“Whites lead yellow” is one of the sayings about the precious metals market. And the white – silver – is down.

That saying describes one of the rules of thumb for the precious metals sector – that silver can be indicating something for gold. There are exceptions from this rule, as silver tends to outperform gold on a short-term basis close to local tops, but it seems that at this time, silver investors know something. Or, more precisely, they are reacting to something that gold or stock market investors don’t really sense yet. Mining stock investors appear to have “felt” it all along.

Miners' Plunge and Underperformance

What do I mean? The fact that miners plunged recently and that they have been underperforming gold for weeks (and for many months from the long-term point of view).

Moving back to silver, in today’s pre-market trading, the white precious metal moved to new yearly lows.

This is a completely normal and unsurprising phenomenon, and you knew about the reason behind it for quite many days.

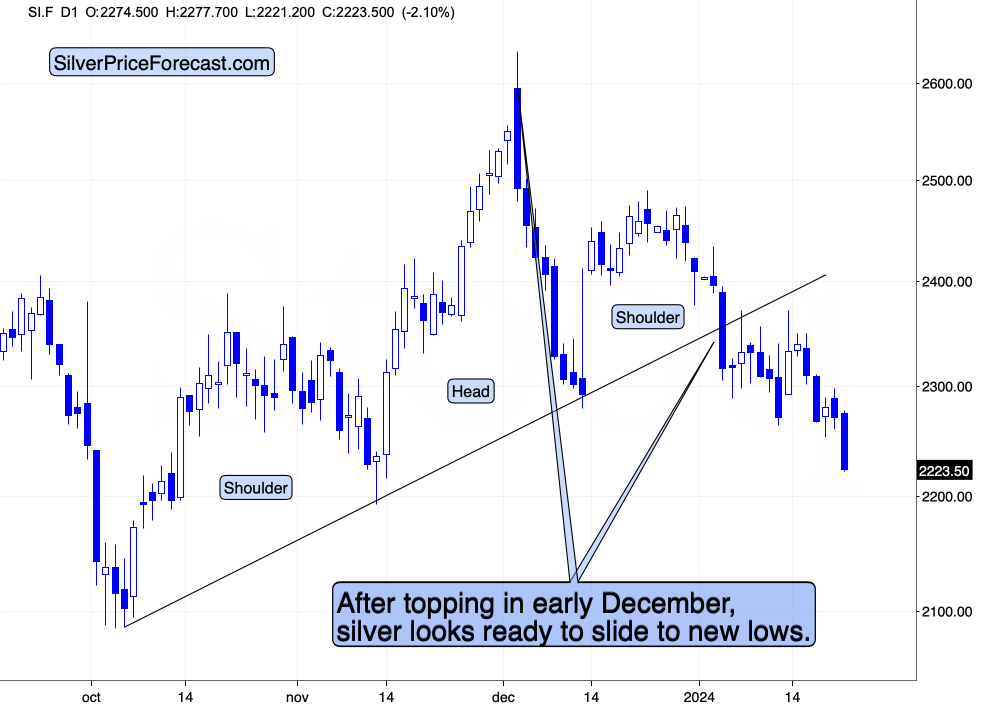

Silver not only broke below its rising support line, but by doing so, it completed its head-and-shoulders top formation. Those formations tend to be followed by pauses, corrections, and/or verifications that take form of a comeback to the previously broken neck level of the pattern. Once this is all done, the price then slides.

That’s exactly what we saw in the previous days. Silver consolidated below the pattern’s neck level, even trying to move back to it, and then it declined. This decline has been continuing up to this day.

Further Fall for Silver

Moreover, this short-term decline is most likely not over yet, as the target based on the pattern is close to the 2023 low – at about $21. This means that silver is likely to fall further.

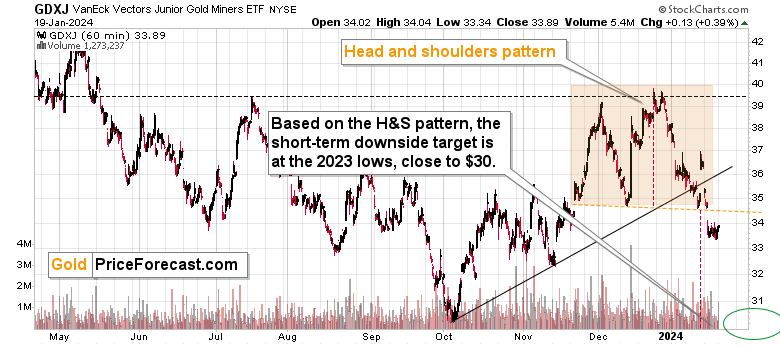

And speaking of the head-and-shoulders patterns in the precious metals sector, we see it as well in the junior mining stocks.

The area marked with an orange rectangle is also a head-and-shoulders top pattern. The neckline (marked with an orange, dashed line) was broken, and the VanEck Junior Gold Miners ETF (NYSE:GDXJ) has been consolidating after the breakdown.

Even though gold (and stocks.) moved higher in the short term, miners didn’t follow. This means that miners have been – once again – weak relative to gold on top of verifying their own breakdown.

This is a perfectly bearish combination that tells us that miners are about to slide once again.

Miners’ lack of rally on Friday is exceptional (-ly bearish) given that the S&P 500 just moved to new highs.

Just imagine how far miners would be likely to slide once the stock market plunges in a decisive manner.

And we might not need to wait for that for much longer, either. If you look at the most recent trading pattern and compare it with what we saw at the end of 2021 and in early 2022, you’ll see that it’s the same kind of price movement.

In both cases, we saw two local tops along with two higher lows and then a sharp rally to new highs, which turned out to be the final top.

We saw the two local tops with two higher lows (so, we saw a consolidation), and on Friday we saw a sharp rally to new highs. Is this a final top? I view that as a likely outcome, especially given that commodities (like copper and silver) are not performing well. Also, have you seen that huge plunge in natural gas?

Weak commodity prices suggest that there’s no significant industrial demand, which is connected with insufficient demand for products coming from many companies. This, in turn, indicates weaker sales, revenues and profits. This means lower stock valuations.

Something doesn’t add up, especially since credit is still relatively expensive compared to what the markets were used to – the interest rates haven’t fallen.

When stocks decline in a meaningful way – and they are likely to – silver and junior mining stocks are likely to be affected to a particularly high extent. And – as you can see in today’s pre-market trading – silver just can’t wait to move to new lows… New lows are most likely approaching in the case of miners as well, and it seems that profits on our short position in junior miners are going to increase shortly.