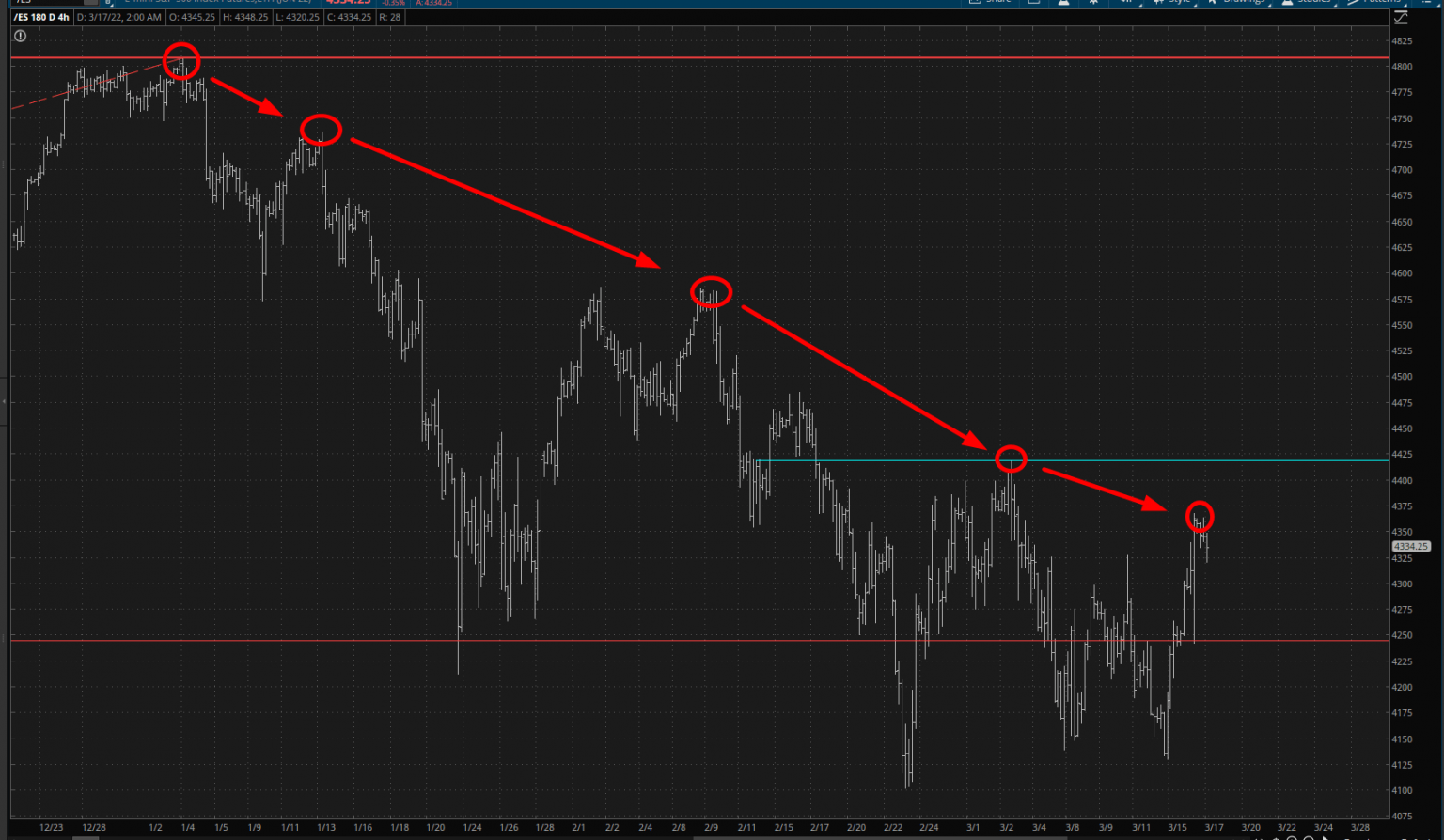

Longer-term, the bearish pattern persists on the S&P 500 futures, although the “lower lows” seems to have terminated for now. Suffice it to say that the final 90 minutes of yesterdays’ session rattled your humble narrator. The pledge of an endless chain of interest rate hikes seriously should NOT produce joy among equity buyers.

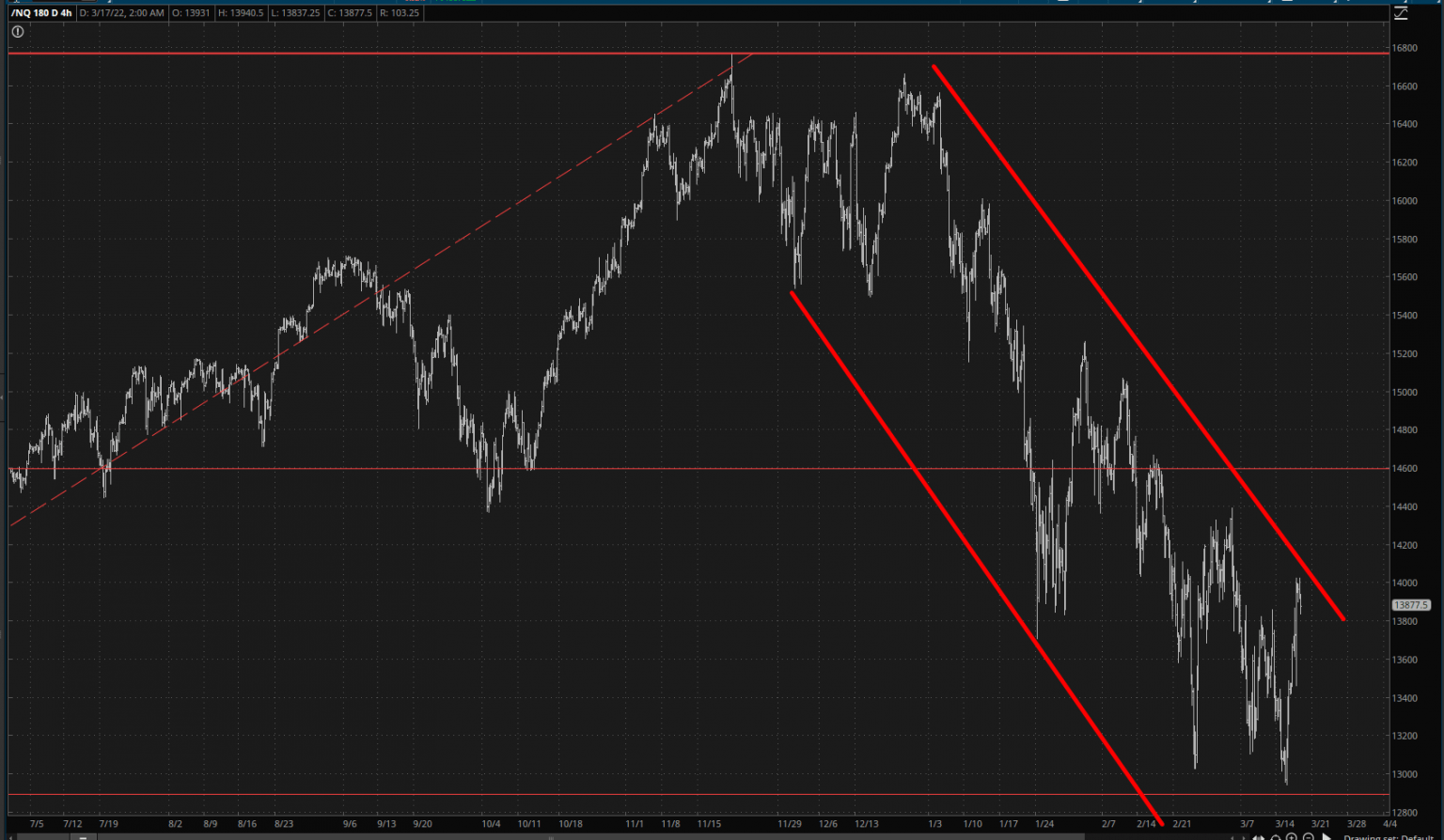

Looking at the NASDAQ 100 futures, the down-channel is still intact, but again, it was disconcerting to see the rise. We are relatively near the top of that channel. The thing is, we’re pretty much at the mercy of geopolitical news at this point. We’re way out of earnings season; the Fed has made it crystal clear what their plans are; yet equity valuations remain astronomical. This is why I’m focused on my “from the bottom, up” style of chart-by-chart positioning. I have one and only one ETF (and it’s king-sized) which is my June $112 iShares U.S. Real Estate ETF (NYSE:IYR) puts.

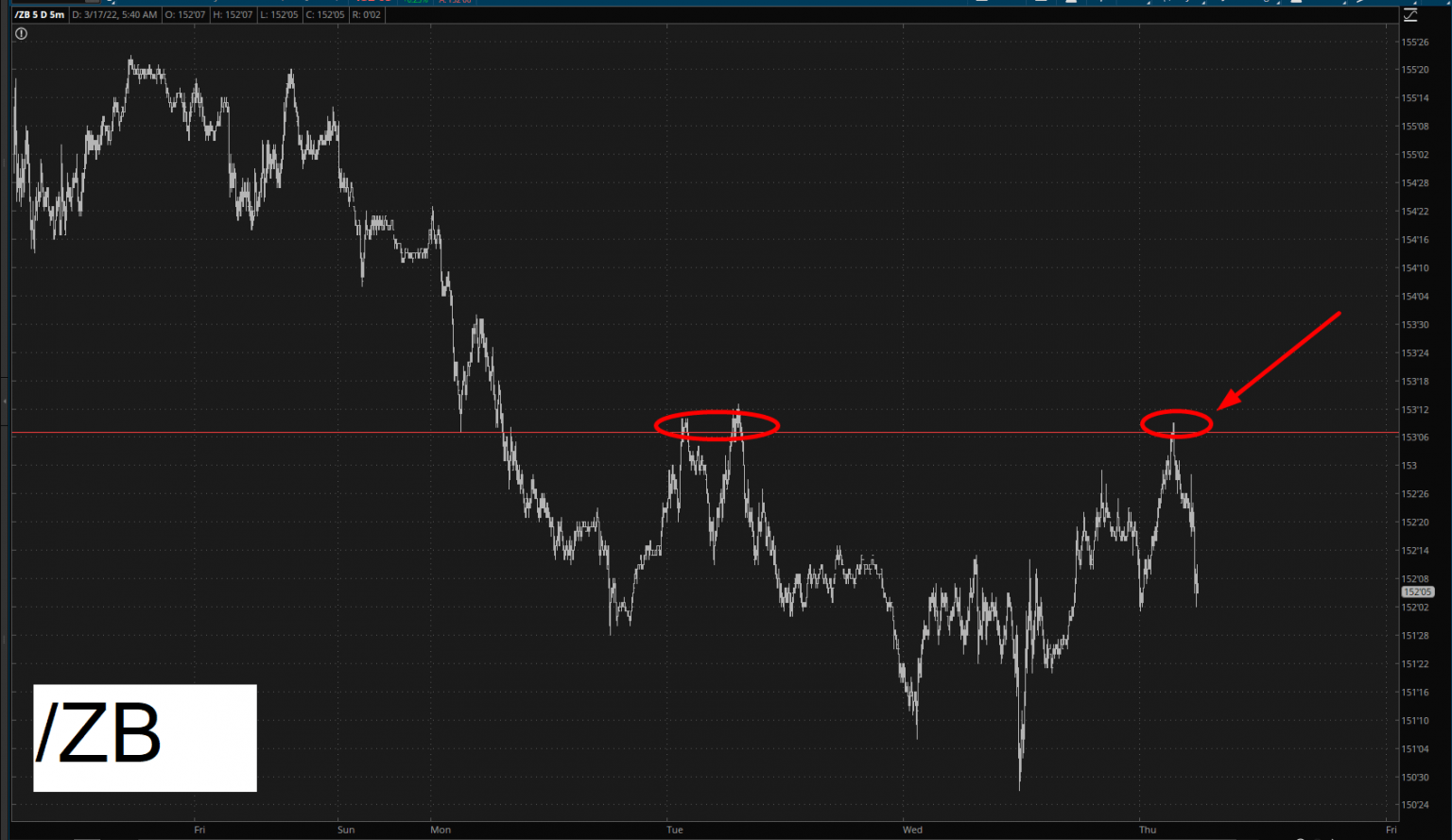

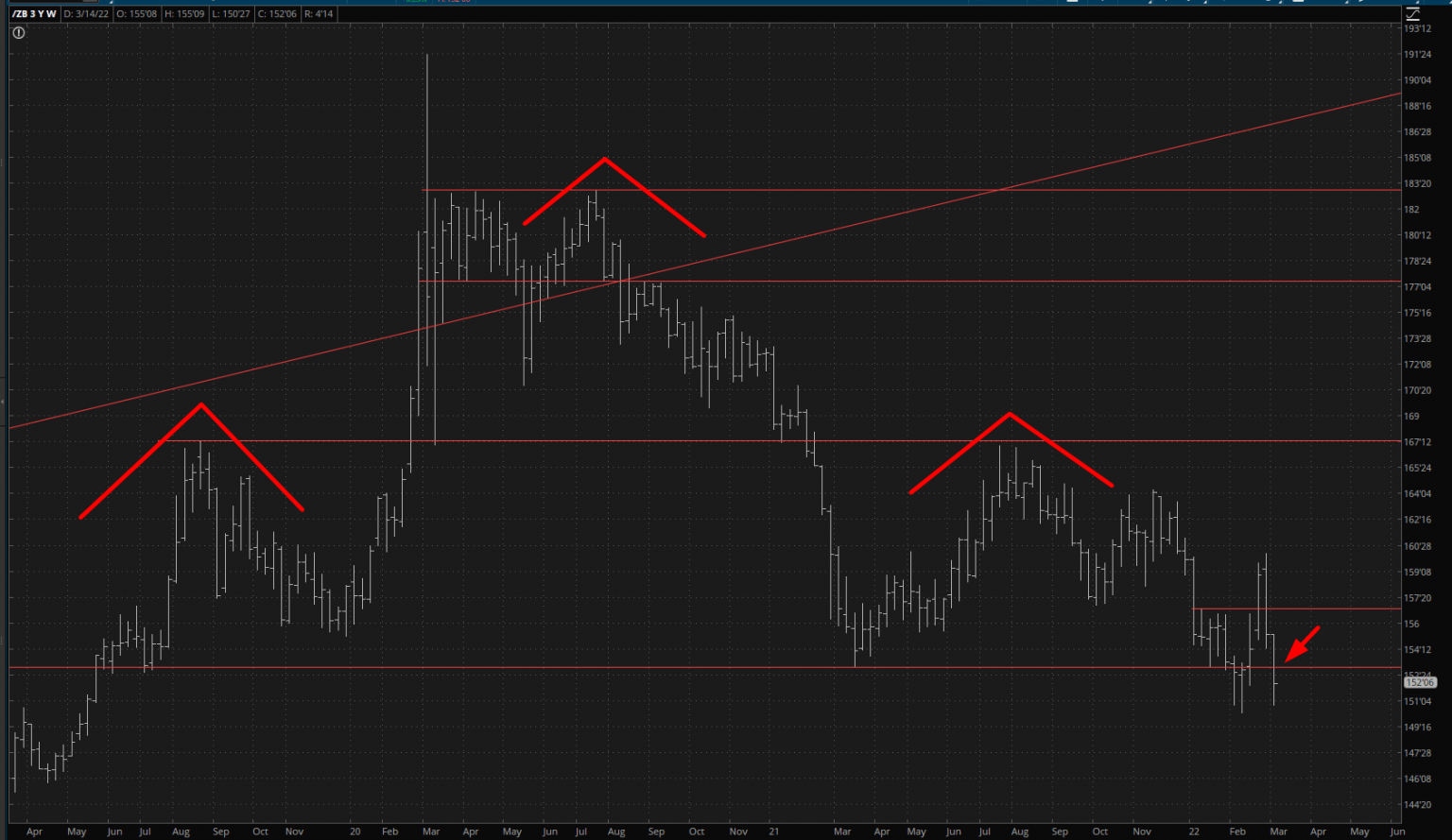

Here’s one interesting thing I saw this morning, and it’s bonds. Take note of what has happened with the ZB futures recently. There is a horizontal line which quite plainly acting as resistance now. Take note of that arrow.

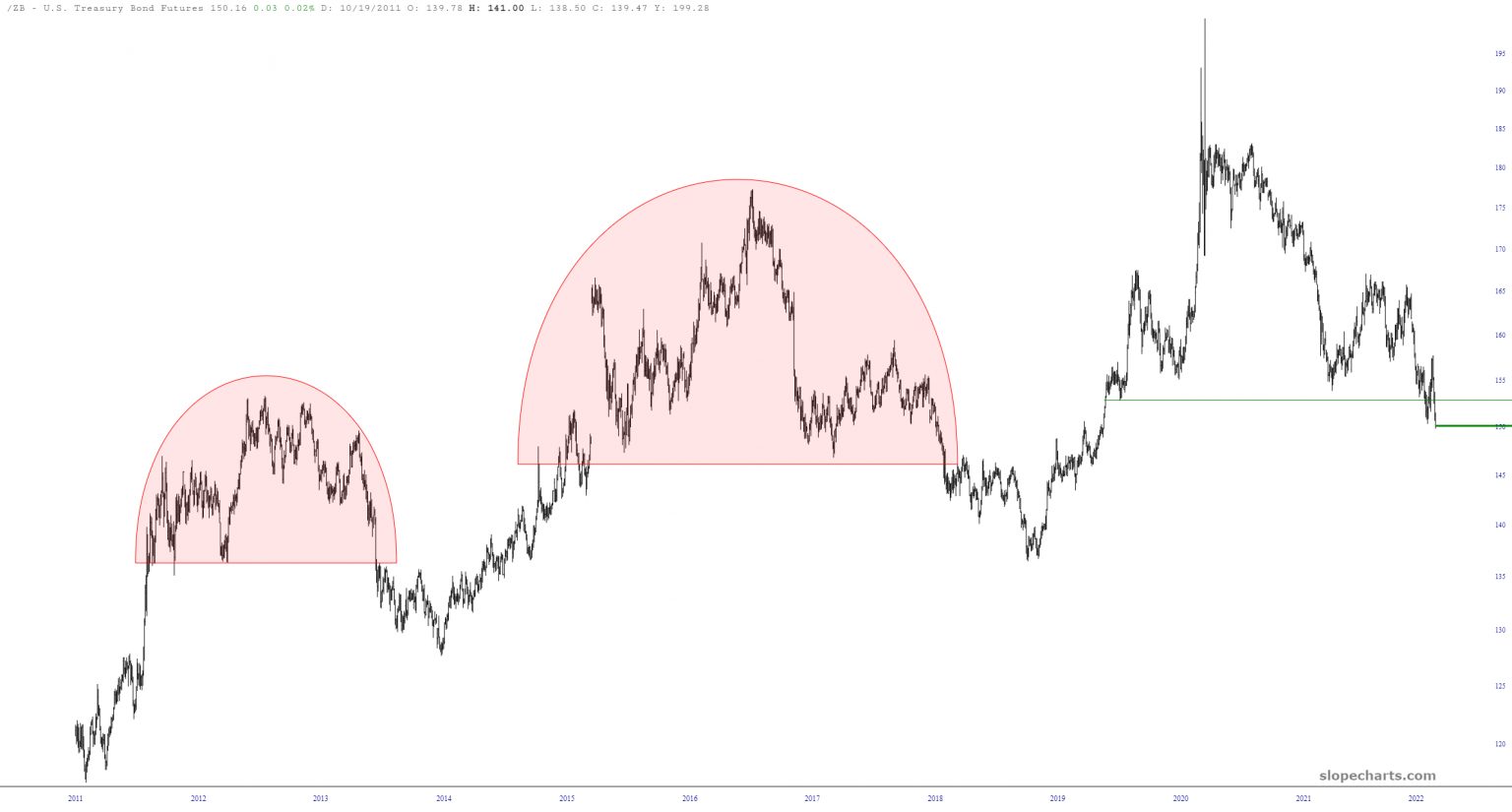

Here is a much, much longer-term chart, with the same location marked with the arrow. As you can see, the same horizontal is the neckline of a gargantuan head and shoulders topping pattern. This might suggest:

- Much lower bond prices;

- Much higher interest rates;

- The slaughter of, oh, say, real estate (cough cough IYR)

Having excited the senses, particularly those of TNRevolution, let me throw in this one cautionary tidbit—the bond market has pulled this kind of stunt before, and although, yes, there were lower prices, it didn’t really amount to much (the very long-term continuous contract is shown below). But—what’s the saying?—maybe it’s different this time.