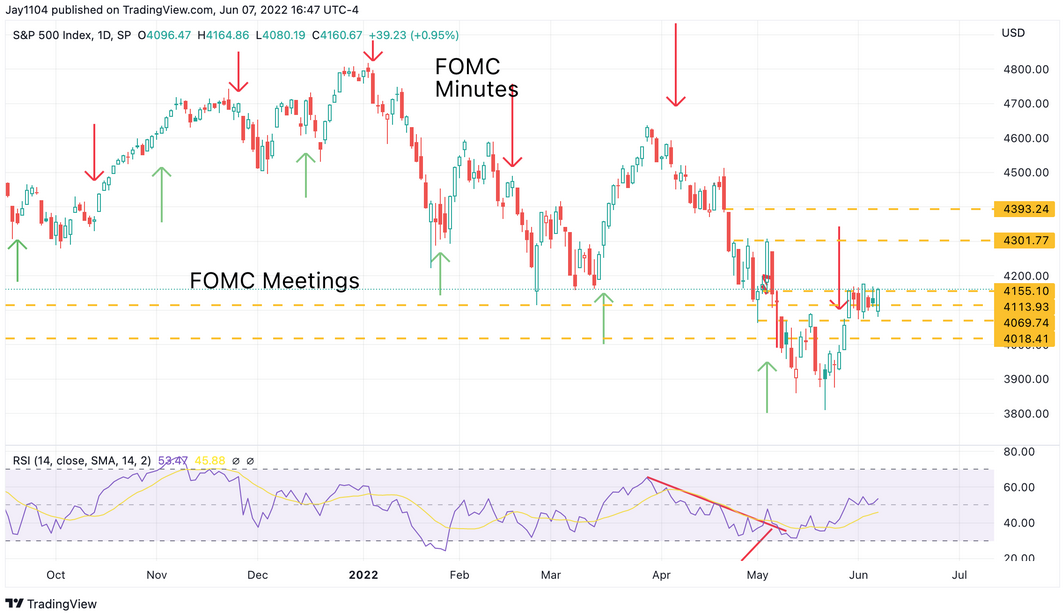

Tuesday was the opposite of Monday, with the S&P 500 dropping to start the day and rallying to end the day higher by 1ish%.

At this point, this has turned into one giant period of nothingness, and sideways consolidation, with the index, basically stuck between 4,090 and 4,160.

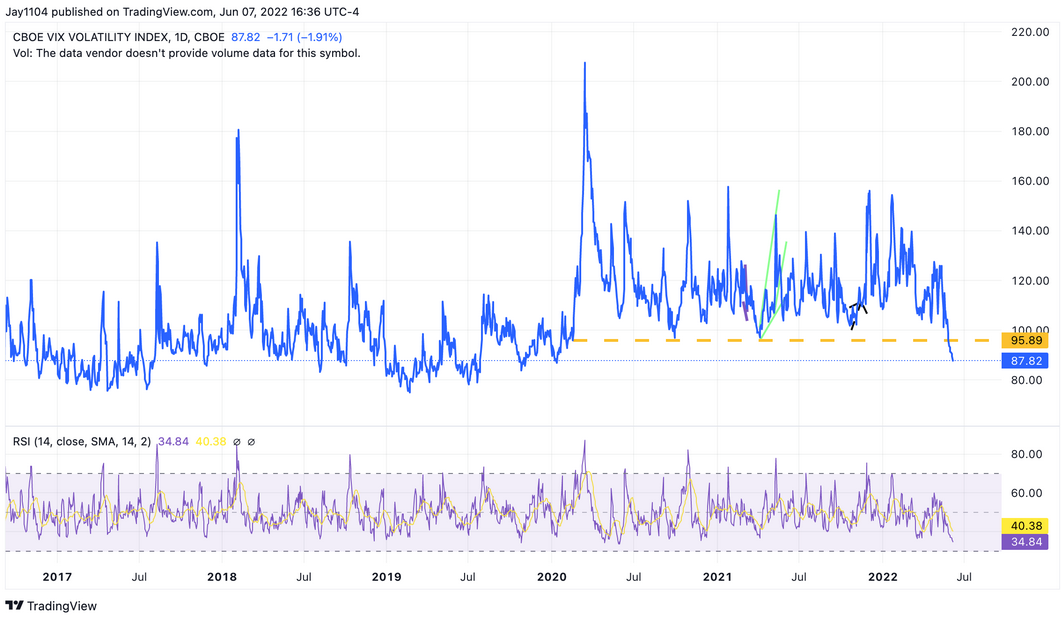

I have no great insights here, other than a lot of event risk coming, and the VIX is getting a bit too low now, closing at 24. What is even more bizarre is that on May 27, the VIX was at 25.70, and Tuesday, it was at 24, while the S&P 500 was virtually unchanged.

So the market has been burning up a lot of implied volatility compression to go nowhere and keep its head above water.

Maybe everyone is fully hedged, but the VVIX is at levels not seen since January 2020, when the VIX was at 12.50. That tells us that buying protection using the VIX right now is pretty cheap because the implied volatility level is low.

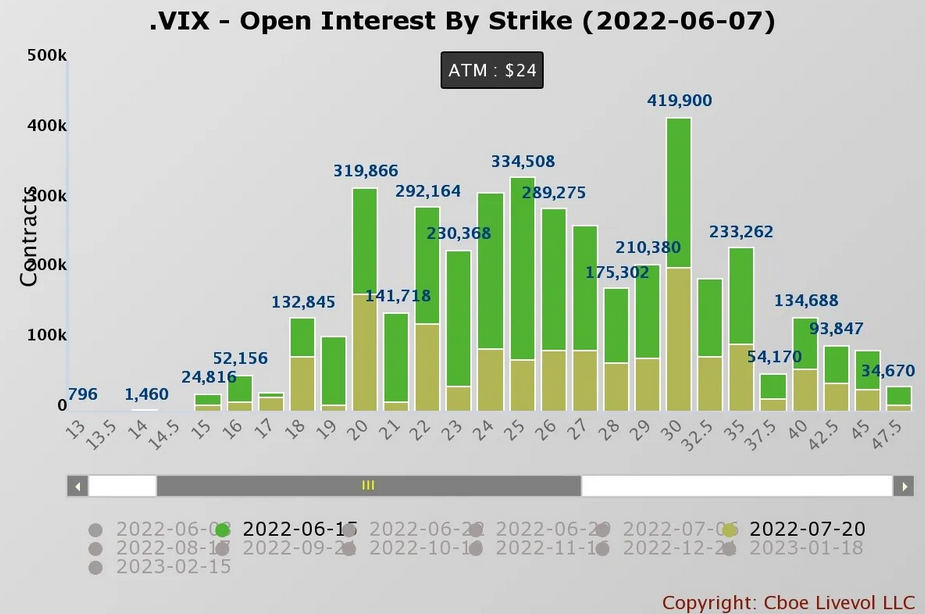

Anyway, we will see how much longer this game can go on, but I think it can’t go on for much longer. The problem is that the VIX options expiration next Wednesday takes place on the open of trading in the morning, and the FOMC meeting is in the afternoon.

We can see that open interest for June is much higher than for July, so traders will need to reload those positions to capture the FOMC.

Nothing has changed for me. I still think the S&P 500 will trade back down to 3,980 in the near term. Does that mean the S&P 500 can’t get up to 4,250 first? It could.

But, ultimately, the upside is limited because there are too many significant events happening and there is bound to be a surprise somewhere along the way.

Given the sell-off in the market following the last FOMC and the rally post-Fed minutes, there is a very good chance the cycle has reversed, and the VIX spikes in the days following the FOMC.

Boeing

Boeing (NYSE:BA) is starting to look better. The stock found and held support at around $120 and, perhaps more importantly, has risen above a downtrend in the relative strength index, which I think is a big positive and bullish.

The only thing standing in the way right now is a downtrend on the price chart around $145.