China's big state companies, confident on the outlook for domestic natural gas reforms, are buying up local distributors and raising fresh capital - and making gas the hottest prospect for energy investment in the world's top energy consumer.

The prospects for expansion and acquisitions also have China's natural gas distributors trading like growth stocks, instead of bog-standard utilities.

China is pushing energy price reforms and spending billions of dollars on gas imports and infrastructure to cut the use of coal, which supplies over 70 percent of its energy but has made it the world leader in mine accidents and greenhouse emissions, and among the worst in air pollution.

While nuclear power and renewables such as solar and wind are also benefiting from the shift, for now gas looks set to gain the most, since plentiful supplies and its use in industrial production and conventional thermal power plants mean it can be developed quickly and efficiently.

"Natural gas is clean energy that is enjoying a lot of state policy support," said Liu Yang, chief investment officer of regional fund house Atlantis, which manages $4 billion and holds shares of Hong Kong-listed Chinese city gas distributors.

"The city gas sector has been under-invested and is just about to take off," she said.

By leveraging their financial muscle and grips on upstream supplies, Chinese oil majors, are well-placed to take over more smaller rivals, including unlisted companies.

"All the small city gas companies will be swallowed up by PetroChina or Sinopec one day," said an executive at a Hong Kong-listed gas distributor. He requested anonymity as his company purchases natural gas from PetroChina.

GROWTH STOCKS

China is moving to double the share of gas in its overall energy supply to more than 8 percent by 2015, when consumption should reach 260 billion cubic meters (bcm), while coal will be cut to just over 60 percent. By 2030, gas use will hit 500 bcm, about what the European Union consumes today, according to industry forecasts.

The lion's share of that additional supply will go to new gas-fired power plants.

China's installed gas-fired capacity will more than quadruple to 220 gigawatts by 2020 from 40 gigawatts last year, creating a gas power equipment market worth 26.5 billion yuan ($4.2 billion) a year for 2011-2020, nearly seven times the average size of the market in the prior five years, Barclays estimates.

The gas sector was virtually non-existent in China until the late 1990s, and while billions of dollars have been poured into construction of pipelines and terminals over the past decade, more than two-thirds of China's 600-plus cities still have no access to gas supplies.

Driving the state firms' push into the gas distribution sector is a government decision to bite the bullet and start freeing up state-controlled domestic prices, to encourage gas importers and producers.

Gas prices are linked to crude oil in the Asia market but inside China have been strictly controlled - like electricity and petroleum product prices - since the authorities fear volatile energy costs could hinder industrial development and create hardships for households.

One of the companies that could be an attractive play is Sino Gas International Holdings (SGAS.OB) traded on the OTC. The company, through its indirectly wholly-owned subsidiary, Beijing Zhong Ran Wei Ye Gas Co., Ltd. ("Beijing Gas"), and the subsidiaries of Beijing Gas, is a leading developer of natural gas distribution systems in small and medium size cities in China, as well as a distributor of natural gas to residential, commercial and industrial customers in China. The company owns and operates natural gas distribution systems in 34 small and medium size cities and serving approximately 234,749 residential and seven industrial customers. Facilities include approximately 1,635 kilometers of pipeline and delivery networks with a daily capacity of approximately 130,000 cubic meters of natural gas. The company owns and operates natural gas distribution systems in Beijing, Hebei, Jilin, Jiangsu, Anhui and Yunnan Provinces. The company's website is here.

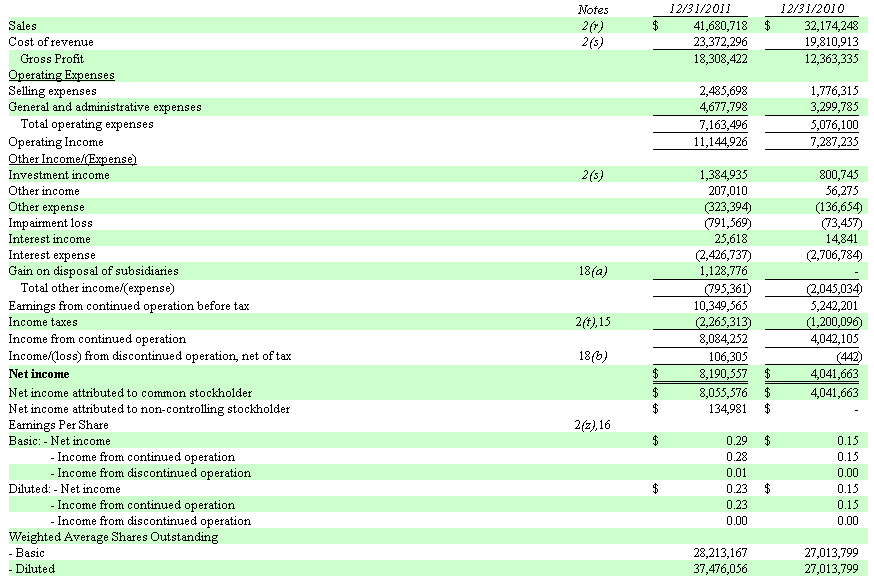

With diluted EPS of $0.23 this company is way undervalued with a P/E below 2. More information in their 10-K. Don't take the non-binding going private proposal of $0.48 if you are a shareholder. It's just a scratch from the company's real value.

Sino Gas International Holdings, Inc.

Consolidated Statements of Income

For the year ended December 31, 2011 and 2010

(Stated in US Dollars)

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sino Gas International: Take-Over Candidate?

Published 05/10/2012, 06:55 AM

Updated 07/09/2023, 06:31 AM

Sino Gas International: Take-Over Candidate?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.