Iflationistas think a major inflationary move is at hand and they bet that with futures. I suggest the opposite.

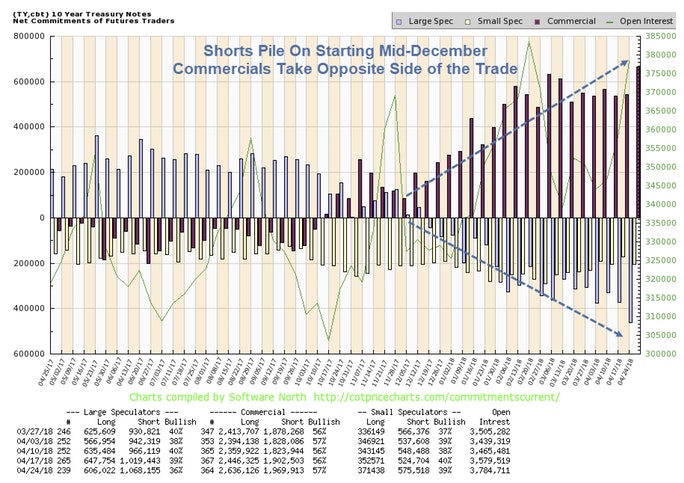

A commitment of traders (COT) report for 10-year treasuries shows record bets that treasury yields are headed higher.

Large Spec Contracts

- Long: 606,022

- Short: 1,058,155

- Net Short: 452,133

- Bullish: 36%

Small Spec Contracts

- Long: 371,438

- Short: 575,158

- Net Short: 203,720

- Bullish: 39%

10-Year Yield

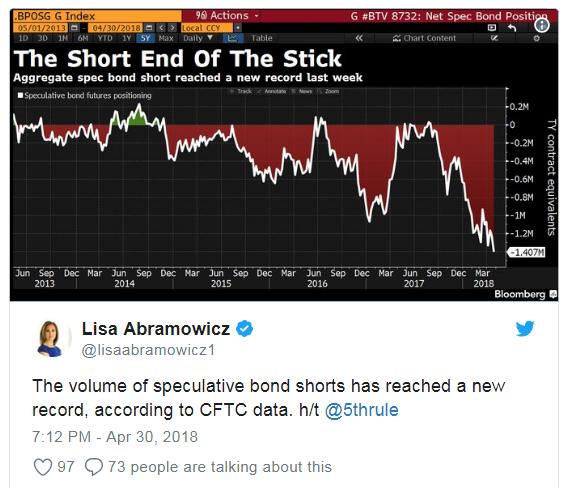

Inquiring minds may be wondering what speculators were doing mid-2016. The feature chart is easy to read but it does not go back far enough. Here is a second treasury chart that completes the picture.

Summary

- Speculators were on the wrong side of a major, 123 point basis point, surge in yield starting mid-2016.

- In early 2017, right as yields were ready to temporarily dive, speculators piled on with shorts. Yields rallied about 55 basis points.

- Since December 2017, speculators amassed a new record short position. Those in early (December 2017), pick up 55 basis points.

Lisa Abramowicz Offered This Tweet

Now what?

I expect those record shorts will get blown out of the water. Only a small minority see things the same way.

As part of Weekend Reading, Lance Roberts suggests Rates Still Headed To Zero.

According to Roberts, "Rates are ultimately directly impacted by the strength of economic growth and the demand for credit. While short-term dynamics may move rates, ultimately the fundamentals combined with the demand for safety and liquidity will be the ultimate arbiter."

Rear View Mirror

My position is Inflation is in the Rear-View Mirror.

Overdue credit card debts are piling up. More Americans are falling behind on mortgages. Car sales are dismal. Consumer spending is drying up. The global economy is slowing. These numbers are huge deflationary. Here are my definitions.

Inflation and Deflation Definitions

- Inflation: An increase in money supply and credit, with credit marked to market.

- Deflation: A decrease in money supply and credit, with credit marked to market.

You may not like or agree with my definitions, but in a fiat credit-based global setup, this is how the real world works.

Deflationary Debt Trap Setup

- Credit card delinquencies are priced as if they will be paid back. They won't.

- As soon as recession hits, defaults and charge-offs will mount. In turn, this will reduce the amounts banks will be willing to lend.

- Subprime corporations who had been borrowing money quarter after quarter will find they are priced out of the market, unable to roll over their debt.

Rear-View Mirror Thinking

Those looking for a huge, sustained, inflation boost fail to understand credit dynamics.

I do not rule out a further spike in oil or any other commodities. Temporarily, Trump's dismally poor tariff policy may also give a boost to prices.

About a year ago, Lacy Hunt at Hoisington Management stated “Secular Low in Bond Yields Remains in the Future”

Fatter Crayons Needed

In January of 2018, Hedge fund heavyweight David Tepper appeared on CNBC and, when asked whether he was short bonds, said, "You bet your heinie." The same day, Bill Gross, citing technical analysis, proclaimed the "treasury bull market is over".

I suggested "You Bet Your Heinie" Bill Gross Needs a Fatter Crayon".

Exploding Debt

In April, Lacy Hunt at Hoisington Management offered this opinion:

"Important to the long-term investor is the pernicious impact of exploding debt levels. This condition will slow economic growth, and the resulting poor economic conditions will lead to lower inflation and thereby lower long-term interest rates. This suggests that high quality yields may be difficult to obtain within the next decade. In the shorter run, in accordance with Friedman’s established theory, the current monetary deceleration, or restrictive monetary policy, will bring about lower long-term interest rates."

Law of Diminishing Returns

Ponder the strong possibility that growth is getting weaker, the Fed is nearly at the end of this rate hike cycle, and numerous firms on interest rate life support are poised to go under.

There is nothing remotely inflationary about that setup.

The Name is Bond

For further discussion of Lacy Hun'ts law of diminishing returns and expected bond yields, please see The Name is Bond, Long Bond.