Sealed Air Corporation (NYSE:SEE) delivered fourth-quarter 2017 adjusted earnings per share of 58 cents, up 16% year over year. Earnings also beat the Zacks Consensus Estimate of 57 cents.

Sealed Air Corporation (SEE): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Original post

Zacks Investment Research

Including special items, the company posted earnings of 14 cents per share, compared with 77 cents per share recorded in the year-ago quarter.

Total revenues increased 11.5% year over year on a reported basis to $1.23 billion in the quarter. Revenues beat the Zacks Consensus Estimate of $1.19 billion. Currency had a positive impact on total net sales of 2% or $25 million. Sales increased across all regions in the quarter.

Cost and Margins

Cost of sales went up 15.6% year over year to $853 million. Gross profit inched up 3% to $374 million. Gross margin contracted 240 basis points (bps) to 30.5% in the quarter.

SG&A expenses increased 9% to $206 million from the prior-year period. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) was $238 million in the quarter compared with $216 million in the prior-year quarter. Adjusted EBITDA margin was 19.4% compared with 19.6% in the prior-year quarter.

Segment Performance

Food Care: Net sales advanced 8% year over year to $764 million. Currency had a positive impact of 2% or $15 million. On a constant dollar basis, net sales increased 6% aided by volume growth of 5% and favorable price/mix of 1%. Volume growth of 7% was noted in North America, 6% in Latin America and 4% in EMEA, offset by a dip of 2% in volumes in Asia Pacific. Adjusted EBITDA decreased 1% year over year to $162 million.

Product Care: The segment reported net sales of $464 million, up 18% year over year and 15% on a constant dollar basis, primarily due to the acquisition of Fagerdala. Volumes rose 5% whole favorable price/mix had a positive impact of 4%. Currency had a positive impact on Product Care’s net sales of 2% or $9 million. Adjusted EBITDA increased 8% to $95 million.

Financial & Other Updates

On Oct 2, 2017, Sealed Air acquired Fagerdala Singapore Pte Ltd., a manufacturer and fabricator of polyethylene foam, for $100 million in cash. The buyout of Fagerdala will considerably expand Sealed Air’s presence in Asia. Notably, Fagerdala’s proficiency in foam manufacturing and fabrication will enable Sealed Air to offer a full portfolio of differentiated solutions, such as automated fulfillment systems and operational excellence consultative services, to consumers.

Cash and cash equivalents were $594 million as of Dec 31, 2017, up from $333.7 million as of Dec 31, 2016. Cash flow from operating activities was $398 million during 2017, down from $907 million in the prior year.

As of Sep 30, 2017, Sealed Air’s net debt came in at $2.7 billion, lower than the $3.8 billion as of Dec 31, 2016 owing to repayment of debt following the sale of Diversey.

The company repurchased approximately $1.3 billion of shares during 2017. As of 2017 end, Sealed Air had approximately $867 million remaining under its authorized repurchase program.

Fiscal 2017 Performance

In 2017, Sealed Air’s adjusted earnings per share came in at $1.81, up 6% year over year. Earnings beat the Zacks Consensus Estimate of $1.80 as well as management’s guidance of $1.75-$1.80. Including special items, the company posted earnings of 33 cents per share, compared with $1.48 per share recorded in the year-ago quarter.

Total revenues increased 6% year over year to $4.46 billion in 2017, surpassing the Zacks Consensus Estimate of $4.42 billion. The company had guided sale of $4.4 billion for 2017.

Guidance

Sealed Air projects net sales of approximately $4.75 to $4.80 billion for 2018, a constant dollar growth rate of approximately 4.5%. Adjusted EBITDA from continuing operations is guided in the range of $890-$910 million. Currency is expected to have a favorable impact of approximately $110 million on net sales and $20 million on adjusted EBITDA. Adjusted earnings per share is expected to be in the range of $2.35-$2.45, a 33% increase at the midpoint.

In 2018, Sealed Air plans to drive profitable growth by improving productivity with its Sealed Air Operational Excellence culture.

Free Cash Flow for 2018 will be around $400 million, based on assumption of capital expenditures of approximately $160 million and cash restructuring payments of approximately $20 million, which excludes restructuring payments of $30 million to address stranded costs.

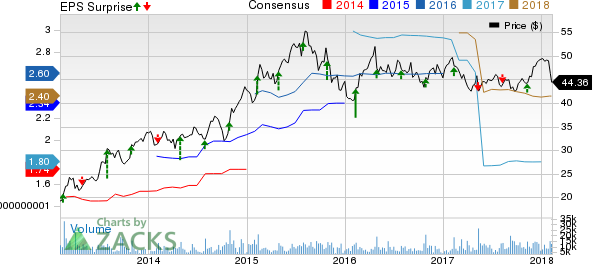

Share Price Performance

Over the past year, Sealed Air has grossly underperformed the industry with respect to price performance. While the stock dipped 5.9%, the industry recorded growth of 7.4%.

Zacks Rank & Key Picks

Currently, Sealed Air carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the industrial product space include Applied Industrial Technologies, Inc. (NYSE:AIT) , H&E Equipment Services, Inc. (NASDAQ:HEES) and Dover Corporation (NYSE:DOV) . All these stocks flaunt a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Applied Industrial Technologies has an expected long-term growth of 12%. Its shares have surged 26% in the past six months.

H&E Equipment Services has expected long-term growth of 18.6%. It shares have rallied 69% over the past six months.

Dover has expected long-term growth of 13%. Over the past six months, its shares have gone up 15%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Sealed Air Corporation (SEE): Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Original post

Zacks Investment Research