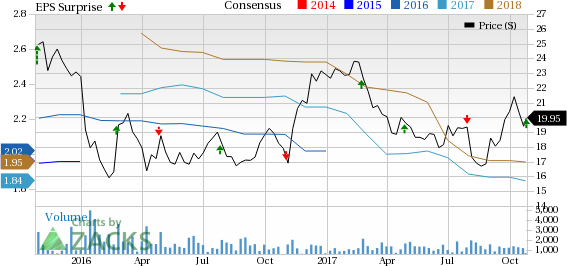

Sonic Automotive Inc. (NYSE:SAH) registered adjusted earnings per share of 40 cents in third-quarter 2017 compared with 47 cents in the year-ago quarter. However, earnings came in line with the Zacks Consensus Estimate.

Total revenues in the reported quarter decreased 2% to $2.51 billion. The figure also missed the Zacks Consensus Estimate of $2.53 billion.

Revenues from total new vehicles declined 0.9% year over year to $1.36 billion. Revenues from used vehicles decreased 0.2% to $659.7 million in the quarter. Wholesale vehicle revenues dropped 38.9% to $43.1 million. Revenues from parts, service and collision repair decreased 3.9% to $347.7 million, while finance, insurance and other revenues grew 3.7% to $92.9 million.

Gross profit increased to $362.6 million in the reported quarter from $359.1 million a year ago. Selling, general and administrative expenses increased to $284 million from $282.1 million in the year-ago quarter. The company reported operating income of $55.8 million compared with $0.97 million in the year-ago quarter.

Dividend Update

The board of directors at Sonic Automotive announced a quarterly dividend of 5 cents per share. The dividend will be paid on Jan 12, 2018, to shareholders on record as of Dec 15, 2017.

Business Update

During the quarter, the company’s EchoPark units retailed rose 37.7% year over year. Also, the company has plans of opening another 10 EchoPark stores by the end of 2018.

During the quarter, all stores in the Houston market had to be closed for around a week due to hurricane Harvey.

2017 Outlook

Sonic Automotive expects adjusted earnings per share in 2017 in the band of $1.85-$1.95 per share.

Sonic Automotive currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the auto space include Fox Factory Holding Corp (NASDAQ:FOXF) , PACCAR Inc (NASDAQ:PCAR) and Fiat Chrysler Automobiles N.V. (NYSE:FCAU) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1(Strong Buy) Rank stocks here.

Fox Factory Holding, PACCAR and Fiat Chrysler have a long-term expected earnings growth rate of 14.2%, 10% and 19.1%, respectively.

Zacks’ Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Sonic Automotive, Inc. (SAH): Free Stock Analysis Report

PACCAR Inc. (PCAR): Free Stock Analysis Report

Fox Factory Holding Corp. (FOXF): Free Stock Analysis Report

Fiat Chrysler Automobiles N.V. (FCAU): Free Stock Analysis Report

Original post

Zacks Investment Research