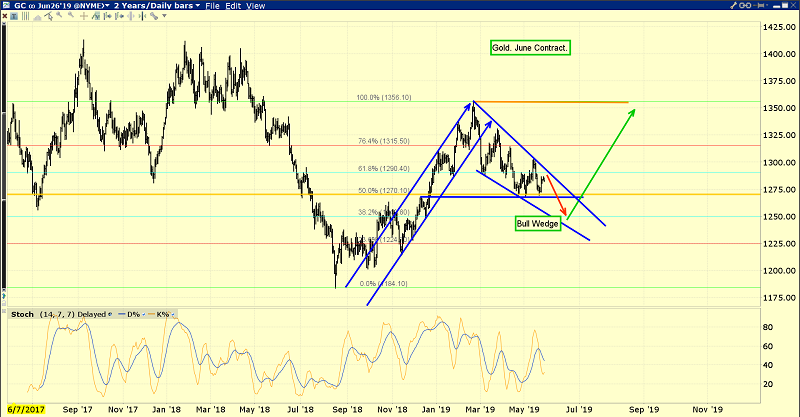

The fear trade for gold continues to gain fundamental strength. The technical picture is also solid. Gold is poised for significant upside action in the second half of this year.

A large bull wedge is in play as institutional investors become more concerned about the slowing global economy.

This Nasdaq ETF chart QQQ looks particularly concerning. A break under the $177.50 price zone could be followed by a significant decline.

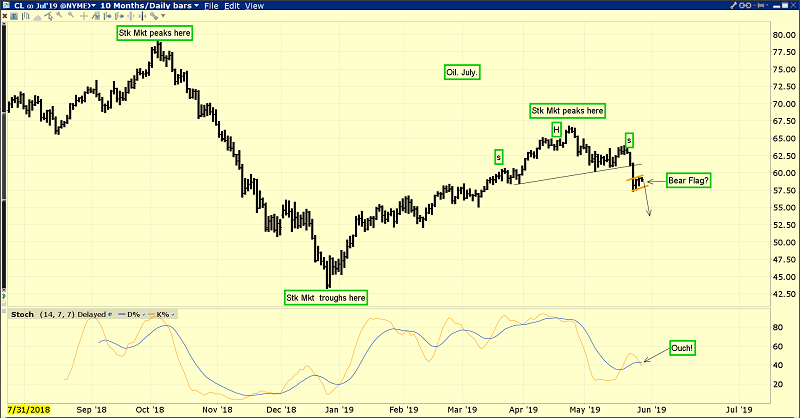

The recent peaks and troughs for the stock market are in sync with the peaks and troughs for the price of oil. If oil can’t rise with Iran being pounded by US government sanctions, something is wrong.

Oil could crash if there’s a softening of the sanctions and that could cause a stock market crash.

This is the oil price chart. Low priced oil helps consumers, but it hurts stock market earnings. An ominous bear flag has appeared on the chart.

US frackers need $60 oil on a consistent basis. They help provide the stock market with the earnings growth it needs to satisfy institutional investors.

$60 oil on a sustained basis is just not happening right now, and I don’t expect it will happen without a major upturn in the global economy.

Institutional analysts are beginning to view the tariff taxes as a growth-inhibiting quagmire that won’t go away for a long time.

They are also beginning to talk about the inflationary implications of the tariffs. What happens if inflation picks up and Trump successfully pressures the Fed into leaving rates alone?

That could cause much greater concern about inflation amongst economists and money managers would likely turn to gold to protect their portfolios.

The second of half of 2019 is likely to see gold get significant investor interest… particularly if the stock market continues to weaken while inflationary pressures rise.

Both my short-term and medium-term stock market trade signals have moved to a “sell”. The long-term buy signal is still holding but it looks shaky.

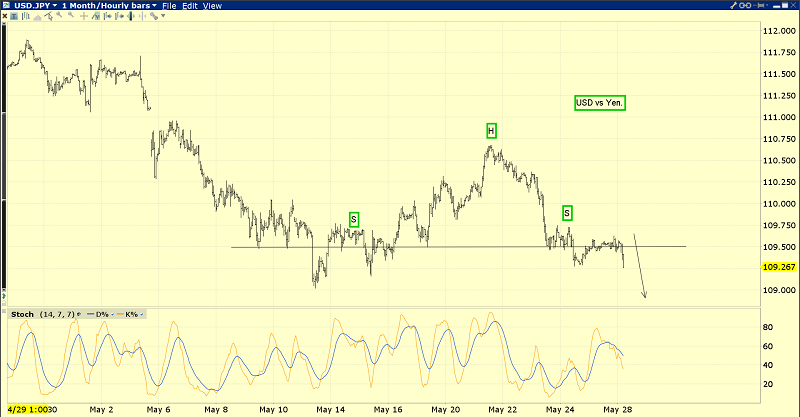

This is the dollar versus yen chart. The dollar looks terrible and a new leg lower seems imminent.

The dollar’s softness relates to lack of interest in US risk-on

markets by investors. They are more interested in safety now than risk-related opportunity. That’s good news for gold!

The US government has referred to the tariff taxes issue as a war. In the short-term, it’s producing higher prices for US consumers and dragging down global GDP growth.

In the medium-term, China’s government could restrict rare earth exports to America. That would probably cause a stock market crash. If the US economy keeps softening as China begins to handle the tariffs issue more aggressively, US democrats could get elected.

In turn, that would put the dollar front and center in the next economic downturn.

My big focus for the long-term asset allocation is the Indian stock market and gold. That’s because Indian GDP growth will almost certainly rise to 10%+ and stay there for decades.

This, while America probably grows at 3%-4% in a good year and averages 1%-2%. There’s only so much upside “blood” that the Fed can squeeze out of a QE “stone” for US stock market investors with that kind of growth. The demographics just aren’t there, and the entitlements are too big of a drag on the economy.

I’m vastly more focused on short-term trading for the US stock market now than long-term investment. I do that at guswinger.com where I also trade Direxion Daily Gold Miners Index Bull 3X Shares (NYSE:NUGT) and Direxion Daily Gold Miners Bear 3X Shares (NYSE:DUST) for gold stock trading enthusiasts.

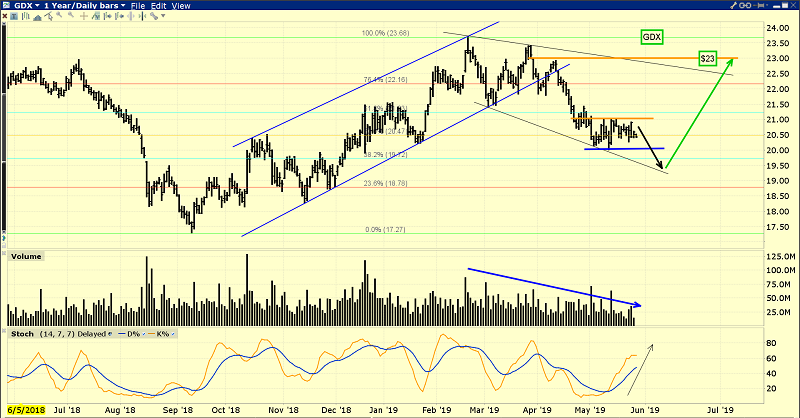

I don’t expect much action from VanEck Vectors Gold Miners ETF (NYSE:GDX) and gold stocks until gold bursts out of the bull wedge formation and the US stock market begins another leg down.

That likely happens as institutional investors accept the tariff talks as an unresolvable quagmire and begin to wonder how the Fed will deal with emerging stagflation.

A Friday close of $23 for GDX, $14 for Barrick (GOLD-NYSE), $36 for Newmont (NEM-NYSE) and $46 for Agnico (AEM-NYSE) are the “launchpad” numbers for gold stock investors to focus on. When those numbers are hit, basis a Friday close, gold, silver, and the miners will be ready for a major bull run.

Stewart Thomson is a retired Merrill Lynch broker. Stewart writes the Graceland Updates daily between 4am-7am. They are sent out around 8am-9am. The newsletter is attractively priced and the format is a unique numbered point form. Giving clarity of each point and saving valuable reading time.

Risks, Disclaimers, Legal

Stewart Thomson is no longer an investment advisor. The information provided by Stewart and Graceland Updates is for general information purposes only. Before taking any action on any investment, it is imperative that you consult with multiple properly licensed, experienced and qualified investment advisors and get numerous opinions before taking any action. Your minimum risk on any investment in the world is: 100% loss of all your money. You may be taking or preparing to take leveraged positions in investments and not know it, exposing yourself to unlimited risks. This is highly concerning if you are an investor in any derivatives products. There is an approx $700 trillion OTC Derivatives Iceberg with a tiny portion written off officially. The bottom line:

Are You Prepared?