Professional development and certification platform Skillsoft (NYSE:SKIL) stock has been a key reopening and return to work benefactor. The provider of professional development and coaching services is a post-pandemic winner as workers not only return to work but seek higher-paying opportunities with development and certification services. Skillsoft benefits from the tightening labor workforce which bolsters demand for its educational content. Corporations are also finding it more cost-effective to invest in its workforce and mold talent, rather than seek outside talent at a premium. This falls right into Skillsoft’s wheelhouse. The total addressable market (TAM) for global professional learning is estimated around $300 billion and growing at 10% annually. Self-paced professional eLearning from home really became mainstream in terms of adoption during the pandemic, but the reopening trend has accelerated the investment by corporations to bolster and nurture its workforce. Skillsoft is ranked number one in leadership and business skills category, number two in the technology and developer segment and number two in the compliance segment based on revenue. Prudent investors seeking exposure in the reopening and strong labor market can watch for opportunistic pullbacks in shares of Skillsoft.

Q2 Fiscal 2022 Earnings Release

On Sept. 14, 2021, Skillsoft reported its fiscal Q2 2022 results for the quarter ending July 2021. The Company reported adjusted revenues of $176 million, up 5% year-over-year (YoY) and adjusted EBITDA of $43 million, up 2% YoY. Bookings exceed expectations by 18%. Percipio bookings rose 47%, highlighting new product momentum and platform migration. The Company acquired Pluma for $22 million, which adds digital coaching and more professional development solutions. The Company achieved strong bookings growth across three segments: Content Learning up 9%, Global Knowledge up 30% and SumTotal up 15%.

CEO Comments

Skillsoft CEO Jeffrey Tarr commented:

“We are pleased with Skillsoft’s strong performance during our initial quarter as a public company. We delivered double-digit bookings growth, won multiple new blue-chip customers, and acquired fast-growing digital coaching platform Pluma, enabling us to offer an on-demand, executive-quality leadership development solution to our customers, which include approximately 70% of the Fortune 1000. We see substantial opportunity to extend our leadership in the rapidly expanding and highly fragmented corporate learning industry as we innovate and invest in growth. Our new leadership team is executing well against our strategic priorities, and we are well-positioned to create significant value for our customers, shareholders and other stakeholders.”

Updated Guidance

Skillsoft raised its guidance metrics for full fiscal year 2022. The Company expects bookings to grow to $690 million to $710 million from previous outlook for $660 million to $690 million. Adjusted revenue estimates were raised to $670 million to $690 million, up from $645 million to $6675 million. Adjusted EBIDTA remains unchanged at $155 million to $175 million.

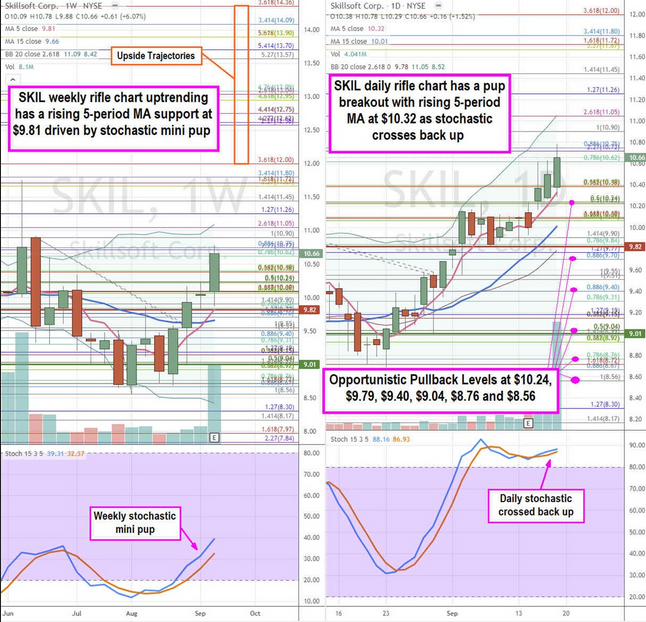

SKIL Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provide a precision view of the landscape for SKIL stock. The weekly rifle chart breakout has a rising 5-period moving average (MA) support near the $10.38 Fibonacci (fib) level. The weekly stochastic formed a mini pup with weekly upper Bollinger Bands (BBs) at $11.09. The weekly 15-period MA support is rising at $9.66. The daily rifle chart triggered the market structure low (MSL) buy signal a breakout above $9.01 level. The daily 5-period MA support is rising at $10.31 followed by the 15-period MA support at $10.01. The daily upper BBs sit at the $11.05 fib. The $9.82 acts as a daily market structure high (MSH) sell trigger. Rather than chasing, prudent investors can watch for opportunistic pullback levels at the $10.24 fib, $9.70 fib, $9.40 fib, $9.04 fib, $8.76 fib, and the $8.56 fib level. Upside trajectories range from the $12.00 fib to the $14.36 fib level.