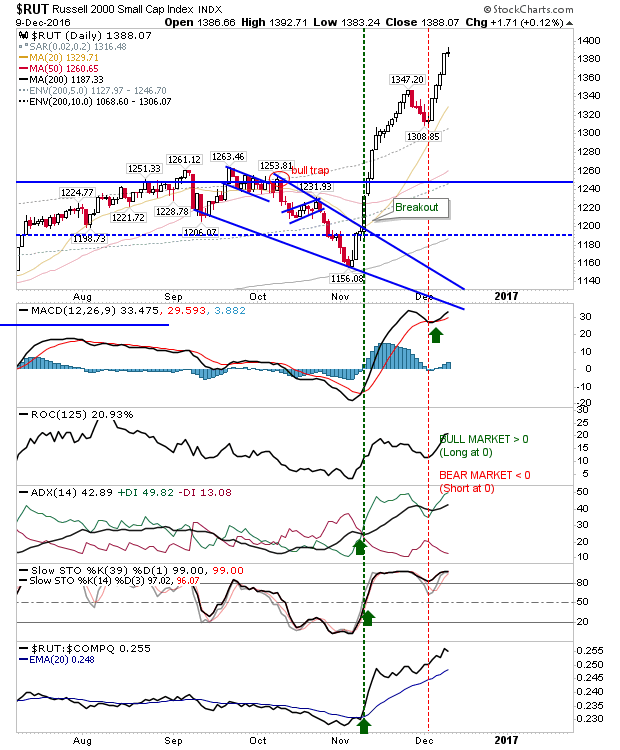

The Russell 2000 is getting close to tagging the 5% zone of historic highs relative to the 200-day MA. Selling covered calls would be prudent for holders of the iShares Russell 2000 ETF (NYSE:IWM) or Small Caps stocks, but since the election it has been all surprises. Premarket for the NASDAQ and S&P suggest the 5% zone could be tagged on Monday. Technicals are so bullish that the zero mid-line for ROC has disappeared off the chart.

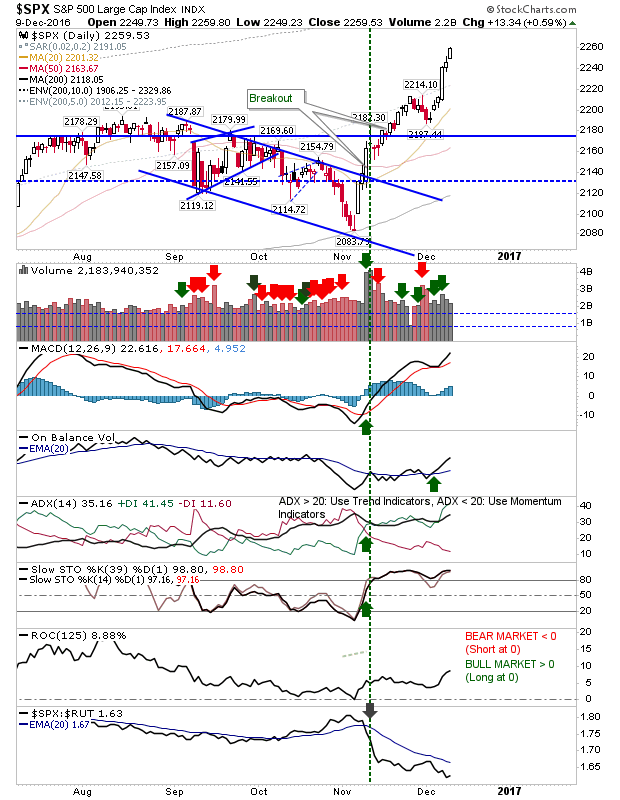

The S&P had a solid finish on Friday and a positive start in early pre-market action. Buying volume has eased over Thursday and Friday, but this slowdown hasn't expressed itself in price action (yet). Technicals are all healthy.

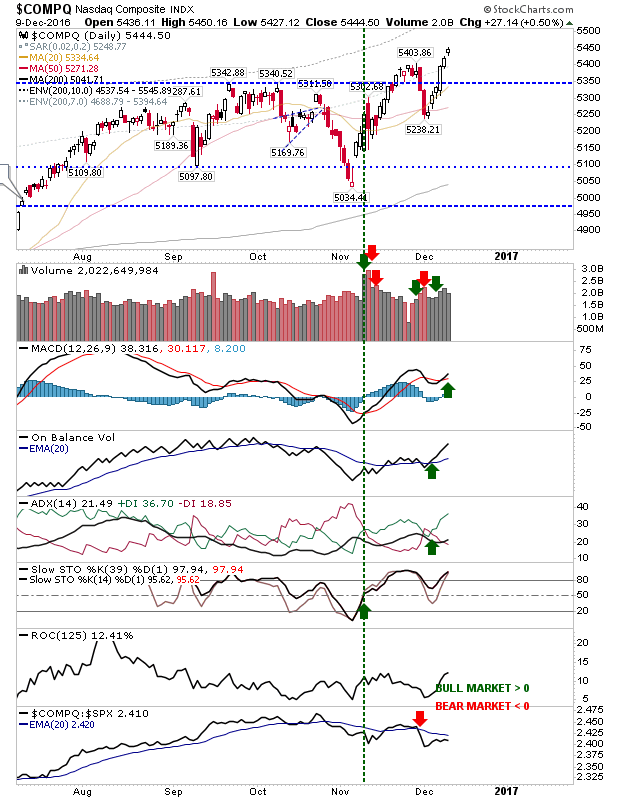

The NASDAQ has been slower to enjoy the benefits of broader market gains. Friday's action reversed the 'sell' trigger in the MACD, returning technicals to net bullish. However, relative performance remains weak.

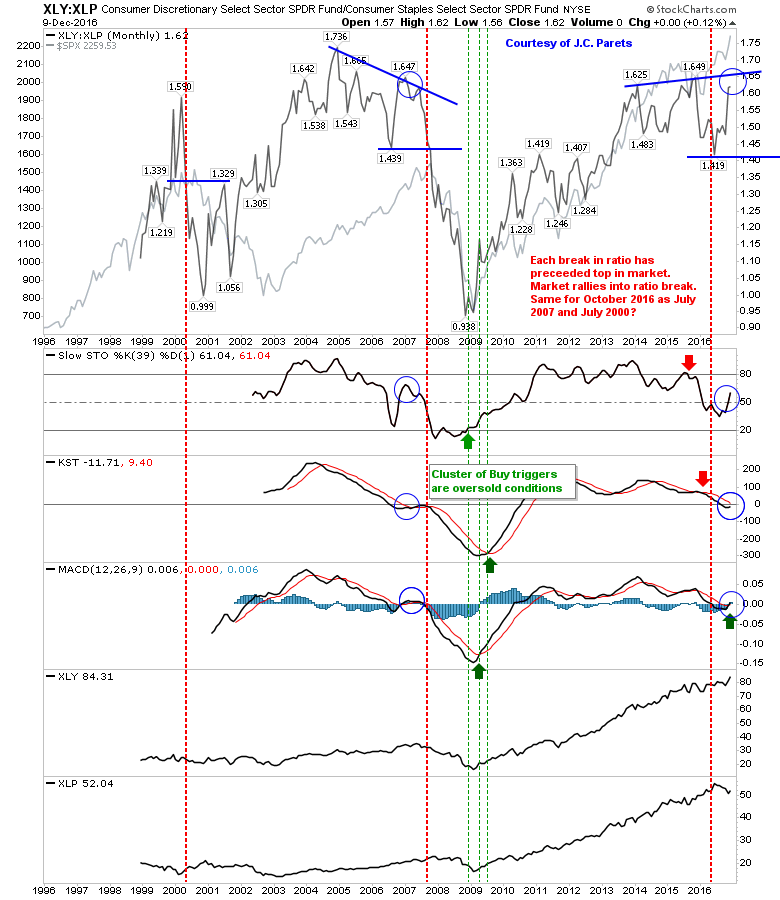

The longer-term picture has some warning signs, but nothing to suggest concerns until the New Year rolls in. The Staples:Discretionary relationship is in a zone similar to early 2007, but it was a number of months before the market peaked, and even then, markets are unlikely to deliver a 2008 style meltdown. What I would want to see would be a broad sell-off at around 30% off highs and markets meeting the loss-relative-to-the-200-day-MAs, as marked in my tables below.

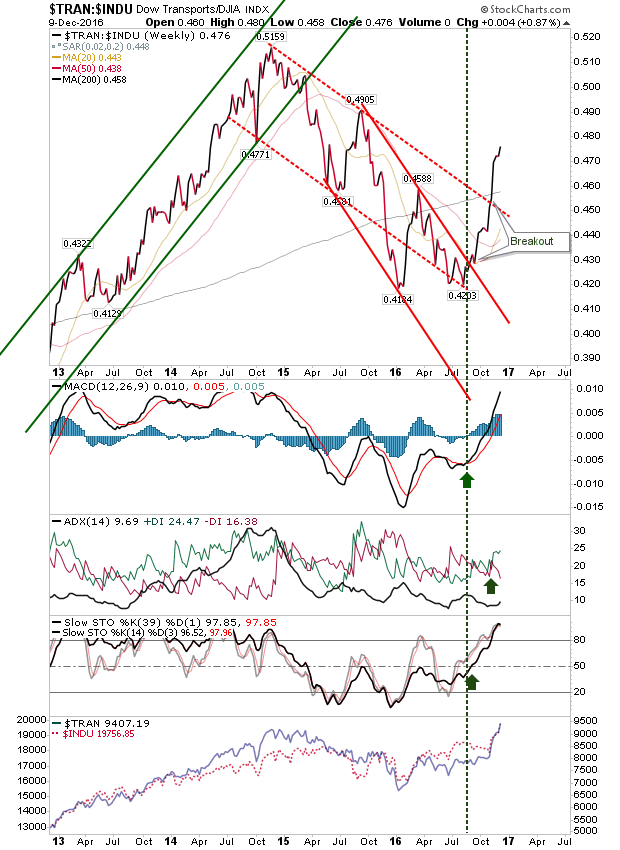

While oil has seen big gains in the overnight session, Transports have had a great second half of the year. This has seen breakouts in two channels, so traders can now look to buying pullbacks for the first time since 2014.

For today, Monday, look for some follow-through higher for indices, but weakness in premarket could be a warning sign to take profits - at least in the Russell 2000.