Stocks raced higher yesterday as markets believe the Fed is again pivoting. I’m sorry to say I think they will again be very disappointed because stocks don’t pay attention to the details.

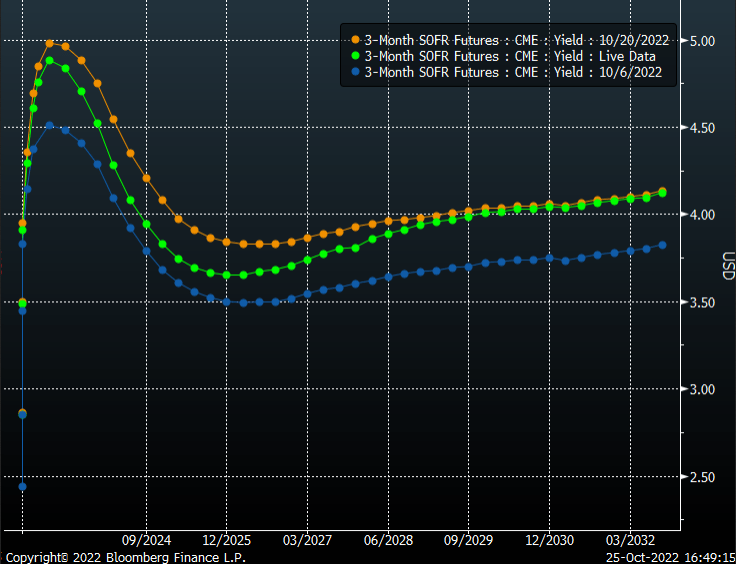

Fed Funds Futures have fallen by a whole ten bps since Thursday. Yes, ten bps to a peak rate of 4.9% from 5.0%. The last time the S&P 500 was trading, around 3,850 Fed fund futures were pricing at the peak of 4.5%.

On October 6, the 2-year was trading at 4.26%, and the 10-year was trading at 3.82%. So bond yields are up, let’s say, up about 20 to 40 bps, but stocks are back to where they were. But the Fed is pivoting? Where is the Fed pivoting to? Bonds are still pricing higher rates than were expected on October 6. So, where exactly has the Fed pivoted? The bond market doesn’t think it has. Sure, yields have fallen some from their parabolic rise.

Anyway, as you can tell, I am beyond tired because fighting the market is a very tiring experience, especially when the same issue comes up again and again and again.

NASDAQ ETF

The QQQ traded up sharply yesterday, but failed to get past resistance at $284 meaningfully. The QQQ is now trading at $280 after disappointing Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) results. If the market trades lower today, we could be looking at a failed breakout attempt.

Microsoft

Microsoft fell despite reporting better-than-expected results. The cloud business came in as expected, and Azure saw a slowdown. It will come down to guidance on the conference call. It is probably not by chance that Microsoft stopped rising at the same resistance region as the Qs stopped rising.

Alphabet

Alphabet missed on both revenue and earnings, sending the shares down. The stock is currently trading back at the recent lows, with $97 being the critical support level. After that, the shares could slip to around $83.