While Asian markets initially opened lower following the US, major indices turned positive after lunch. The development lifted Australian and New Zealand Dollar slightly. But Canadian Dollar is treated differently as weighed down by resumption of free fall in oil prices. The Loonie is trading as the weakest for today, after Yen and then Dollar. Nevertheless, for the week, Aussie and Loonie remain the worst performing. Swiss Franc is the strongest one, followed by Yen and Dollar. The economic calendar is not too heavy ahead.

Technically, while Dollar recovered overnight, there is no follow through buying to confirm underlying strength yet, except versus Canadian. AUD/USD and AUD/JPY defended near term minor support levels, and thus maintained mild bullishness. EUR/GBP is a pair to watch today as it lost further momentum ahead of 0.8939 resistance. UK May’s meeting with EU Juncker, and the EU’s report on Italy’s budget could trigger some volatility in EUR/GBP.

In other markets, DOW lost -2.21% yesterday to 24465.64. S&P 500 closed down -1.82% and NASDAQ dropped -1.70%. Treasury yields were mixed with five year yield closed up 0.004 at 2.870. But 10 year yield dropped -0.009 to 3.048. In Asia, Nikkei closed down -0.35%. But other major Asian indices turned positive after initial selloff. At the time of writing, Hong Kong HSI is up 0.30%, China Shanghai SSE (LON:SSE) is up 0.19%, Singapore Strait Times is up 0.55%.

European Commission to publish report on Italy’s budget today

The European Commission will publish its views on the draft budget plan of all 19 Eurozone states today, at around 1100GMT. And without a doubt, Italy’s DBP will be included. It’s generally expected that the Commission will, at the same time, publish a report regarding Italy’s breach of EU rules. That will be the first step in the so called Excess Deficit Procedure, which could eventually lead to fines for Italy up to 0.2% of its GDP.

Reactions in the bond markets will be closely watched today. For now, German 10 year yield stands at 0.354. Italian 10 year yield stands at 3.618. That is, German-Italian spread is now at 326. It’s generally agreed that 300 is an alarming level while 400 is definitely unsustainable. Many of the smaller, regional Italian banks will have capitalization problems at 400.

UK May to meet EU Juncker with strongest position for a while

UK Prime Minister Theresa May will meet European Council Jean-Claude Juncker in Brussels today, to work on the political declaration covering future relationship after Brexit. May appears to be in the strongest position for a while. The campaign to oust May, led by ERG chair Jacob Rees-Mogg, ended in humiliating failure. Only 26 MPS had publicly said that they had submitted the letter demanding no-confidence vote, well short of the threshold of 48.

According to European Commission spokesman Margaritis Schinas. The aim of the meeting between May and Juncker is for preparation for Sunday, Nov 25, EU summit, for approving the Brexit withdrawal agreement. The so-called political declaration on future relationship will also be covered.

Fed Kashkari: Preemptively rate hike might cause the end of economic expansion

Minneapolis Fed President Neel Kashkari, a known dove, sounded cautious in on interest rates on his comments again. He said in a radio interview yesterday that “one of my concerns is that if we preemptively raise interest rates, and it’s not in fact necessary, we might be the cause of ending the expansion”.

He reiterated that Fed should “pause and see how the economy continues to evolve.” Also, he said “I’m not seeing signs that the U.S. economy is overheating, so I don’t think we need to preemptively raise interest rates.”

USTR: China has not fundamentally altered its unfair practices

The US Trade Representative released an update on Section 301 IP investigation on China yesterday. Less than two weeks ahead of the Trump-Xi meeting as sideline of G20 summit in Argentina, USTR is piling more pressure on China for reforms. In short, the report complained that “China has not fundamentally altered its unfair, unreasonable, and market-distorting practices that were the subject of the March 2018 report on our Section 301 investigation.”

The report also noted that “despite repeated U.S. engagement efforts and international admonishments of its trade technology transfer policies, China did not respond constructively and failed to take any substantive actions to address U.S. concerns.” And, China, “made clear – both in public statements and in government-to-government communications – that it would not change its policies in response to the initial Section 301 action.” The report also said “China largely denied there were problems with respect to its policies involving technology transfer and intellectual property”.

WTI crude oil hit 52.7, more downside ahead

Crude oil prices have declined for 6 consecutive weeks. A confluence of factor has triggered the sharp selloff: concerns that the slowdown of Chinese economic growth would accelerate, reports that Russia would not join OPEC to cut output further, Trump called for Saudi Arabia to raise output, news of possible concession on Iranian sanctions. All these factors can be summarized in a demand/ supply relation. More in Oil Update – Oversupply Likely Continues to Weigh on Oil Prices Next Year

On the data front

Australia Westpac leading index rose 0.1% mom in October. Japan all industry activity index dropped -0.9% mom. UK publica sector net borrowing will be the main feature in European session.

Later in the day, US durable goods will take center stage. jobless claims, leading index, existing home sales will also be released. Canada will release wholesale sales.

EUR/GBP Daily Outlook

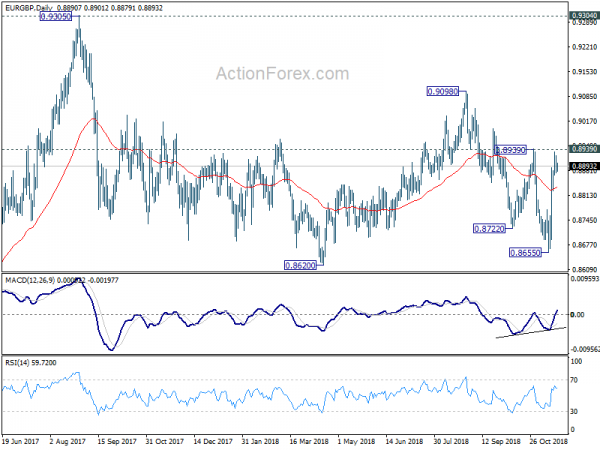

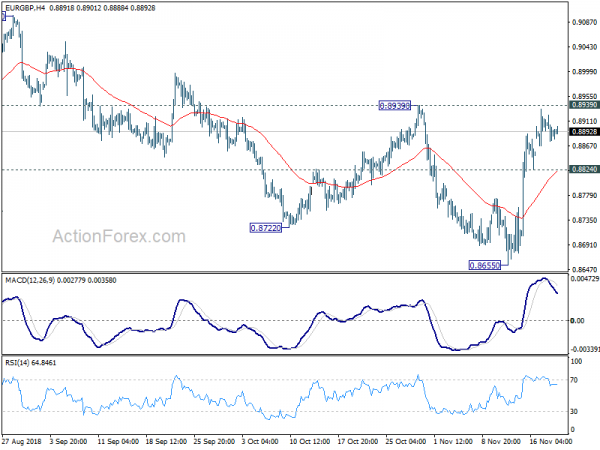

Daily Pivots: (S1) 0.8870; (P) 0.8897; (R1) 0.8920

Intraday bias in EUR/GBP remains neutral at this point. Further rise is expected with 0.8824 support intact. On the upside, decisive break of 0.8939 will extend the rally from 0.8655 to 0.9098 resistance next. However, break of 0.8824 will now suggest completion of the rebound from 0.8655. Intraday bias will be turned back to the downside instead.

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Medium term fall from 0.9305 is possibly in progress and could extend through 0.8620. On the upside, break of 0.8939 resistance is needed to indicate medium term reversal. Otherwise, outlook will remain cautiously bearish even in case of rebound.