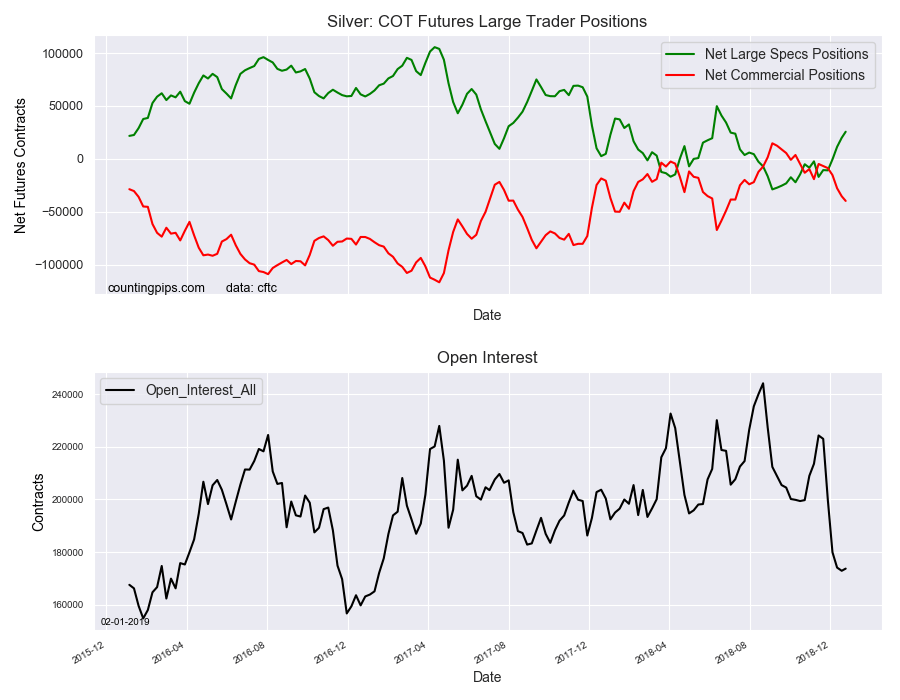

Silver Non-Commercial Speculator Positions:

Large precious metals speculators raised their bullish net positions in the Silver futures markets in late December, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from late in December due to the government shutdown which halted the releases. The CFTC will be releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of Silver futures, traded by large speculators and hedge funds, totaled a net position of 25,550 contracts in the data reported through Tuesday December 24th. This was a weekly boost of 5,719 net contracts from the previous week which had a total of 19,831 net contracts.

The week’s net position was the result of the gross bullish position (longs) increasing by 3,291 contracts to a weekly total of 77,314 contracts compared to the gross bearish position (shorts) which saw a drop by -2,428 contracts for the week to a total of 51,764 contracts.

The silver net position, in this delayed data, shows that speculators pushed up their bets to the highest level since June and for four straight weeks through December 24th.

Silver Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -39,869 contracts on the week. This was a weekly fall of -4,393 contracts from the total net of -35,476 contracts reported the previous week.

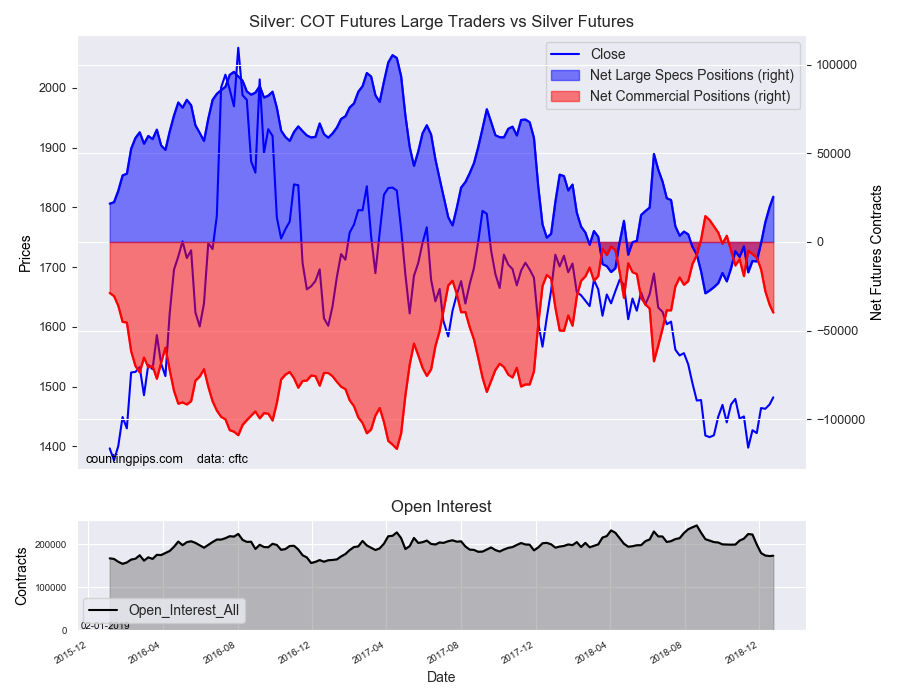

Silver Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the Silver Futures (Front Month) closed at approximately $1482.00 which was a rise of $11.90 from the previous close of $1470.10, according to unofficial market data.