Daily charts show indexes in a bit of a freefall, so the focus shifts to weekly timeframes. The S&P 500 was the last of the lead indexes to break weekly-trend support, lining up the 200-day MA for the next support test.

Volume climbed to register as distribution, rubbing salt into the wound of bulls. The only positive for bulls is that intermediate stochastics [39,1] are above the bullish mid-line, but with other technicals turning negative it's unlikely to stop the rot.

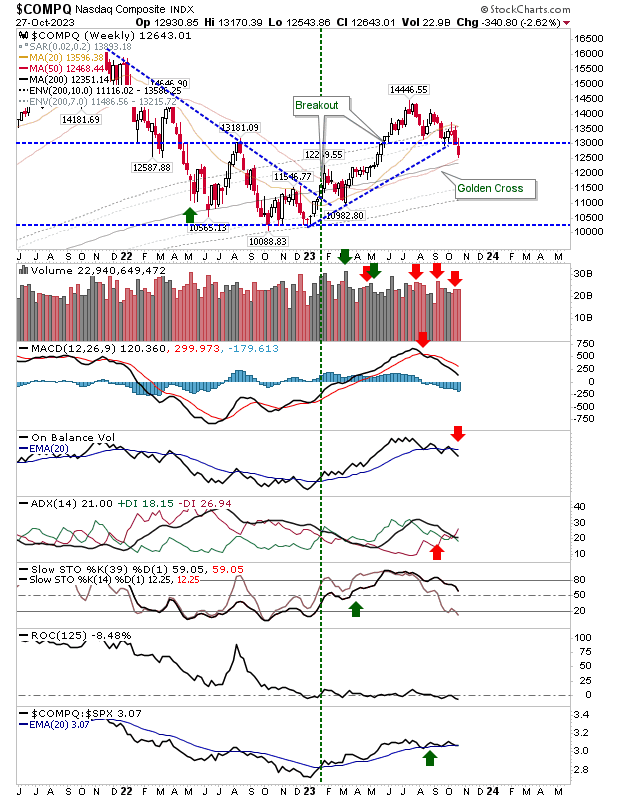

The Nasdaq lost weekly support and is testing (ironically) the bullish 'Golden Cross', but this latter bullish signal is looking more of a 'bull trap', and I expect this index to continue lower.

Last week's selling volume didn't quite rank as distribution, but volume was still high. Despite breaking the rising trend it hasn't challenged intermediate stochastic support, and this might be critical in the coming weeks.

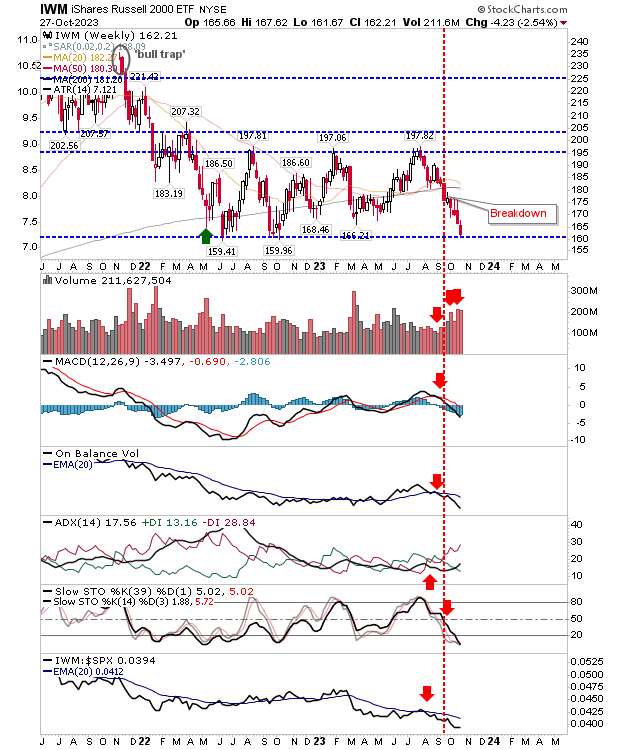

The index most on the rack is the Russell 2000. It has made its way all the way back to 2022 June lows, lows that I had marked as a major buying opportunity for investors as it occurred near the 200-week MA.

The situation is more damaging now with the 200-week MA long since breached, and technicals net negative in a straight push to this key swing low.

Worse to come appears likely or a weak bounce at best. I should add that investors shouldn't be fearful here; yes, the index can go lower, but if there is a crash it will make its way back and there will be real value in small-cap stocks.

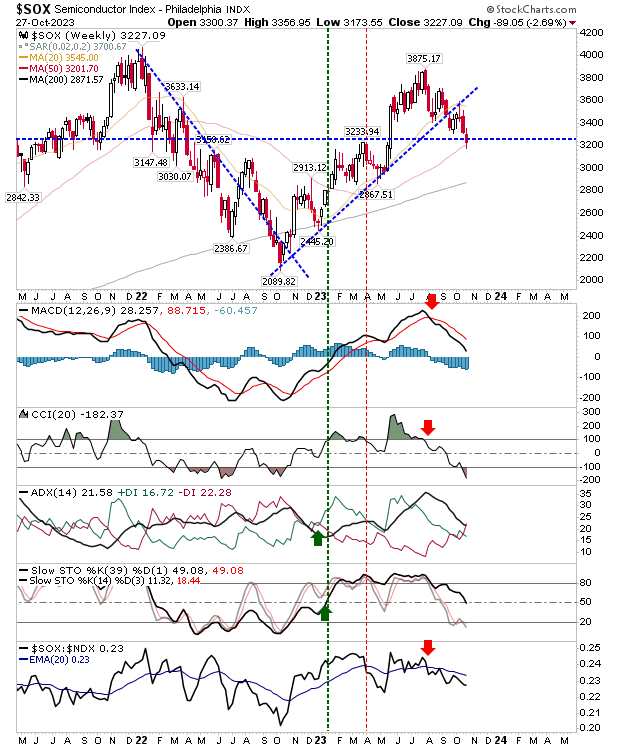

As a final chart, I will show the Semiconductor Index. The weekly chart is back at key price support alongside its 50-week MA (effectively, the 200-day MA).

It's still weeks away from a test of its 200-week MA that other indexes have now breached. If this can hold it will offer support for the Nasdaq and potentially spread some goodwill to other indexes.