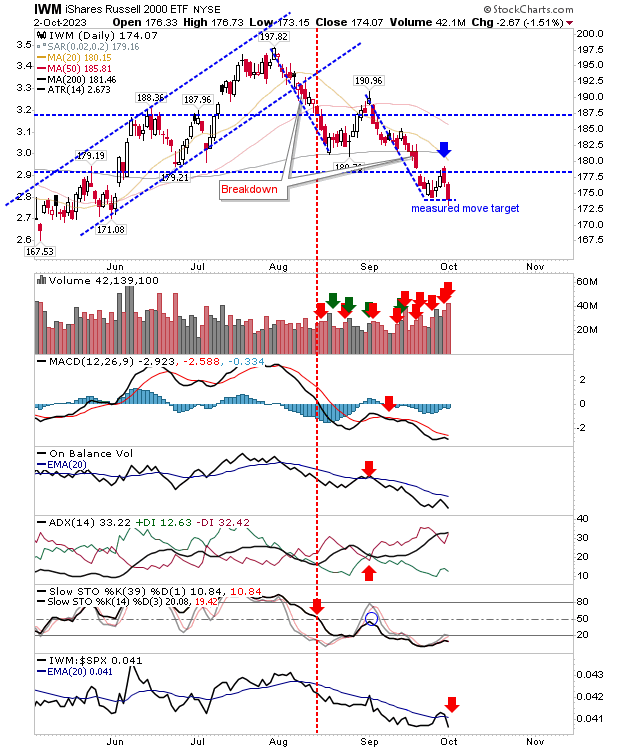

It has been a tough start to the week for the Russell 2000 via (IWM) as a bearish ending to the prior week was followed by a disappointing Monday. The measured move target marked on my chart offered a launch point for a rally, but this rally quickly got overwhelmed by a former support level, which turned resistance, around $178.

To add to the misery, volume climbed in confirmed distribution for both Friday and Monday, and relative performance against peer indices (Nasdaq and S&P500) took a sharp turn lower. There is no love for market-leading Small Caps, and now have to look at 2022 lows around $160 as a possible support test.

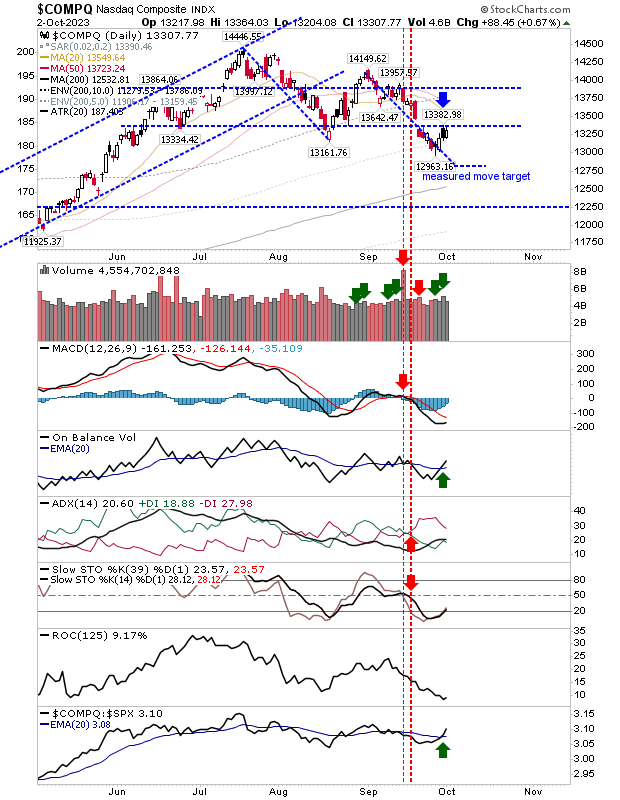

The Nasdaq is facing its own resistance challenge around 13,350. Given the reaction in the Russell 2000, the likelihood of a reversal is quite high. If there is a bright spark, it's that volume buying has tipped in favor of accumulation, but an undercut of Friday's low would also turn all that volume into overhead supply. If the index can push above 13,400 it might help support the Russell 2000, although it would be a bit of a stretch.

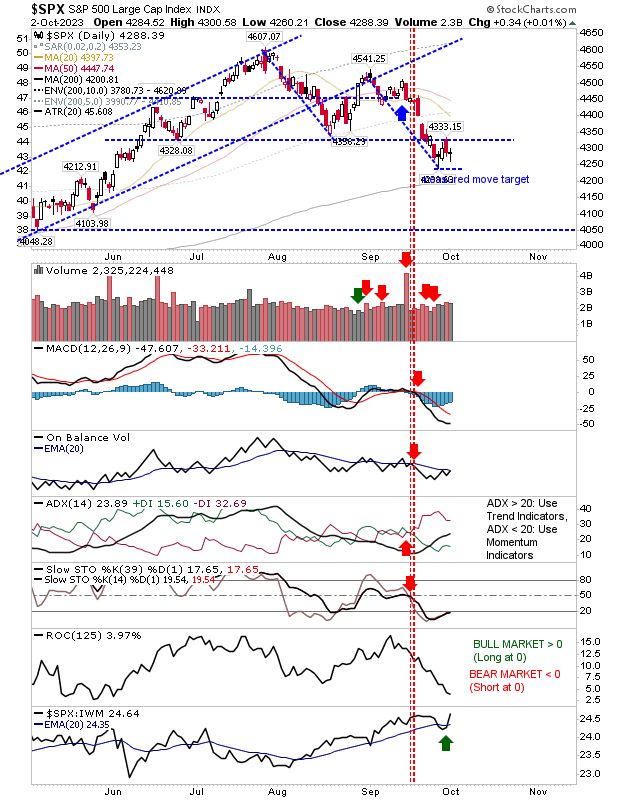

The S&P 500 is also lingering between resistance and its measured move target. It's an index in a "wait-and-see" pattern. If there is a tip of the hat, it's in favor of bears after Friday's reversal of 4,330 resistance.

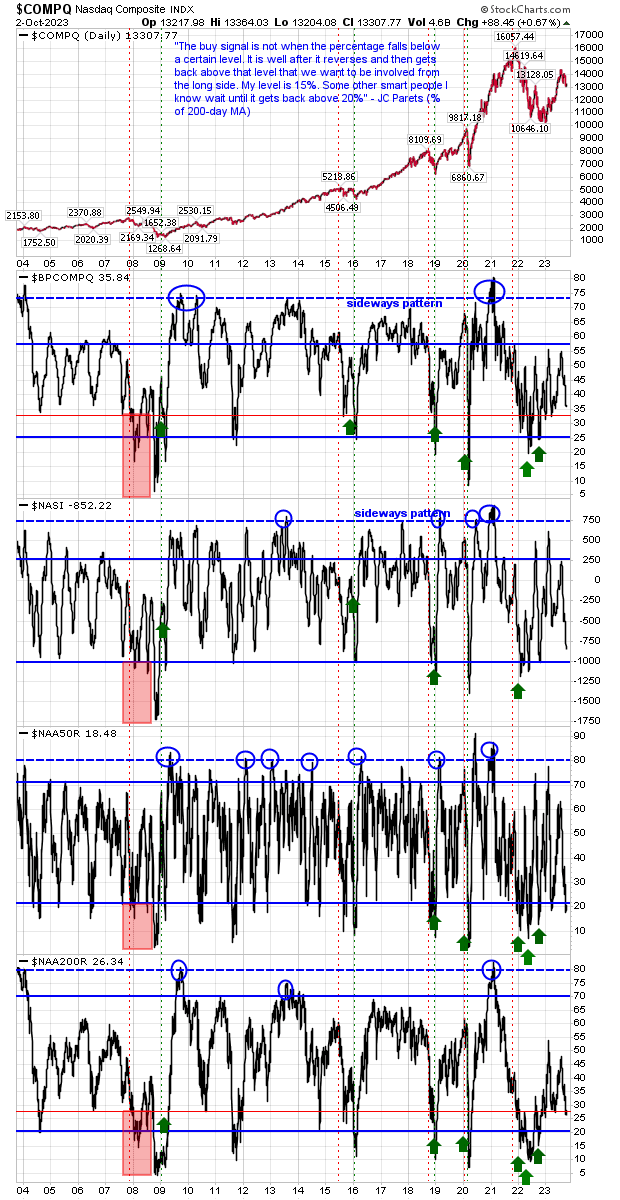

With indices now looking at further declines we need to keep an eye on breadth metrics for when any such selling may stop. The Nasdaq breadth metrics are still well off an oversold state that typically marks a bottom in the index. It was the summer of 2022 when we last had a bottom of Nasdaq breadth metrics, and it could be well into 2024 before these metrics next bottom; rocky times ahead?

In the short term, the Russell 2000 ($IWM) appears that will continue to push lower, possibly taking the S&P and the Nasdaq along with it. There will be little incentive for buyers to reappear until the Russell 2000 ($IWM) gets back to 2022 summer lows, although even then, I wouldn't view this as strong support.