Investing.com’s stocks of the week

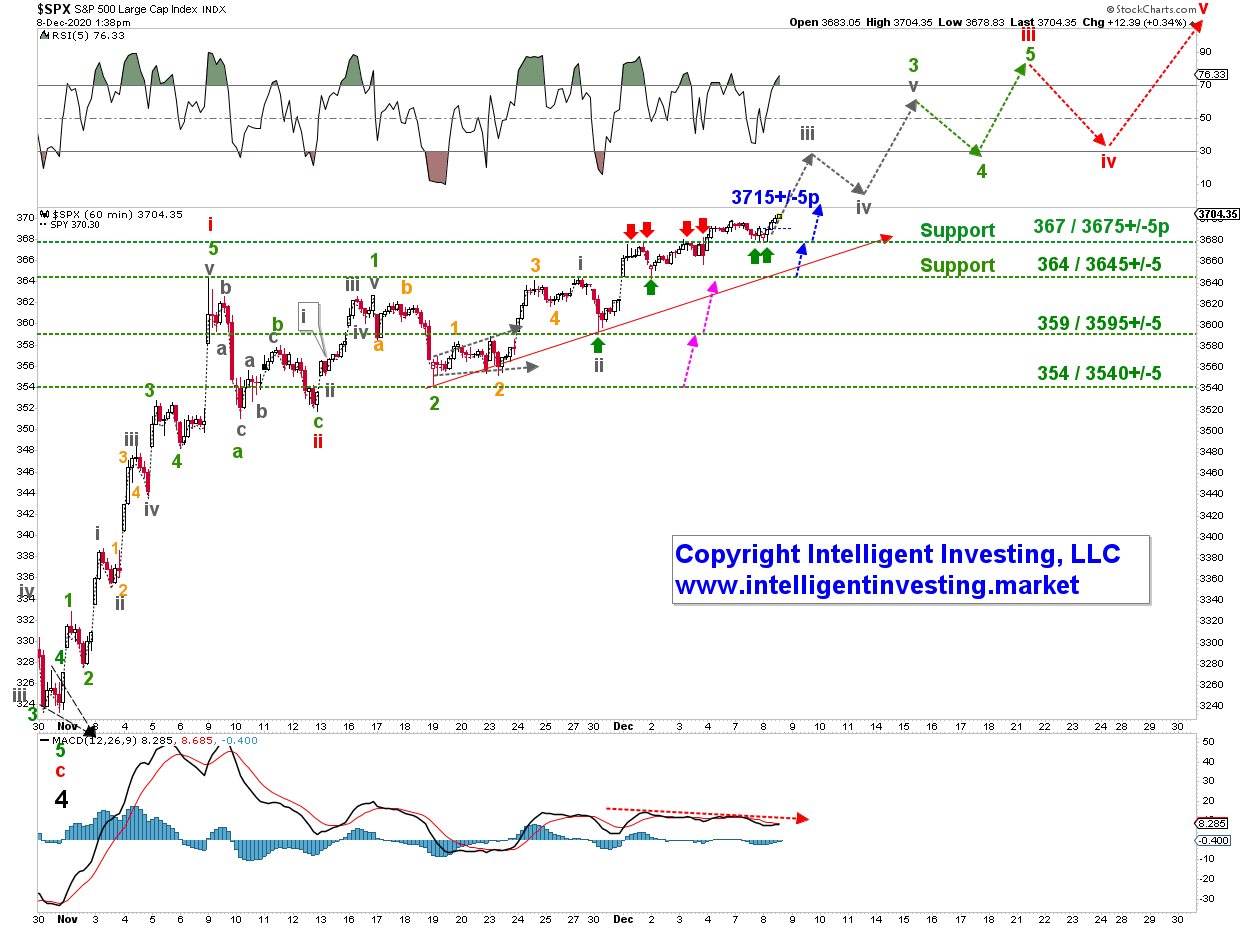

Over the past several weeks, I kept you informed about how the S&P 500 was setting up. Now, it is most likely on its way to SPX 4000+. Last week it bumped into SPX 3675 resistance four times, red arrows in Figure 1, but managed to break above it on Friday. What once was resistance may now act as support, and the index has retested the SPX 3675 zone three times already this week (green arrows). So far, it is holding, and as long as it does, we can expect SPX 3715+/-5p next.

Why?

That is the simple symmetry breakout target (blue dotted arrows), just like the breakout above SPX 3595 and successful retest thereof lead to the rally to SPX 3645+/-5P (purple dotted arrows).

Figure 1:

This “stair-stepping” behavior is normal bull-market behavior: breakout, retest the breakout successfully, move higher to the next symmetry/Fibonacci-based price-level. Thus, the bears were unable to close the index below SPX 3640 (see last week’s article here) and, therefore, we can now move those “watch-out-below“ levels up by one step to SPX 3675 and SPX 3645. As a trader, one can, for example, move up stops on any index-related long positions accordingly.

Besides, the grey, green and red arrows show the preferred Elliot wave principle (EWP)-based path as we advance (not accurate in price and time). The index bottomed late-October for (black) major wave-4 and is now in major wave-5, which consists of five smaller waves: (Red) intermediate waves i, ii, iii, iv, v. So far, only (red) waves i and ii completed. Intermediate wave-iii is now, ideally and preferably, under way as long as the support levels mentioned above hold.

Since markets are fractal in nature, this red intermediate wave-iii is made up of five smaller waves: (green) minor waves 1, 2, 3, 4, 5. Etc. Based on my internal waves assessments, the index is now in (grey) minute-iii of minor-3 of intermediate-iii of major-5. The grey, green and red dotted arrows show the ideal path going forward to complete major-5, which is the last larger wave up from the March low struck this year. It should end in the spring of 2021 at around SPX 4000-4200. After that, we should see a very sizable correction.