In yesterday’s flagship Stock Trading Alert, we have evaluated the week just over, and examined the health of the S&P 500 advance. As the S&P 500 declined profoundly yesterday, we’ll revisit the credit markets and one key S&P 500 sector to assess just where are we in the unfolding S&P 500 downswing. Then, we’ll turn to the Fed and go down the rabbit hole.

Let’s start with the S&P 500 itself, and check the weekly and daily perspectives (charts courtesy of http://stockcharts.com ).

S&P 500 in the Medium- and Short-Run

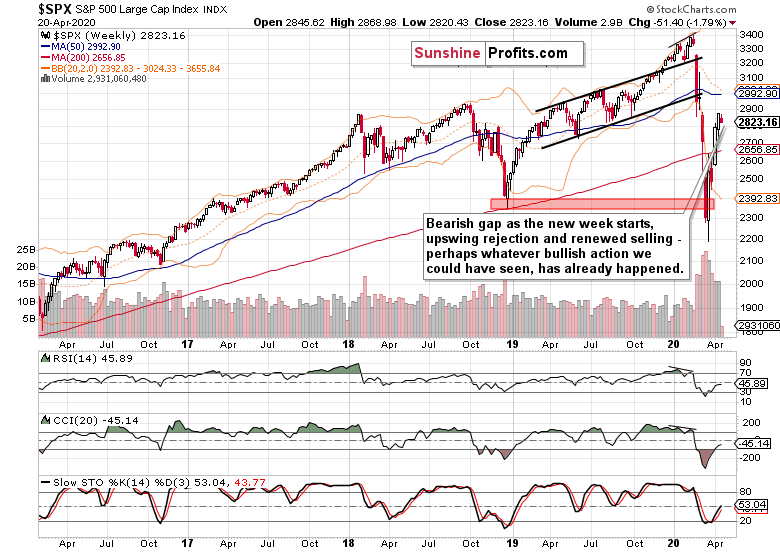

The last two weeks brought us higher prices, but the upside momentum decreased in the prior week as the bears reemerged. Had the volume behind the rally been higher, it would have made the price recovery more credible.

This week opened with a bearish gap, erasing all upswing attempts and the sellers are holding the reins. It’s more than a rhetorical question to ask whether we’ve seen all there was to see in the bullish run already.

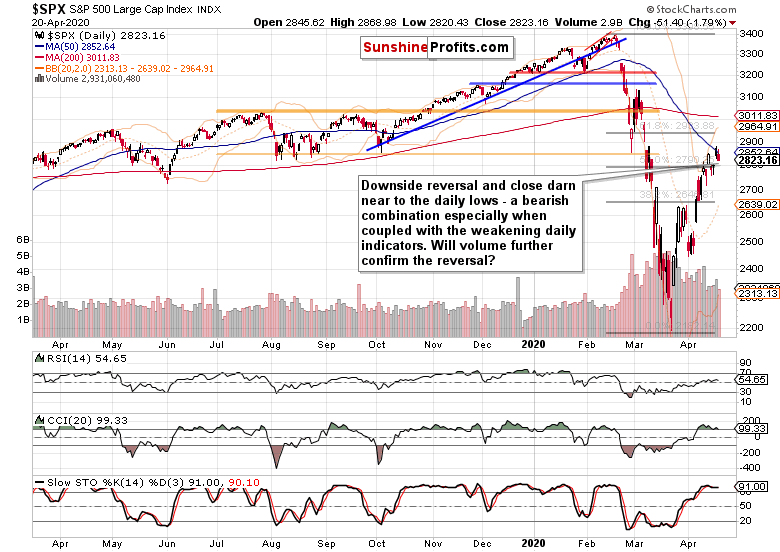

Let’s check Monday’s action on the daily chart.

Prices clearly rolled over to the downside yesterday, closing near the daily lows. The volume was not too shabby but it could have been higher. But we’re not living in an ideal world where all the ducks always line up in one row. Suffice to say that last Friday’s volume is sticking out like a sore thumb, lending credibility to the unfolding reversal lower.

Clearly, the breakout above the 50% Fibonacci retracement is in jeopardy.

These were our yesterday’s comments regarding the daily indicators. They:

… are getting increasingly extended, with both CCI and RSI struggling to keep from rolling over. Stochastics’ overbought readings will arguably take longer than it is the case with CCI to flash its upcoming sell signal. These increase the likelihood of the S&P 500 taking a breather shortly.Just like we’ve seen quite a few bullish gaps in the recent days and early April, bears may respond with some of their own making (and today may be first such day as the S&P 500 futures trade at around 2825 as we speak).

While there’s no noticeable change in the daily indicators posture to speak of, we’ve certainly seen the first bearish gap in quite a few days. And indeed also today, the S&P 500 is bound to open lower as it trades around 2760 as we speak.

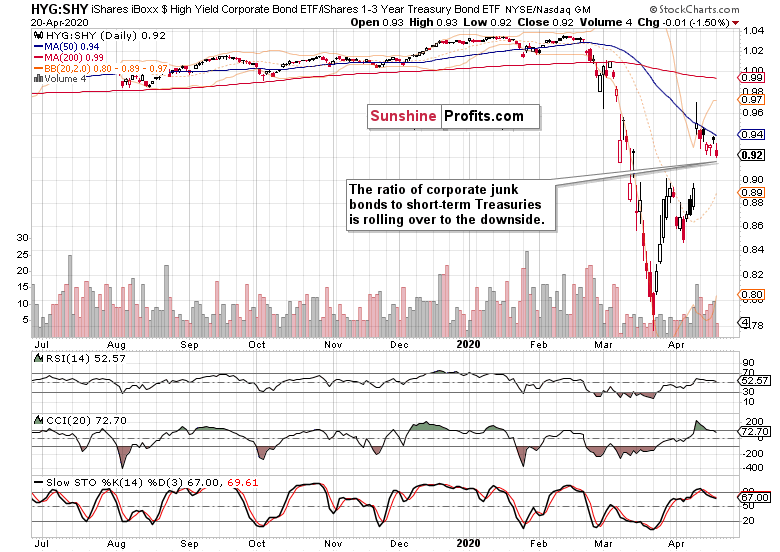

As we move to the credit markets next, let’s repeat our Thursday’s intraday commentary as it keeps standing the test of time:

… the credit market metric of high yield corporate bonds to short-term Treasuries keeps trading down. That serves to confirm thin air as the S&P 500 challenges 2800, and actually points to a disconnect between the two markets. And it’s the bond guys who usually get it right, which is one more reason apart from the fundamental coronavirus fallout, why we expect renewed selling in stocks.

The Credit Markets’ Point of View

If we had to pick just one metric for today, it would be the high-yield-corporate-bonds-to-Treasuries ratio. What can we deduce from its day-to-day move?

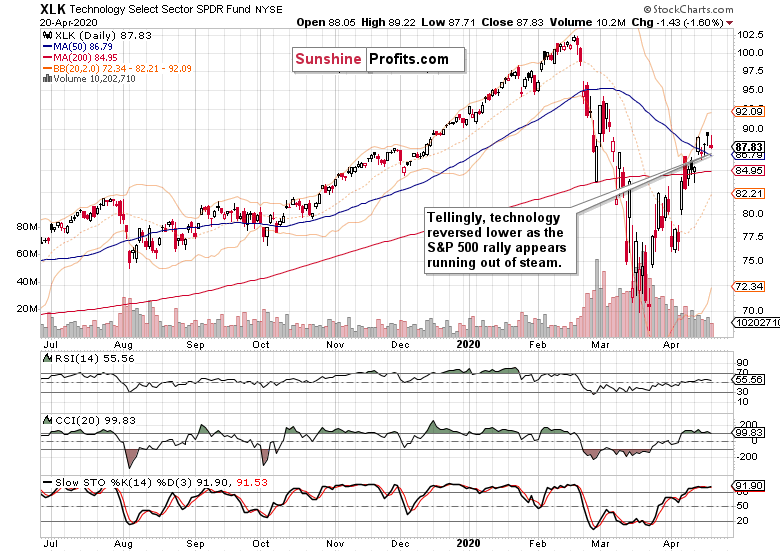

Houston, we have a problem. The ratio is moving to the downside, confirming our yesterday’s point about the defensive nature of the S&P 500 rally. In one breath though, we’ve pointed out the strong showing of the technology sector (XLK ETF).

Let’s see exactly how it did yesterday.

The S&P 500 Technology Sector

The shape of its daily candle is very similar to another engine of the recent S&P 500 upswing – the health-care sector (XLV ETF). Both are not so subtly but rather tellingly bearish, illustrating the headwinds the bull run is facing. Such price action doesn’t really point to bright short-term prospects in stocks.

The Fundamental S&P 500 Outlook

Please see yesterday’s flagship Stock Trading Alert as it went to great lengths covering these. Today, we’ll enrich the perspective with yet another angle that goes to support the poor prospects for the S&P 500 this week. It’s the volume of Fed’s interventions in the Treasury market – the liquidity pump has been progressively turning the volume down.

Originally, the Fed had come in with a $75-billion per day cashbook. That volume gradually decreased to $30 billion per day on average during the past week. And throughout this week, we’re slated to see it halved to around $15 billion per day merely. That’s certainly a lot less dough propping up the many asset classes (stocks included as we have seen in their decreasing upswing momentum on a weekly basis) and just goes to show the degree of Fed’s capture of the market. Additionally, this underscores the issues of finding different qualifying bonds after such a buying spree. Even monetary policy has its limits. What would the Fed put next on its wish list? Stocks as Bank of Japan did already?

From the Readers’ Mailbag

Q: Am I imagining things or does the trading in the general stock market seem a little “funny” to you over the last 2 to 3 weeks? In other words, do you think the stock market is being “artificially” buoyed? It seems to me that every time the daily trading shows a “bearish pattern” and should go down, it doesn’t.

Personally, I don’t know who in the world would buy stocks at this time anyway. No one knows how hard earnings are going to be hit in the quarters ahead, except that they will be clobbered to a greater or lesser degree. I warn all my friends to go to cash in their 401Ks, however. ”their guy” says just hold put. But still who wants all their money exposed to stocks right now?

A: Well, the Fed has quite a history of intervening in the markets, and this isn’t going away any time soon. If you look at the moments where various QE programs have been initiated, it was during decisive, even technically turning points. QE2 serves as a good example of the “when in doubt, inflate” approach. We have to live with the many and increasingly inventive monetary interventions, and take them into account in our decision-making. The above peek into this week’s Fed’s buying plans serves as a good example as it’s one more tailwind arguing for lower stock prices (besides the shaky medical progress on coronavirus new infections and increasingly dashed hope of meaningfully lifting the lockdown “right now”).

We certainly agree that earnings are going to be hit hard, and are on the record as saying that their decline would be way bigger than is currently being projected for the quarter(s) ahead. We also agree that a better time to buy stocks will emerge, and we don’t think that the buy-and-hold mindset would win the day. Being nimble will be handsomely rewarded over the many coming weeks and months – that’s what we deal with at Stock Trading Alerts.

Summing up, the S&P 500 upswing has been challenged yesterday, and will be up for scrutiny even more so today. As the Fed is tapering its asset purchases and the fundamental headwinds remain unchanged since our yesterday’s analysis, the bulls can be expected to be on the defensive very much throughout this week. The breakout above the 50% Fibonacci retracement looks increasingly likely to be invalidated, the credit markets continue to underperform, and the formerly leading S&P 500 sectors have stalled yesterday. We didn’t have to wait too long to see stocks roll over to the downside it seems. As the coronavirus fallout gets worse before getting better and as the battle gets broadly recognized as being far from won, the drive to reopen the economy will suffer – and its elusive nature actually drive exasperation among the public at large.

Technically, the renewed selling pressure has arrived, and the bears have their sights on the March lows. Our short position remains justified.