The random walk theory states that financial markets are totally unpredictable. Furthermore, it claims that beating the market is impossible, except by chance.

While investors like Warren Buffett and Peter Lynch are definitive proof that the latter claim is false, we disagree with the former one, as well. In fact, with the help of Elliott Wave analysis, we’ve been able to stay ahead of the next swing plenty of times. More recently, in the S&P 500 index.

The stock market benchmark dropped below 3900 last week on the back of a plethora of worries. High inflation, rising interest rates, the Ukraine war, and China’s lockdowns disrupting global supply chains, just to name a few.

So, with the benefit of hindsight, the S&P 500's plunge can be easily explained. Unfortunately, the trader of today cannot profit from yesterday’s market moves. Instead, we prefer to focus our energy on predicting, not explaining after the fact.

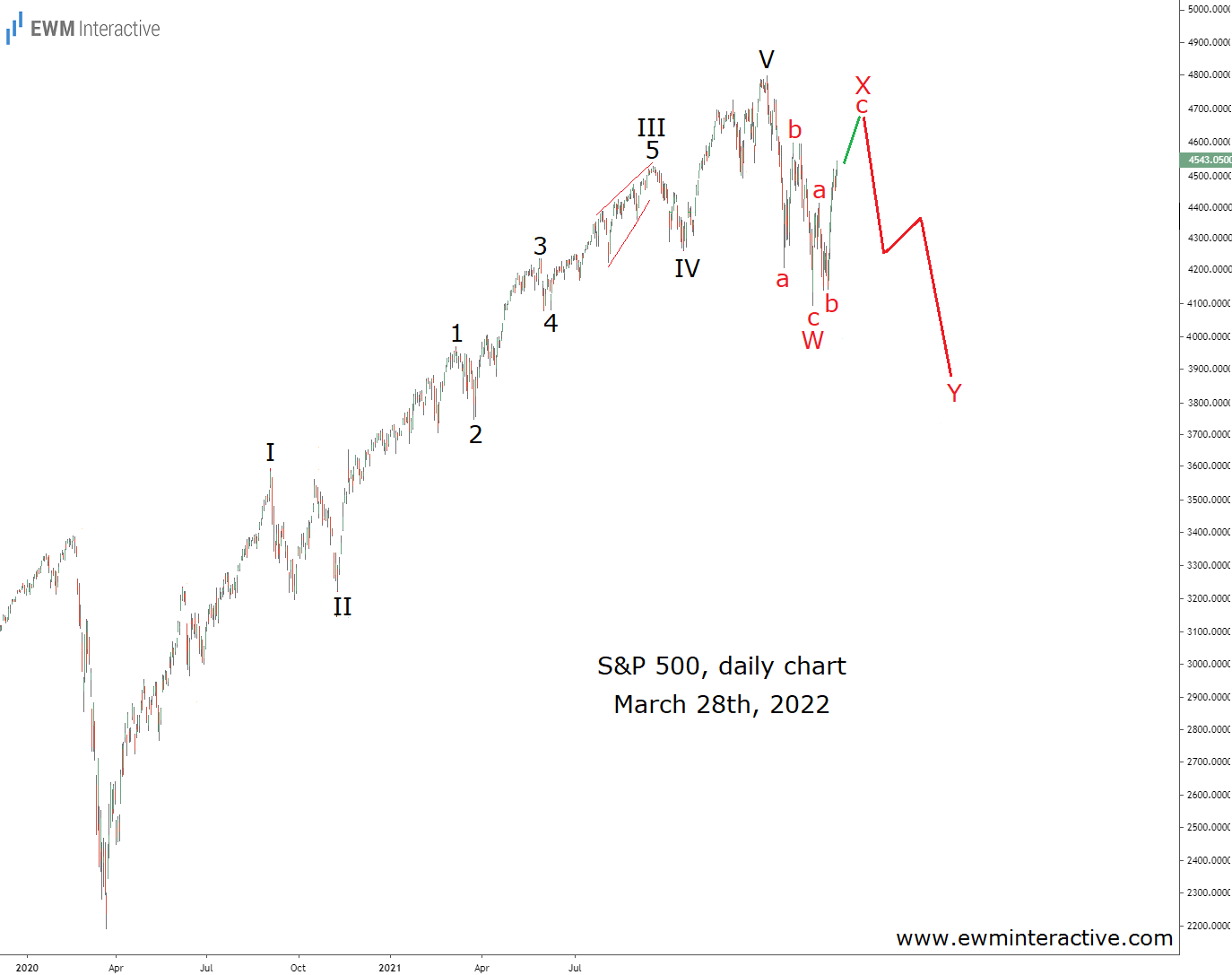

The chart below shows that the stage was set for a decline in the S&P 500 over a month ago.

The S&P 500's daily chart revealed that the post-March 2020 uptrend was a complete five-wave impulse. The pattern was labeled I-II-III-IV-V, where the five sub-waves of wave III were also visible.

According to the theory, a three-wave correction follows every impulse. And indeed, a drop from 4819 to 4115 did occur. It was far too shallow in comparison to the impulse it corrects, though, so we thought the bears weren’t done yet.

Staying Ahead Of The 800-Point Selloff In The S&P 500 With Elliott Wave Analysis

Instead, we thought the bottom at 4115 marked the end of wave W within a bigger W-X-Y double zigizag correction that was still in progress. Once wave ‘c’ of X was over, it would be time for another leg down in wave Y, which was likely to drag the S&P 500 close to 3800. A month and a half later now, the updated chart below shows how things went.

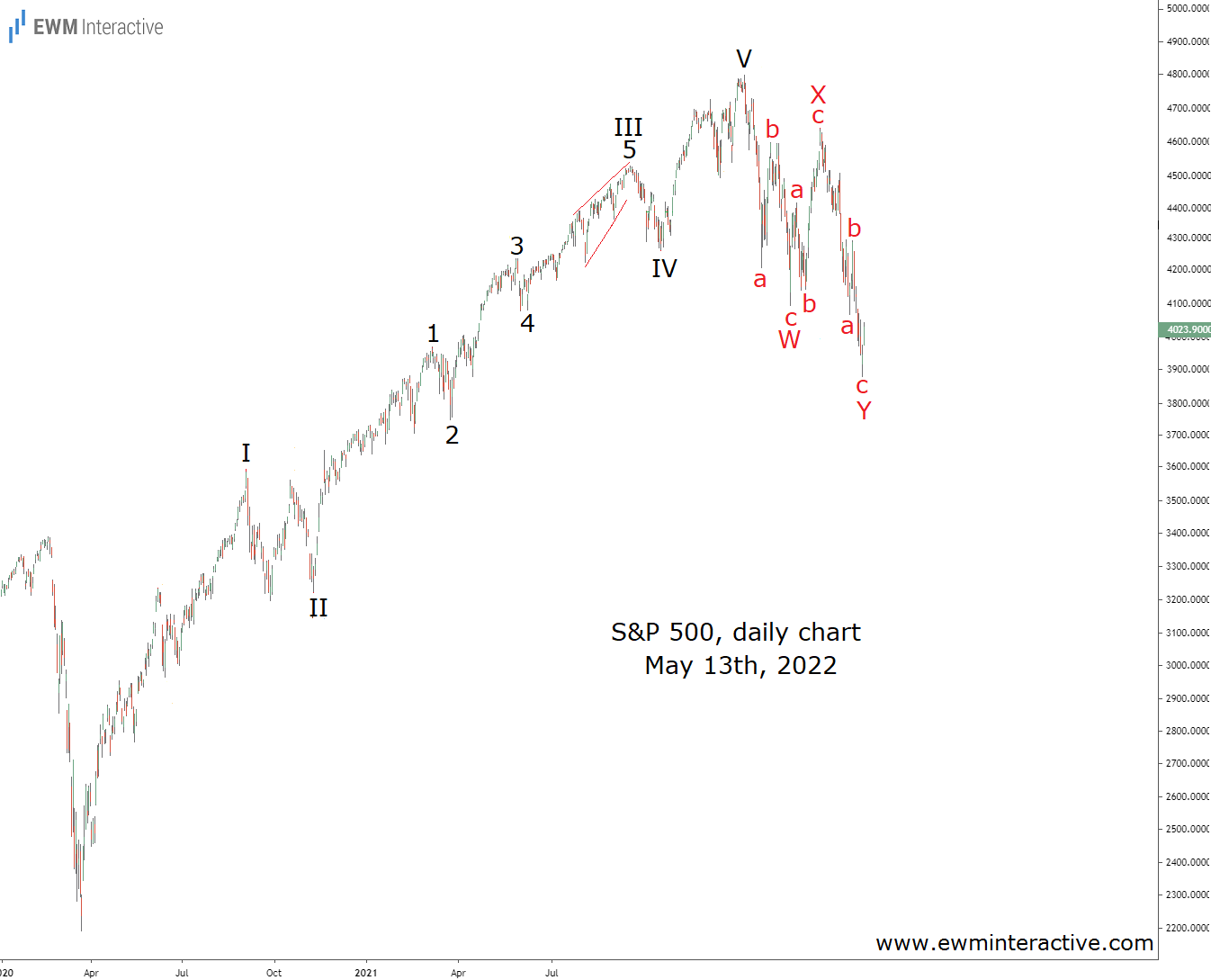

Wave ‘c’ of X ended at 4637 on Mar. 29, 2022. By May 13, the bears had already pulled the index down to 3859 in wave Y, whose structure was shaped as another simple a-b-c zigzag.

While the markets are not always that easy to predict, they are far from a totally unpredictable random walk. Repetitive patterns do form, allowing the experienced analysts to often stay ahead and take advantage of the next big price swing.