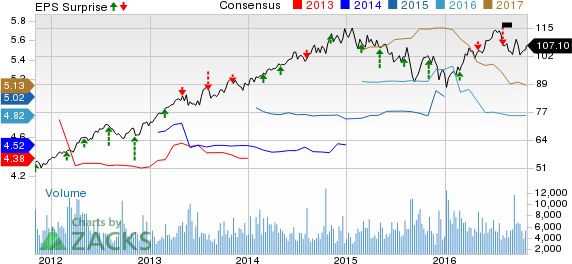

Sempra Energy’s (NYSE:SRE) third-quarter 2016 adjusted earnings per share came in at $1.02, beating the Zacks Consensus Estimate of 97 cents by 5.2%. Earnings also improved 3% from 99 cents reported in the prior-year quarter.

GAAP earnings were $2.46 per share in the quarter, compared with 99 cents a year ago.

Total Revenues

In the quarter under review, total revenue was $2,535 million, up 2.2% year over year, due to higher contributions from the energy-related businesses (1.1%) and utilities (2.3%). However, total revenue missed the consensus mark of $2,665 million by 4.9%.

Segment Update

San Diego Gas & Electric (SDG&E): Quarterly earnings were $183 million compared with the year-ago figure of $170 million. During the quarter, California Public Utilities Commission approved SDG&E's proposal to construct a new 15-mile, 230-kilovolt transmission line to improve reliability. Also, the CPUC approved a proposal by SDG&E to build two new energy storage projects in San Diego County to enhance electric reliability.

Southern California Gas Company (SoCalGas): The segment registered no earnings in the third quarter of 2016, compared to a year-ago loss of $8 million.

Sempra South American Utilities: The segment recorded earnings of $46 million in the third quarter, up from $43 million in the prior-year quarter.

Sempra Mexico: The segment recorded earnings of $332 million, up from $63 million in the prior-year quarter, primarily due to the $350 million after-tax re-measurement gain on the Gasoductos de Chihuahua acquisition. This was offset by the $65 million after-tax charge related to the planned sale of the Termoeléctrica de Mexicali plant and beneficial effects of foreign currency and inflation in third-quarter 2015.

Sempra Renewables: The segment recorded quarterly earnings of $17 million, up from $15 million in the prior-year quarter.

Sempra Natural Gas: The segment reported earnings of $77 million, compared to the year-ago quarter’s $1 million. The improvement was driven by the $78 million after-tax gain from the sale of EnergySouth.

Parent & Other: The segment reported a loss of $33 million in the third quarter, narrower than the year-ago loss of $36 million.

Financial Update

As of Sep 30, 2016, Sempra Energy’s cash and cash equivalents were $518 million, compared with $403 million as of Dec 31, 2015.

Long-term debt was $13,522 million as of Sep 30, 2016, compared with $13,134 million at 2015-end.

Cash flow from operating activities was $1,691 million in the first nine months of 2016, down from $2,089 million in the year-ago period.

In the third quarter, the company’s capital expenditures and investments were $2,247 million, compared with $783 million in the prior-year quarter.

Guidance

Sempra Energy reiterated its 2016 adjusted earnings guidance at the range of $4.60 to $5.00 per share.

Zacks Rank

Sempra Energycurrently carries a Zacks Rank #3 (Hold).You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

DTE Energy Company (NYSE:DTE) reported third-quarter 2016 operating earnings per share of $1.96, beating the Zacks Consensus Estimate of $1.54 by 27.3%. Reported earnings were also up 40% from the year-ago figure of $1.40.

Entergy Corporation (NYSE:ETR) reported third-quarter 2016 operating earnings of $2.31 per share, beating the Zacks Consensus Estimate of $1.95 by 18.5%. The reported number also improved 21.6% from $1.90 reported a year ago.

CMS Energy Corporation (NYSE:CMS) reported third-quarter 2016 adjusted earnings per share of 70 cents, beating the Zacks Consensus Estimate of 60 cents by 16.7%. Quarterly earnings also increased 32.1% from the year-ago figure of 53 cents.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

CMS ENERGY (CMS): Free Stock Analysis Report

ENTERGY CORP (ETR): Free Stock Analysis Report

DTE ENERGY CO (DTE): Free Stock Analysis Report

SEMPRA ENERGY (SRE): Free Stock Analysis Report

Original post

Zacks Investment Research