S&P 500 Futures March finally collapsed - I have waited far too long for this move, and I do not understand why we saw a 4% rally on the CPI number.

The massive negative candle on the weekly chart suggests the next leg lower in the bear trend will be brutal for bulls.

Nasdaq 100 Futures March lower as predicted to 11400/350, with the close below 11300 acting as the next sell signal targeting 11100/11000 - a low for the day only 32 ticks above.

Dow Jones Futures March collapsed as expected after the sell signal, hitting my target of 33100/33000 and only 20 ticks from 32850/750.

Remember, when support is broken, it usually acts as resistance and vice-versa.

Today's Analysis

Emini S&P March finally collapsed and I believe we are resuming the 2022 bear trend at last. We broke support at 3940/30 and I think we should continue lower as investors' reality finally wakes up and accept the reality that no pivot or rate cut is coming.

At last, the market is reacting negatively to bad news and not seeing it as a factor that will force a pivot - this last month has been a load of nonsense.

We hit my next targets of 3910/00, then 3870/60 and 17 points from 3810/00. On further losses, look for 3785/75, perhaps as far as 3735.

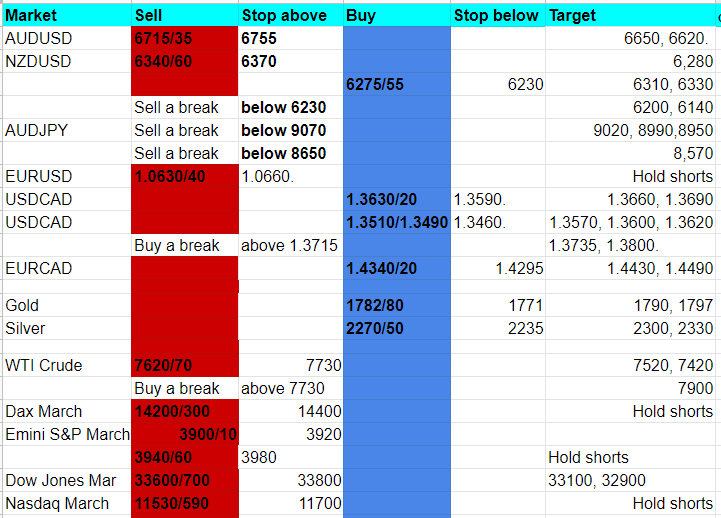

Again, gains will likely be limited, with minor resistance at 3900/10 (a high for the day exactly here) and strong resistance at 3940/60. Shorts need stops above 3980.

Nasdaq March close below 11300 is the next sell signal targeting 11100/11000, perhaps as far as 10850/750.

Gains are likely to be limited with strong resistance at 11380/420. Strong resistance at 11530/590. Shorts need stops above 11700.

Emini Dow Jones collapsed again as predicted to my target of 32850/750. Longs are risky. A break lower targets 32500/450 and then 32100/32000.

Gains will likely be limited with strong resistance at 33300 and 33600/700. Shorts need stops above 33800.