The release of the higher-than-expected Consumer Price Index (CPI) on Tuesday led to a pull-back in stocks, and on Wednesday, the S&P 500 index gained almost 1% as dip-buying prevailed again.

Recently, the stock market continued to rally, fueled by advances in a handful of tech sector stocks, but as I wrote last Wednesday, “We may have to deal with a correction or consolidation of several weeks of advances. With the season of quarterly earnings announcements coming to an end and a series of important economic data, profit taking may follow.”

This morning, futures contracts indicate that stocks are likely to open 0.2% higher, retracing some more of Tuesday's losses. The Retail Sales data release has been worse than expected at -0.8% m/m.

Investor sentiment has worsened a bit; yesterday’s AAII Investor Sentiment Survey showed that 42.2% of individual investors are bullish, while 26.8% of them are bearish. The AAII sentiment is a contrary indicator in the sense that highly bullish readings may suggest excessive complacency and a lack of fear in the market. Conversely, bearish readings are favorable for market upturns.

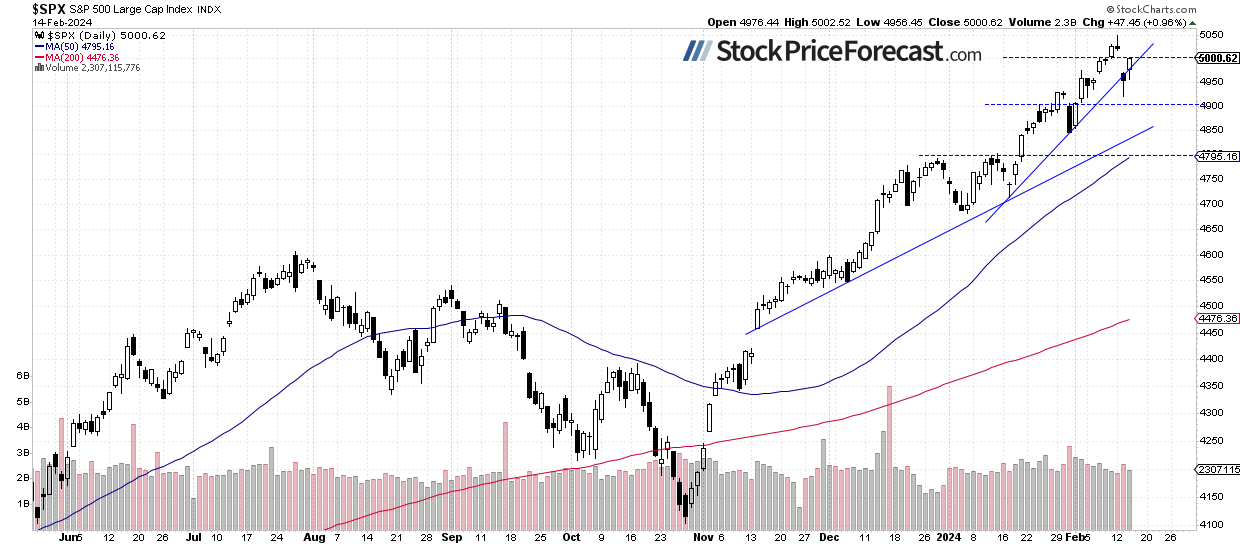

On Tuesday, I mentioned, "The market may return to a month-long upward trend line, currently around 4,950", and indeed, the S&P 500 did just that, briefly dipping below that line. The previous highs and lows from January acted as support levels around 4,900, as we can see on the daily chart.

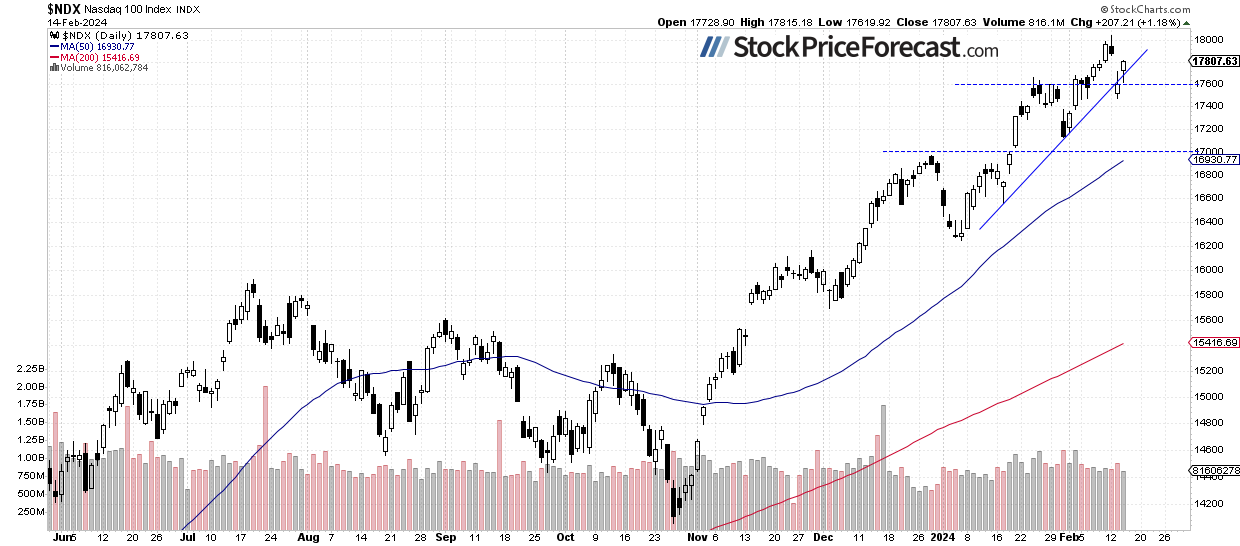

Nasdaq 100 Also Bounces

On Monday, the technology-focused Nasdaq 100 index reached a new all-time high at 18,041.45, and on Tuesday, it sold off below the 17,500 level. Recently, it has been relatively weaker than the broader stock market, but last week, it caught up with the S&P 500. However, Nasdaq’s rally was led by a handful of “FANG” stocks like META (NASDAQ:META), NVDA and MSFT. Last Wednesday, I wrote about the NYSE FANG+ index. Yesterday, it gained over 1%, getting back above a month-long upward trend line.

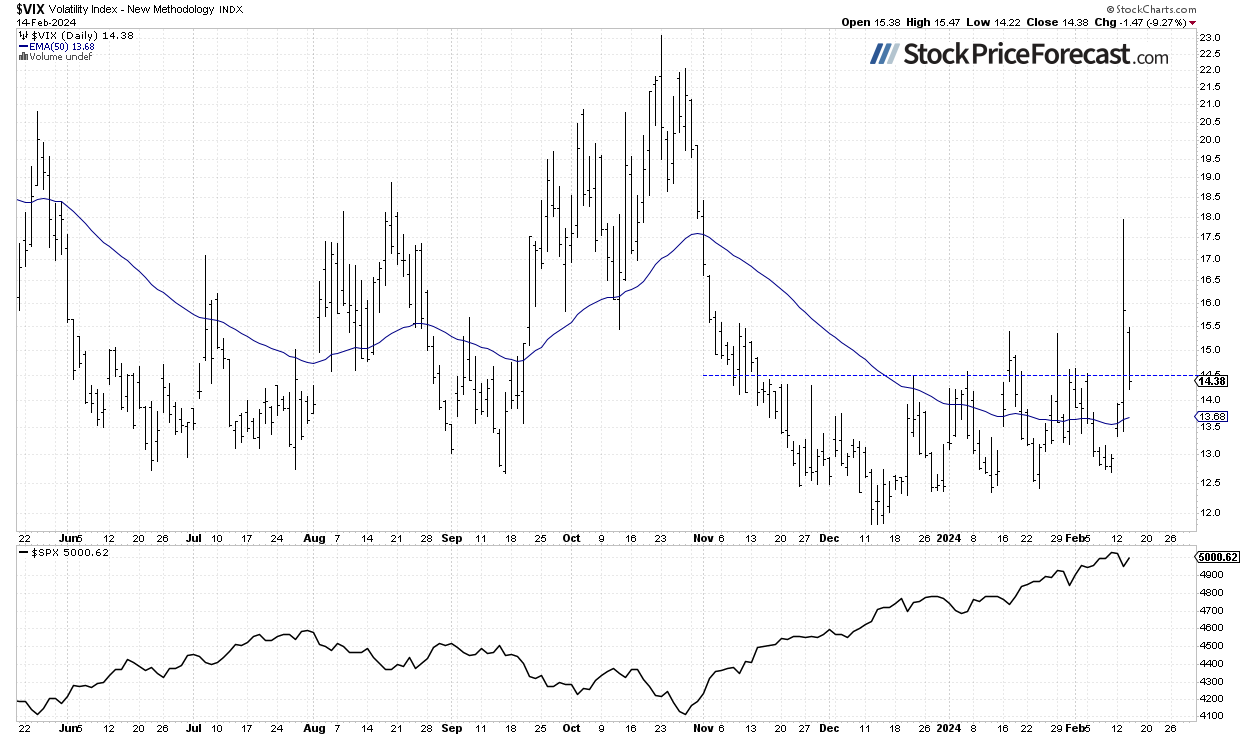

VIX – Retracing Tuesday’s Advance

The VIX index, also known as the fear gauge, is derived from option prices. Last week, it fell below the 13 level, indicating a lack of fear in the market as stock prices reached record highs. However, on Tuesday, it broke above the previous local highs of around 15.00-15.50, peaking at 18. Yesterday, it retraced closer to the 14 level.

Historically, a dropping VIX indicates less fear in the market, and rising VIX accompanies stock market downturns. However, the lower the VIX, the higher the probability of the market’s downward reversal.

Futures Contract Bounces to 5,000

Let’s take a look at the hourly chart of the S&P 500 futures contract. On Tuesday, the market sold off following the CPI announcement. However, it had already begun to retreat from its record high. The local low was around 4,940, and since then, the market has been retracing the declines. This morning, it’s trading above the 5,000 level. The potential resistance level is at around 5,040-5,060.

Conclusion

The recent trading action was very bullish, with some of the tech stocks rallying to new record highs, the S&P 500 index breaking above 5,000, and the Nasdaq 100 index getting close to 18,000. In my analysis on Tuesday, I noted that, “in the short term, the possibility of a downward correction cannot be overlooked. A quick glance at the chart reveals that the S&P 500 index has recently become more volatile.”. Indeed, the correction occurred pretty fast, with the inflation number contributing to the downturn.

This morning, the market is likely to retrace more of Tuesday’s decline, with the S&P poised to open 0.2% higher. In the short term, we can expect consolidation and an increased volatility. The index will likely fluctuate around support and resistance levels as investors seek to capitalize on profits following the rally from last year's late October low.

For now, my short-term outlook remains neutral.

Here’s the breakdown:

- The S&P 500 is likely to extend its yesterday’s rebound this morning.

- A consolidation phase may ensue, following an extended rally over the past months.

- In my opinion, the short-term outlook is neutral.