Stocks finished the day lower, with the S&P 500 dropping by around 1.1%. The index had been down nearly 1.8% at its worse. The market seems to be facing several headwinds that will make it hard to see an end-of-year melt-up.

COVID cases are on the rise, the fiscal stimulus deal appears to be shelved, and the Fed is tightening monetary policy all at the same time. The equity market is sure not to like this situation very much; it shouldn’t.

Before this is all said and done, the markets will likely be screaming for the Fed to reconsider its tapering schedule and demand the Fed stop the taper altogether. Give this a few more days to all seep into the market’s train of thought. I don’t see how this end-of-year rally is going to manifest itself.

S&P 500

Even the VIX is hardly positioned to help. The VIX was at 27.35 at its peak on Monday and closed at 22.86, a pretty significant drop, and all the index could rally was about 60 bps, hardly equal to the big Vanna rally we saw after the Fed meeting. Perhaps the S&P 500 attempts to fill that gap at 4,620, and the VIX pushes back to 20. But I’m not too fond of the macro factors heading into the final days of the year.

Treasuries/Bonds Ratio

The IEF/LQD ratio moved sharply higher Monday, indicating that financial conditions are likely still tightening. Not a positive for stocks and an indication that the VIX can remain elevated for some time longer.

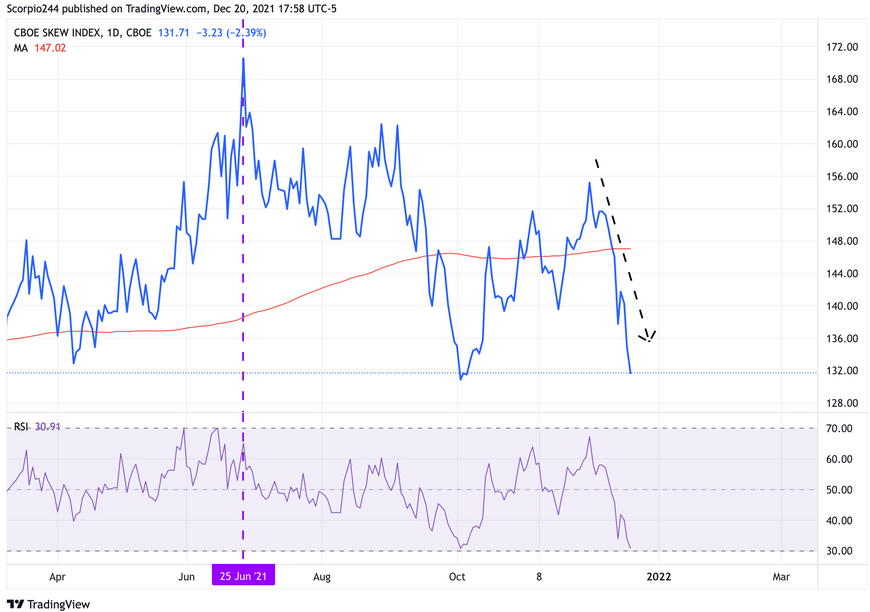

Skew Index

Another indication that the VIX may not be so fast to come down is that the SKEW index continues to decline. It fell again yesterday, which is an indication that traders aren’t looking for out-of-the-money options for hedging, which means they probably aren’t selling volatility.

Shopify

Shopify (NYSE:SHOP) finished very close to a significant level of support, around $1,280. A break of that support level likely leads to a considerable drop, perhaps to about $1030.

Tesla

Tesla (NASDAQ:TSLA) closed below support yesterday at $910, and the uptrend, a bearish indication. It suggests there is still further to fall here, with the next level to watch for around $840.

Chipotle

Chipotle Mexican Grill (CMG) still looks weak, too. The stock managed to rise back to resistance at $1,750 and failed. It seems like it wants to move to $1575 and then make a more significant move down.