It’s the last week of what has turned out to be an incredibly light-volume summer, with equities quietly grinding higher for months…

The blue chip indices are still very close to 52-week highs, but last week’s action raised some questions in terms of how sustainable this mild bullish action really is.

Both the Dow and the S&P 500 had ugly reversal days on Tuesday. The Dow after coming within 8 points of hitting a new high, and the S&P after hitting a new high earlier in the day.

Both indices not only closed at the low of their daily trading range, but also took out the lows of previous day’s ranges – tracing out an unusually volatile day considering the placid action of the last few weeks.

Small caps followed a similar path, with the Russell 2000 Index (IWM) clearing the July high, only to finish lower on the day and continue to fall later in the week.

From a macro perspective, the risks continue to loom, with plenty of bearish potential catalysts threatening. Europe’s debt issues continue to weigh on the global market. And now that a German recession is likely, traders have to worry about a lack of German demand for goods and services – adding more pressure to an already weak eurozone.

In China, the situation is shifting from bad to worse. China remains an export-based economy, despite efforts to boost domestic consumption. With less demand from the developed world (Europe primarily, but also the US), China simply cannot maintain robust growth rates.

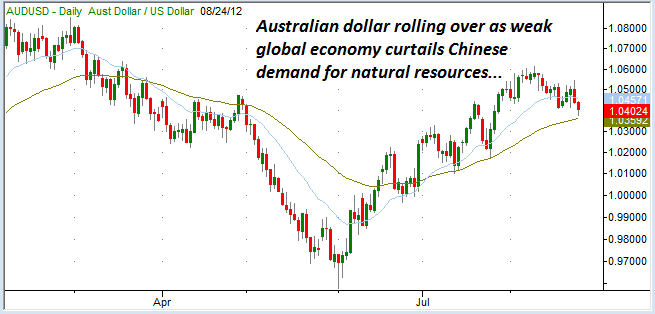

This creates an interesting dynamic for the Australian economy which relies heavily on Chinese demand for natural resources like coal and base metals. Our most aggressive position right now is a bearish bet on the Australian dollar.

Our short AUD/USD position should continue to benefit from weakening demand from China, as well as a potential reversal of “safe haven” capital flows which have been supporting Australian government bonds.

While it may be a long shot, our trade could benefit significantly from any surprise announcement from the Reserve Bank of Australia. There is increasing incentive for the RBA to lower rates in order to increase the country’s competitive stance – which in turn would add tremendous pressure to the Australian dollar… Aussie Aussie Aussie, Oi Oi Oi!

Despite the relatively calm action for domestic equity markets, we’re seeing a number of situations developing that could lead to excellent trading scenarios. As we finish up a dull summer and first-string traders start turning their attention to markets once again, things could quickly heat up and kick off some dramatic trading opportunities. Below are a few of the areas we’re tracking this week:

Reach For Yield Puts Dividend Stocks in Vulnerable Spot

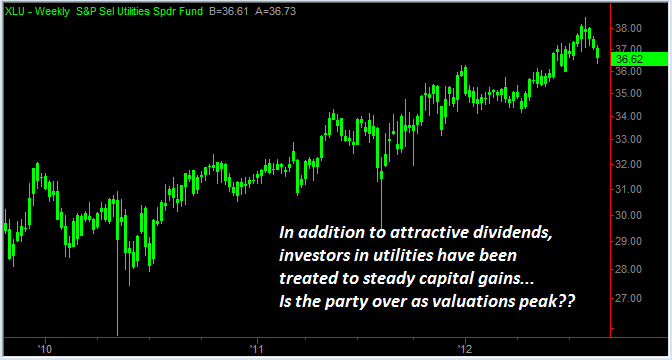

The Fed’s “Stupid Stimulus” zero interest rate policy has created a stretch for yield that has affected a wide range of asset classes. Treasury prices rallied to record levels (and corresponding low yields), corporate bonds – both investment quality and junk – have seen massive capital inflows, and dividend stocks have been bid higher as investors try to generate income.

Barron’s weekend article, The Danger in Dividend Stocks, notes the extent to which investors’ appetite for yield has driven prices to unsustainable levels:

Sectors with the highest dividends are trading at rich premiums to the broad market, relative to the historical norms…

Utility stocks, which yield about 4%, are more expensive than they have been roughly 90% of the time. Likewise, telecoms, which yield about 4.5%, are costlier than they have been about 80% of the time. The consumer-staples sector, which yields north of 3%, is in nosebleed territory, too: Its valuation is higher than it has been in almost 90% of its history.

While we’re not likely to see the FOMC hike rates anytime soon, traders appear a bit too optimistic about additional liquidity measures considering the relatively strong domestic economic data.

Treasuries are already beginning to back off (with corresponding rates increasing). As Treasury rates increase, the effect trickles into the corporate bond world and also into high-yield equities. The presence of alternative income options could very well shift capital away from the high-dividend equity areas, triggering a reversion to the mean in terms of industry valuations.

Utility stocks have been in a bull market for well over three years now. Given the extended valuations, a shift in the fundamental dynamics could trigger an extended selloff – with plenty of opportunities for bearish swing trades along the way.

Consumer Stress Pressures Retailers

The retail sector has been a dangerous minefield during the second quarter earnings season. Last week, Big Lots Inc. (BIG) blew up, dropping roughly 25% after missing earnings and issuing lower guidance for Q3. Breaking down the report, it appears that low-margin items like groceries did well, while sales for higher-priced items such as furniture and home goods were poor.

We’ve seen this this theme across the board, with discretionary purchases being delayed, and retailers competing to capture revenue from low-margin staple items. This trend has put tremendous pressure on grocery stocks like Kroger Co (KR) and Safeway Inc. (SWY) as big box retailers and drug store pharmacies capture more market share.

Even the luxury / leisure side of retail has been hit as fewer middle class consumers can afford big-ticket discretionary items. As mentioned in the August 6th turret, the Harley Davidson (HOG) CEO issued sobering comments regarding the uncertainty for consumer purchases heading into the second half.

While retail stocks have been relatively resilient as a group, the third quarter could usher in some significant shifts as traders begin to incorporate weak Q3 guidance along with the broad macro issues.

Precious Metal Mania

We’re watching the action in precious metals as interested observers from the sidelines right now.

Silver in particular had a tremendous week – rallying 9.2% and logging gains in each of the 5 trading sessions.

From a technical perspective, the move looks very powerful with spot metal prices and precious metal miner stocks all participating in the action. Short covering likely added firepower to the move as resistance levels were broken and light trading volume made it difficult to cover positions efficiently.

Looking at the action from a macro economic viewpoint, it’s difficult to place a lot of confidence in the move. A rally in precious metals would imply increasing confidence that the Fed will embark on another round of quantitative easing.

But consider the following:

- Blue-chip equities are near 52-week highs.

- Employment metrics have been showing modest improvements.

- The presidential election is just around the corner.

Given this environment, the Fed is likely to act only on a delayed basis – and even if they do act, the result is likely to be swift disappointment (the hope better than the delivery).

If the bullish action in precious metals continues, we are certainly prepared to participate. Even if the move turns out to be a false trend, there is nothing false about profits pulled from the action.

But with a flawed fundamental backdrop for the current rally, we remain skeptical for now with a watchful eye on the situation.

Heading into the week, our roster of open trades is modestly bearish with plenty of cash available for new trade setups. With the second quarter earnings season over, traders will now turn their attention to news from the Fed meeting in Jackson Hole, along with the evolving global economic picture.

Given the low level of volatility over the last several months, it would not be abnormal to see a major price move (higher OR lower). Traders have been lulled into complacency with the tame price action, and the light volume makes it difficult to react to any significant shift in expectations.

Trade ‘em well this week!

Disclaimer: This content is general info only, not to be taken as investment advice. Click here for disclaimer.