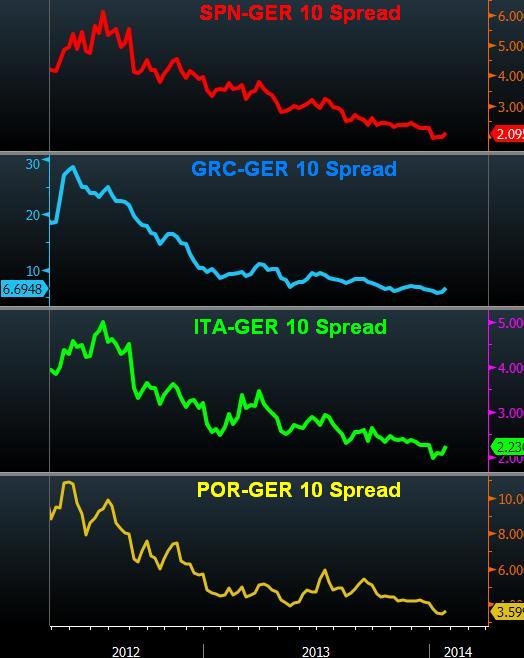

In the week when Spain exited its debt bailout program, UK posted its biggest drop in unemployment in 17 years and margins on Italian govt bonds were reduced, rumours of a China sovereign downgrade hit the market after Shanghai interbank rates pushed rebounded and China's manufacturing PMI hit 6-month lows.

Positives

- Spain exits Eurozone bailouts (this week)

- Spain's biggest drop in unemployment in 9 years (this week)

- UK posts biggest unemployment decline in 17 years (this week)

- LCH.Clearnet eases margins on Spanish & Italian bonds (this week)

- Roubini says risks of Eurozone collapse has receded (this week)

- Arch bear Hugh Hendry says will buy stocks (last month)

Negatives

- Rumours of China sovereign downgrade emerge from struggling shadow banking

- Biggest 1-day drop in USDJPY in 5 months (August 27)

- Brazil equities hit 5-month lows.

Optimism in the Eurozone has boosted the rallying euro on the unwinding of the EUR-to-EMFX carry trade following deterioration in the mother of all EMs– China. A downgrade of China's sovereign rating may not materialize anytime soon, but fears of default in China's shadow banking products may set off an ominous precedent and an additional fear factor to Ems besides Fed tapering.

Spain's exit from bailouts

Markets will monitor Spain's efforts in tapping bond markets thanks to 3-year lows in 10-year Spain-German spreads, while simultaneously producing further declines in unemployment. Despite Spain's 26% unemployment rate, this week's figures showing a 8,400 decline in Q4 2013 jobless compared with Q3 2013 (and 69,000 decline vs Q4 2012) was the biggest drop in nine years. The huge imbalance between temporary and permanent employment causes employers to invest little in the workforce, encouraging labor to seek jobs elsewhere. And so even if the unemployment rate peaks out, the number of those existing the labour force will have to be addressed. Yet, at this point, markets have been accustomed to focus on stability in market metrics (falling bond yields, ultra-low volatility) rather than macro metrics and structural unemployment.

Filling Athens' gap

Greek's government is exploring ways to roll-over the its € 4.5 billion gap, due in May, by reducing the required capital adequacy ratio to 8% from 9%, which would be in line with those required by European banks. An agreement would be vital ahead of the results of the stress tests on Greek banks, to be released later this month. Athens' request to tap in the remaining of the €25 bn in funds aimed at shoring up its banks remains to be considered by the Troika. Failure to reach consensus may lead to revisiting the stress tests in November, when all European banks will be tested.

Carney reconsiders forward guidance

BoE governor Carney's speech on forward guidance was more of a reiteration that the BoE is considering additional variables to its forward guidance aimed affirming the prolongation of low interest rates. We do not deem Carney's comments on sterling strength dampening exports to be a new shift in currency policy as the central bank requires sterling's robustness to maintain a cap on inflation as rates are suppressed in the face of tightening labor markets. Our long-held view to $1.6900 in GBP/USD remains on track as bond traders' rate views continue to dominate.