Forex News and Events

South Korea: 4Q GDP in line

South Korea released the advanced 4Q 2015 earlier this morning. The economy grew 3%y/y, up from 2.7% in the in the prior quarter, in line with median forecast. On a quarter-over-quarter basis, GDP advanced 0.6% (s.a.), also in line with estimates. Domestic consumption improved substantially over the fourth quarter with private consumption growing 1.5%q/q compared to 1.2% in the previous quarter. Overall, the data showed that the economy reacted positively to the new environment of low oil prices and was also able to weather the weaker demand from China by boosting its exports (up 2.1% compared to -0.6% in 3Q) to other countries. The weak won, low interest rates and the strong domestic demand should allow the economy to stabilise in 2016. However, one should keep an eye on China’s slowdown as it remains the biggest to the South Korean economy.

EUR/CHF flirting with 1.1000

Yesterday, the Swiss Franc has weakened to 1.10 CHF for one euro for the first time since September last year. In a world where actual returns are very difficult to grasp, the Swiss currency is more and more used as a funding currency. This is of course providing some relief to the Swiss National Bank which is still concerned about the overvaluation of the currency. The continued weakening of the Helvetic currency against the single currency is also proving the market confidence in the European Central Bank’s policy despite Draghi announced at last week’s meeting that the current European monetary policy will be reviewed at next March’s meeting and that more stimulus may be added.

It also seems that we are not in a full risk-off environment. The Global turmoil, the Chinese slowdown and current equities losses are not yet sufficient to give back the safe haven status to Switzerland. For the time being, the yen looks much more attractive due to the fact that the overnight rate, even though very low, is positive. A long position in the Japanese currency provides interests. Last but not least, the Switzerland economy is at stake, for example December Trade Balance has been released this morning well below expectations are CHF 2.54 billion vs CHF 3.14b and the exports are also suffering with a continued declined to -1.4% m/m vs a prior revised data of -3.3% m/m for November.

Anyway, we believe that there is a threshold for which a too strong risk-off environment will drives inflows of capital toward Switzerland. For the time being, confidence is still there, monetary policies around the globe are still believed to be efficient to help countries to recover from current economic slowdown. As a result, we think that the EUR/CHF may go up to 1.1200 but not above. Downside pressures will then be too strong.

Gold - Bullish Momentum Is Growing.

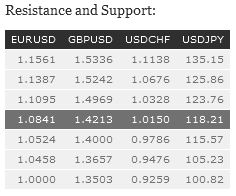

The Risk Today

EUR/USD lies in a short-term downtrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). Expected to show further very short-term increase. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD keeps on declining inside the downtrend channel. Hourly resistance is given at 1.4363 (22/01/2016 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to show further weakness below 1.4000. The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is trading mixed. Hourly resistance lies at 123.76 (18/11/2015 high). Hourly support lies can be found at 115.98 (20/01/2016 low). Expected to further bounce toward 120.00. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF's uptrend momentum is still lively despite yesterday's bearish retracement. Yet, the pair remains in the upward channel. Hourly support is located at 0.9876 (14/12/2015 low) and hourly resistance can be found at 1.0184 (24/01/2015 high) and at 1.0328 (27/11/2015 high). Expected to show continued strength. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.