Words mean little on Fridays in the Wall Street Daily Nation.

Instead, I select a handful of graphics to put important economic and investing news into perspective for you.

So I’ll try to shut up now…

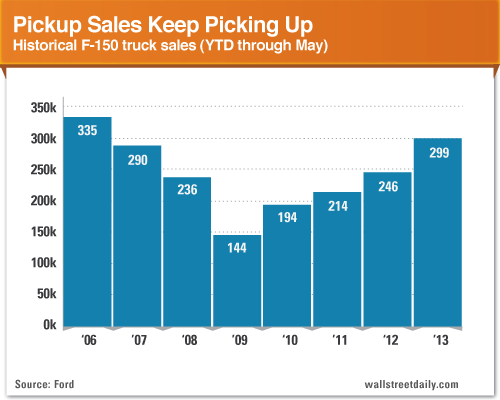

Another Pick-Up for Pickups

Last week, I did my best Jeff Foxworthy impression and mentioned that you might be a redneck if you drive a pickup. But you’d be a pretty darn smart redneck if you also owned a few hundred shares of Ford (F).

Well, that’s even truer today.

Since then, Ford F-150 sales data for May came out. And it looks like the boom times are back for dealerships!

Ford sold a total of 72,000 trucks in May, which brings the year-to-date total up to almost 300,000. That’s a 21.5% increase over last year – and the highest total since the recession hit.

As Americans keep buying pickups, is your portfolio built Ford tough? It should be.

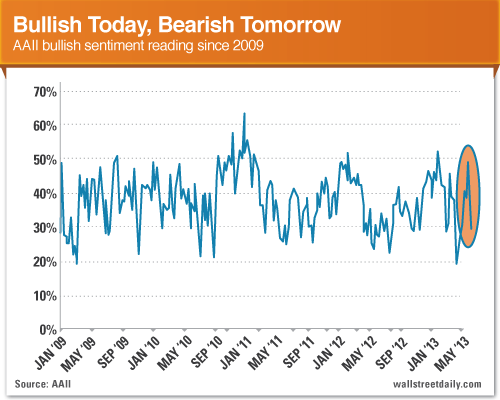

Get a Grip, Would Ya?

The summer months promise to bring volatility to the stock market. But investors really need to get a grip on their emotions.

The latest bullish sentiment reading from the American Association of Individual Investors (AAII) dropped to 29.5%. Keep in mind that two weeks ago, it stood at a jubilant 49%.

So we’re talking about the largest two-week decline in bullish sentiment since the bull market began, according to Bespoke Investment Group.

And all it took was about a 5% selloff for the S&P 500?

Again, investors need to get a grip. I get that their risk appetite remains “almost paralyzed,” as UBS Group’s (UBS) CEO, Sergio Ermotti, said. But there’s no such thing as investing without volatility. Unless you’re Bernie Madoff.

I must confess. The contrarian in me rejoices when I see this data.

As average investors get more and more cautious about the rally, it’s a strong indicator that stock prices are going to head higher still. Bring it!

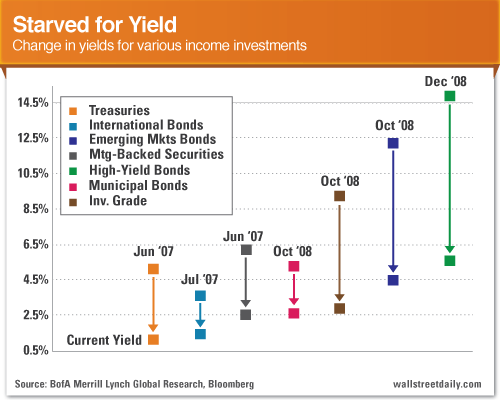

Wherefore Art Thou, Yield?

Yesterday, I chastised Bloomberg for preying upon everyday investors’ insatiable hunger for income.

Today, I want to flip the script and share why we’re such easy targets: We’ve watched yields literally collapse ever since the Great Recession hit.

“In the past six years, central banks around the world have cut interest rates 515 times, increased global liquidity by $12 trillion and crushed bond yields to the point that almost 50% of all global government bond market cap currently trades below 1%,” says Michael Hartnett at Bank of America (BAC).

That’s left investors of every stripe wondering if they can get any income at all these days.

Sure you can. Just not a lot. Not from the old tried and true investments, at least.

Now you know why I’m such a fan of merger arbitrage opportunities in this zero-yield world. It’s a proven (but largely overlooked) way to earn short-term yields of 5% to 10% (or more).

Speaking of which, it appears that one of my recent merger arbitrage recommendations, Zhongpin, Inc. (HOGS), will close in the next 30 days or so. But fear not, I’m researching several new opportunities and will be in touch immediately once I find a suitable one.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Schizophrenic Investors, More Pickups And Why Yield Matters So Much

Published 06/07/2013, 05:13 AM

Updated 05/14/2017, 06:45 AM

Schizophrenic Investors, More Pickups And Why Yield Matters So Much

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.