daily chart, we see that both the RSI and the advance/decline line appear to have broken a downtrend, barely. So again, today, we will need to see a confirmation and follow through.

Apple (AAPL)

Apple (NASDAQ:AAPL) reached resistance at $257 yesterday and was also able to poke above it. Again, with confirmation today, it could probably rise to around $275.

Visa (V)

Visa (NYSE:V) rose sharply, reaching resistance at $170. I’m not sure the stock gets back over resistance today. If not, it falls back to $150.

Amazon (AMZN)

Amazon (NASDAQ:AMZN) was able to get back to resistance yesterday at $2000 and is where it stopped going up.

Texas Instruments (TXN)

Maybe a good indicator of where things are going to go is Texas Instruments (NASDAQ:TXN), the stock also rose just above resistance yesterday, and again, if we get a follow-through today, it can probably go to $115.60.

Alibaba (BABA)

Alibaba (NYSE:BABA) needs to get over $197, or its risks going right back to $187.