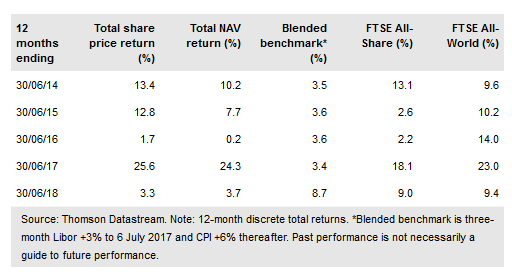

Seneca Global Income Growth (LON:SIGT) aims to generate an average total return of at least CPI +6% pa, with low volatility, over the course of a normal business cycle, while growing annual dividends at least in line with UK inflation. It employs a value-based, multi-asset approach, investing in UK and overseas equities, fixed income and specialist assets. SIGT’s investment team employs a long-term strategic asset allocation (SAA), using a shorter-term tactical asset allocation (TAA), to take advantage of relative valuation differences between asset classes. In anticipation of an expected global economic downturn in 2020, SIGT’s managers are continuing to reduce risk by lowering equity exposure broadly at a rate of 1pp every couple of months. The TAA can vary markedly from the SAA when deemed appropriate, illustrated by the current zero exposure to North American equities.

Investment strategy: Multi-asset approach

To achieve SIGT’s total return objective, the investment team at Seneca Investment Managers (SIML) seeks to construct a multi-asset portfolio where each position is trading at a discount to its perceived value. Investments are primarily direct for UK equities, and via third-party funds for overseas equities, fixed income and specialist assets. Compared to the SAA, at end-May 2018, SIGT’s TAA was underweight UK equities, market weight overseas equities, underweight fixed income and overweight specialist assets, along with an overweight 5.5% TAA allocation to cash.

To read the entire report Please click on the pdf File Below: