Trading position: (short-term, my opinion; S&P 500 futures contract): In my opinion, the short-term outlook is neutral, and no positions are currently justified from the risk/reward point of view.

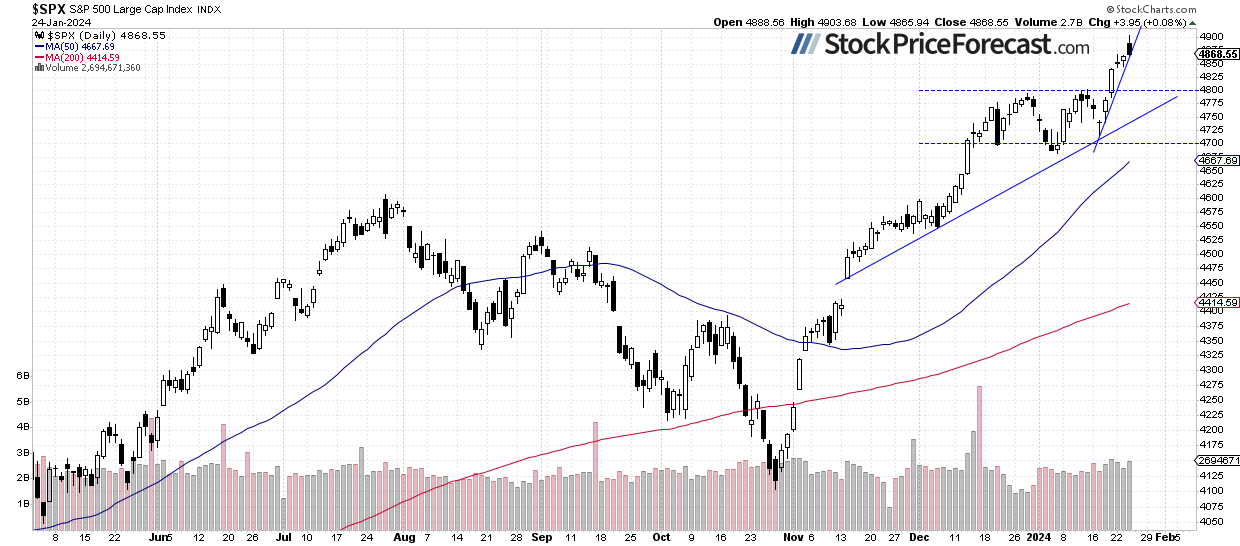

There is a lot more uncertainty in the market right now, and despite reaching a new record, the uptrend is no longer as evident. Yesterday, the S&P 500 index set a new all-time high at the level of 4,903.68, but at the close, it gained only 0.08%. It's becoming more challenging to speak definitively about trend following, and if someone is still bullish, they should consider at least partially closing positions.

Surprisingly, investor sentiment has slightly worsened once again - yesterday’s AAII Investor Sentiment Survey showed that 39.3% of individual investors are bullish, lower than the previous week. Meanwhile, the neutral reading increased to 34.6%. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

Nevertheless, investor sentiment is still historically bullish ahead of the upcoming quarterly earnings releases and the expected monetary policy easing by the Fed this year.

Last Friday, stock prices broke above their month-long trading range, invalidating any potential medium-term topping pattern scenarios. On Monday, I wrote that “in the short term, one would expect some downward correction as the market becomes increasingly overbought”. Despite a new high, it seems that a correction scenario is likely in the near term. The market rallied from its Wednesday’s daily low of around 4,715 – an advance of almost 190 points. Of course, it's hard to tell if this marks the peak of a rally, but caution may be advised, as a correction or consolidation could occur at some point.

The S&P 500 futures contract is trading 0.2% higher following yesterday’s quarterly earnings release from Tesla (NASDAQ:TSLA). Despite the stock being down 9% in pre-market trading, better-than-expected economic data has boosted sentiment. Consequently, the S&P 500 index is likely to retrace some of its intraday decline from yesterday this morning. Investors will be awaiting more important earnings reports. After today's session closes, the market will receive a report from INTC.

The market retreated from the 4,900 level, as we can see on the daily chart.

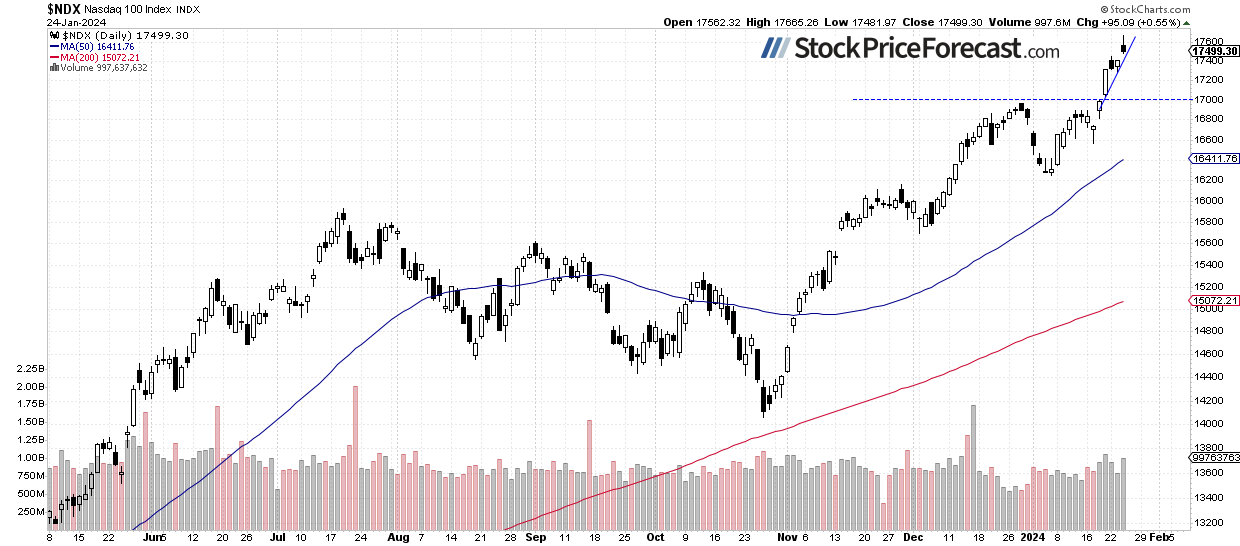

Nasdaq Remains Relatively Stronger

Yesterday, the technology-focused Nasdaq 100 index reached a new all-time high at the level of 17,665.26. This morning it is expected to 0.3% higher after yesterday’s intraday pull-back. The market isn’t reacting significantly to Tesla's quarterly earnings release, with TSLA trading almost 9% lower in the pre-market.

In early January, it bounced sharply, followed by another advance and closing above the important daily gap down of 16,687-16,758, which was a positive signal. Consequently, it broke to new record highs last week. However, a correction may occur at some point as the market is currently technically overbought in the short term.

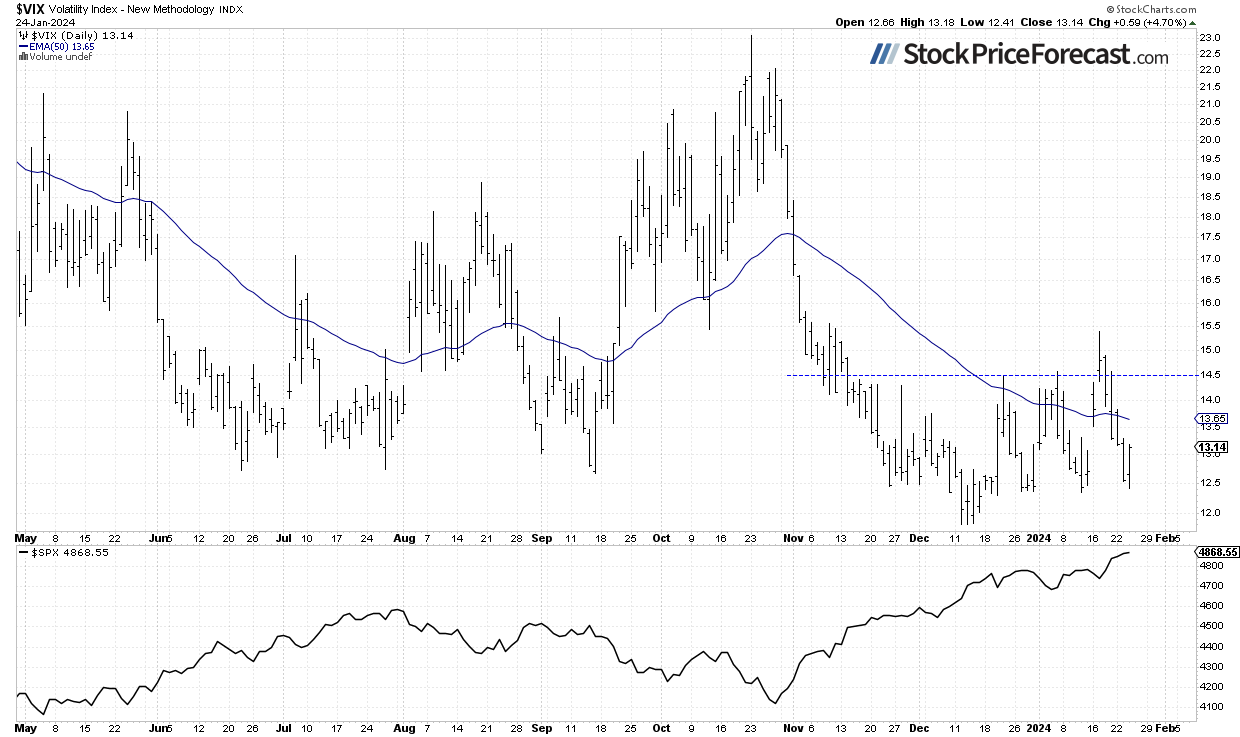

VIX Bounced From New Low

The VIX index, also known as the fear gauge, is derived from option prices. On Thursday, it came back below the 14.50 level, marked by the previous local highs. Subsequently, it continued its decline in response to advancing stock prices. Yesterday, it rebounded from the previous local lows in the 12.00-12.50 range, gaining almost 5%.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

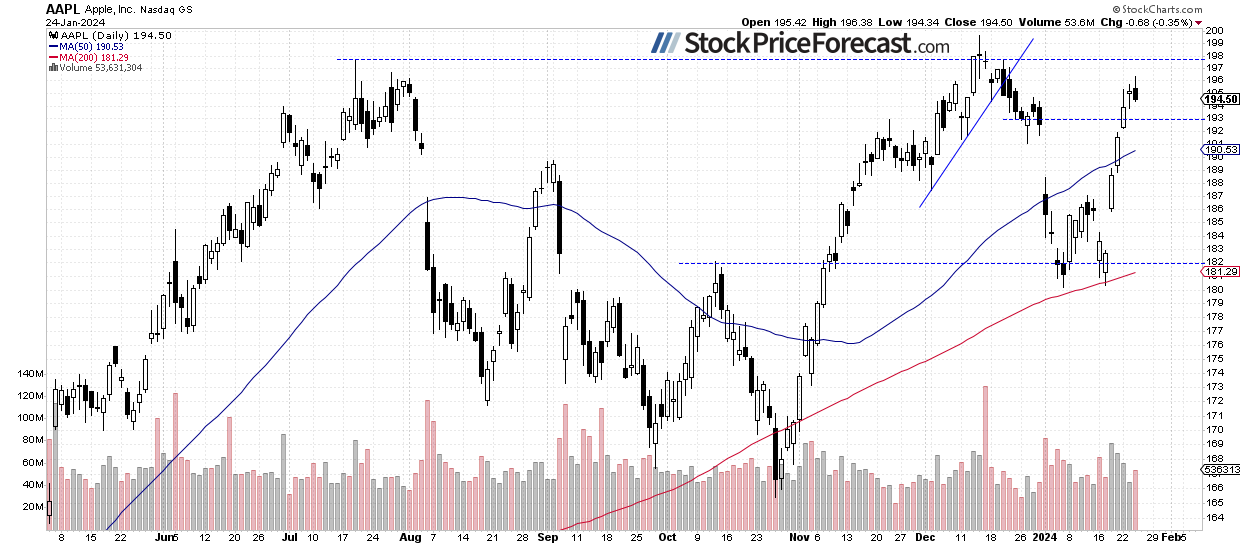

Apple (NASDAQ:AAPL) - Consolidation Below Important $200 Mark

Let’s move on to an individual stock – Apple, which is one of the most important market movers. In early January, it experienced a sharp sell-off. The decline has been significant, suggesting a change in trend. On January 8, I wrote that “(…) the stock approached a potential support level of around $180.” and “The market may see a rebound here.”

This prediction proved accurate; last week, Apple broke above the resistance level of $188-190. This week, the market reached a potential resistance level of $195-200, where it is likely to consolidate as investors await the quarterly earnings release on February 1.

Futures Contract Trading Along 4,900

Let’s take a look at the hourly chart of the S&P 500 Futures contract. This morning, it is trading above the 4,900 level. It retraced yesterday’s intraday rally to new high of around 4,933. There have been no confirmed negative signals so far; however, the market became increasingly overbought in the short-term. The support level remains at 4,880-4,900, marked by the recent consolidation.

Conclusion

Stocks are likely to open slightly higher this morning, following yesterday’s Tesla earnings release and today’s important economic data. The Advance GDP number came in much higher than expected at +3.3% vs. expected +2.0% q/q. Investor sentiment remains elevated ahead of upcoming quarterly corporate earnings releases, but a correction or consolidation may occur at some point.

On December 21, I mentioned that “in a short-term the market may see some more uncertainty and volatility”, and indeed, there was a lot of uncertainty following the early-December rally and the breakout of the S&P 500 above the 4,700 level. However, last Friday’s price action left no illusions of a potential medium-term trend reversal. The market is overbought in the short term, but predicting a correction is currently very challenging.

For now, my short-term outlook remains neutral.

I think that no positions are justified from the risk/reward point of view.

Here’s the breakdown:

- The S&P 500 reached new record high yesterday, but there may be some uncertainty in the near term.

- The breakout above the recent highs marked a positive signal; however, it’s uncertain whether the market won’t retrace some of the rally. The index may be nearing the peak of a short-term uptrend.

- In my opinion, the short-term outlook is neutral, and no positions are justified from the risk/reward point of view.