Although you can't be happy if you're bullish at this moment in time. There are more reasons than we need to think about things like a bear market or at the least, a severe correction. The weekly and monthly-index charts are poor. The daily charts are showing weak oscillators. Froth has been off the charts for a very long time. Bears are in deep hibernation. It's been far too long as well. The bulls saw an incredible head fake last week with two strong gap up days that ran higher all day. Well, let's just say it could end up being a huge head fake. That story still unwritten. The market looked powerful prior to the open. With about one hour to go before it opened the futures started falling fast allowing for a flat bell ring.

It didn't go well from there for the bulls as the market began to fall harder and harder as the day went along. Lots of little rallies along the way but in the end a pretty dismal day for the bulls. The good is that for the moment the bulls were able to hold the bottom of the second gap up but a few pennies. If that goes away there's the first gap to deal with, but for now, you still can't get bearish as there's no major break of key support. So we're not totally bearish, but there's nothing to get excited about on the long side of the ledger. The market simply unplayable for the most part. Cash the best position out there for the moment.

Once again the bearish stocks of the past few months, after seemingly putting in bottoming sticks last week, under performed. The technology stocks we're used to seeing only headed north are spending a great deal of time heading south. From Google Inc. (GOOG) to Priceline.com Incorporated (NASDAQ:PCLN) and from Netflix Inc. (NFLX) to Tesla Motors Inc (NASDAQ:TSLA) and Amazon.com Inc (NASDAQ:AMZN) the group is getting hit almost daily with solid losses. In the real world that makes perfect sense based on their valuations, but this game isn't real so it's worrisome to see these stocks unable to bid even after clear bottoming candles.

Head fakes and nothing more. Same deal with the financial's. Two recent breakouts have led to almost instant reversals back below those breakout levels. You can't count on anything bullish holding these days, and in my opinion it's due mostly to the problem of froth, which has been with us far too long. To be blunt, this is the number one reason I'm so cautious. Commodities stocks are now being joined by other areas of the market in finding it difficult to bid. Fewer and fewer areas in the market that are bidding well. Not great for the bulls. The number of stocks to throw the darts at are diminishing.

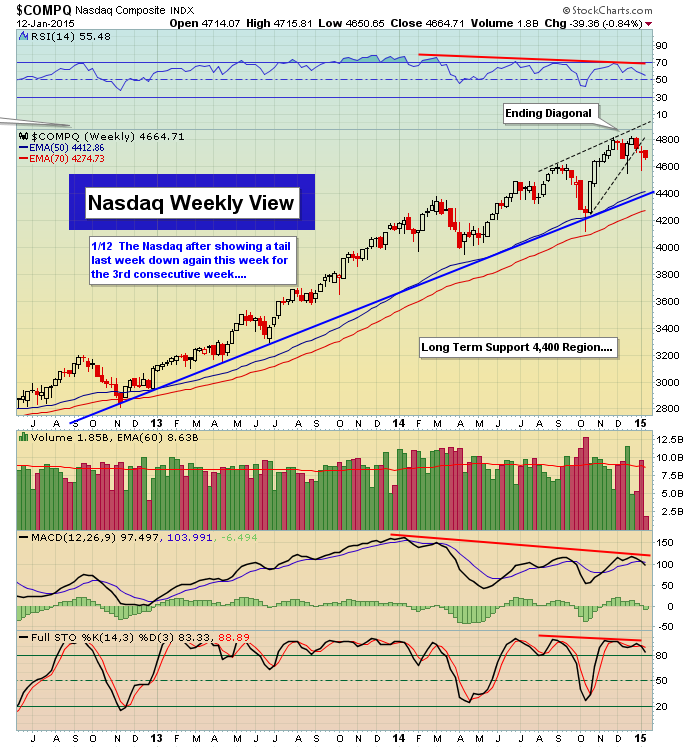

Listen folks, there's no way to know what we can expect from here. The environment is complicated since we haven't broken the 50-day exponential moving averages quite yet with force thus we haven't had the classic back test and failure which would usher in a much larger selling episode. Until this occurs it's really not prudent to get too bearish. Front running hasn't worked but it's clear up side sustainability is more troublesome for the bulls for here. In times like this we go to the third position which is cash. It can be your best friend until more clarity is upon us. This would be what I believe is best for everyone, but, of course, you may have different thoughts and ideas, so play as you wish, but recognize the risk for both sides here as the market works out what it wants to do short to medium term.

Difficult is the best word I can find to use for where we are in this cycle. Keeping it light.