The Census Bureau reports November Construction Spending rose 0.9% from October. That’s a 10-year high, but it’s highly unlikely to last.

U.S. construction spending rose more than expected in November, reaching its highest level in 10-1/2 years, which could provide a lift to fourth-quarter economic growth.

Spending on private construction projects jumped 1.0 percent in November to its highest level since July 2006 as single-family home building, as well as home renovations, increased.

Investment in private nonresidential structures — which include factories, hospitals and roads — rose 0.9 percent after tumbling 1.5 percent the prior month.

Public construction spending gained 0.8 percent in November to the highest level since March. It was the fourth straight month of increases. Outlays on state and local government construction projects rose 0.6 percent, also gaining for a fourth consecutive month.

Federal government construction spending surged 3.1 percent after rising 0.2 percent in October.

Construction Boom

As expected, the Econoday parrot is singing happy tunes.

Highlights

Construction had been lagging through most of 2016 but, like the factory sector, appears to have picked up steam going into year-end. Spending rose 0.9 percent in November which just tops Econoday’s high estimate and is the best reading since June.

Residential spending rose 1.0 percent in the month on top of October’s 1.6 percent gain. The gain here is concentrated in single-family homes which offset a monthly dip for multi-family units which otherwise have been leading the residential sector. Home improvements added to the spending in November.

Non-residential spending was also strong, up 0.9 percent which most categories showing gains led by office construction and transportation construction. Public spending was also solid including a 3.1 percent monthly jump in Federal spending.

The breadth of gains is most impressive in this report, one that will give a lift to fourth-quarter GDP estimates.

Six Reasons Boom Won’t Last

The construction boom is in its last legs. Here’s six reasons why.

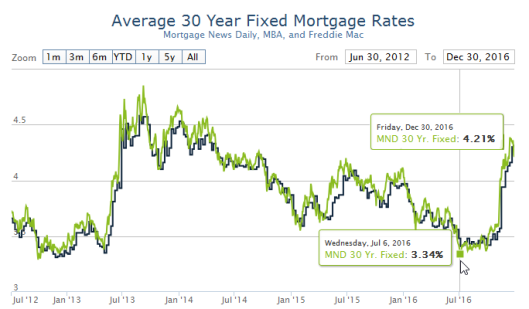

1. Mortgage rates are rising and the Fed expects more hikes.

Since July, mortgage rates are up nearly a full percentage point.

2. Housing Starts Dive 18.7 Percent

New Residential Construction Details

- Permits down 4.7% from October

- Permits down 6.6% from year ago

- Starts down 18.7% from October

- Starts down 6.9% from year ago

- Completions up 15.4% in October

- Completions up 25% from year ago

3. There’s a Glut in Luxury Apartments

High-end sales and leases have been helped by the rising stock market. The market is insanely priced, yet investors expect more.

5. Online sales killed department store sales.

6. 21 states plus D.C. have minimum wage hikes this year.

Retail stores, especially box department stores and fast food restaurants, will not want to expand rapidly in an environment where interest rates are up, wages are up, and sales are slow because of online competition.