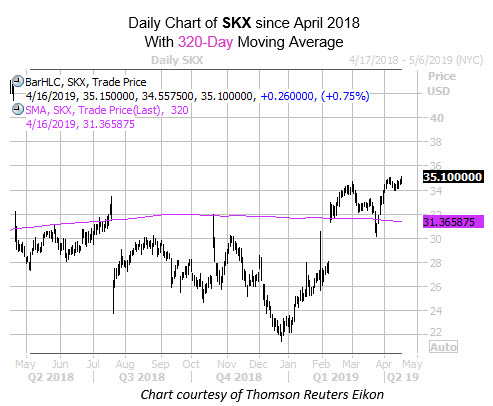

Shoemaker Skechers USA Inc (NYSE:SKX) is slated to report first-quarter earnings before the market opens, Thursday, April 18. The security has been moving higher in recent weeks and was last seen back above the $34 mark. Another notable trendline the shares have utilized is the 320-day moving average, which has been the support since mid-February. At last check, SKX is up 0.8% at $35.10 in today's trading, and from a broader standpoint has added 53% year-to-date.

Looking at Skechers' earnings history, the California-based company's stock has closed higher the day after reporting in five of its past eight earnings, including a 15.2% surge last report, and an incredible 41.4% jump in October. Over the past two years, the shares have swung an average of 16.2% the day after earnings, regardless of direction. This time around, the options market is pricing in a higher-than-usual 19.9% swing for Thursday's trading.

On the options front, data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) shows a 10-day put/call volume ratio of 1.40, in the 87th annual percentile. In other terms, puts have been purchased over calls at a faster-than-usual clip. During this time frame, the May 34 and 35 puts have been most active, meaning put buyers expect the stock to stay at or below its current price point until options expiration on Friday, May 17.

Lastly, short interest has increased by 15.8% on SKX during the past two reporting periods and now accounts for 7.6% of the stock's total available float. At the equity's average pace of daily trading, it would take shorts more than four days to buy back their bearish bets.