Last week’s review of the macro market indicators noted heading into the last week of the first quarter, equity markets had hit a speed bump. Elsewhere looked for Gold ($GLD) to resume its uptrend while Crude Oil ($USO) continued higher. The US Dollar Index ($DXY) despite all the noise remained in a broad consolidation while US Treasuries ($TLT) were breaking higher.

The Shanghai Composite ($ASHR) continued in the uptrend while Emerging Markets ($EEM) fell back into consolidation. Volatility ($VXXB) looked to remain low but building putting some pressure on the equity index ETF’s $SPY, $IWM and $QQQ. Their charts were showing some divergence with the IWM pulling back in a short term trend reversal while the SPY held and consolidated and the QQQ continued higher highs.

The week played out with Gold reversing after a small gain Monday and falling back to end lower while Crude Oil held up and consolidated. The US Dollar rose within the consolidation zone while Treasuries exploded to the upside. The Shanghai Composite pulled back to support and bounced while Emerging Markets drifted in a tight range.

Volatility reversed and dropped back into the low teens, making life easier for equities. The Equity Index ETF’s held just off of their highs. The SPY and QQQ stayed in a tight range all week while the IWM started to move back higher. What does this mean for the coming week? Let’s look at some charts.

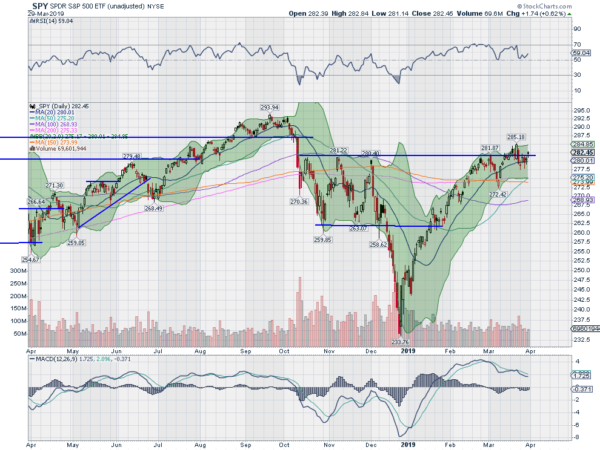

SPY Daily, $SPY

The SPY came into the week at the 20-day SMA and just under the resistance level of the October through December consolidation. It moved higher with the 20-day SMA and then gapped up Friday to close the week back over resistance. It looks as if there will be a Golden Cross print on Monday.

The daily chart shows the RSI turning back higher in the bullish zone with the MACD remaining flat but positive. The Bollinger Bands® have gone flat and with the small body candles all week. The word consolidation seems appropriate on this timeframe.

The weekly chart continues to inch higher with the highest close since October 1st and a bullish engulfing candle. The RSI is still hanging under a move into the bullish zone with the MACD crossed up and rising. There is resistance at 284 and 285 then 287 and 289.50 before 292 and 294. Support lower comes at 282 and 280 then 279 and 277.50 before 274.50. Consolidation.

SPY Weekly, $SPY

With the books closed on the first quarter equity markets had a great 3 months but remain short of their all-time highs. Elsewhere look for Gold to continue lower while Crude Oil pauses in its uptrend. The US Dollar Index looks to move up in the broad consolidation while US Treasuries are breaking higher. The Shanghai Composite and Emerging Markets are consolidating their gains.

Volatility looks to remain low easing pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts are mixed now with the QQQ in a solid uptrend while the SPY consolidates sideways, with the IWM pulling back in a long bull flag. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.