Don’t put all your eggs in one basket. This timeless comment, passed down for generations, is a classic phrase when it comes to investing. Whether you’re just starting your investing journey, enjoying retirement, or at any point in between, having the right mix of investments (known as “asset allocation”) can help you weather the market’s ups and downs and pursue your goals.

But how many baskets should you have, and how many eggs should be in each basket? In other words, how do you determine the appropriate asset allocation by age and by other factors?

- Time horizon. When do you plan to use the money in your portfolio?

- Goals. What are you investing for (first home, children’s education, retirement)?

- Investment objective. Are you looking more for growth or income?

- Risk tolerance. Will market fluctuations stress you out? Or, are you exposed to the risk of a bear market or even a crash just before you might need to cash out the value your investments?

- Current and future income sources. Are you working or retired?

Asset Allocation by Age and Investor Type

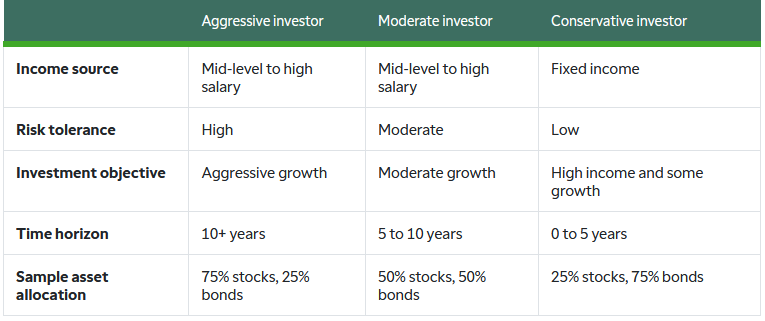

Considering these things can help you decide if you’re an aggressive, moderate, or conservative investor. Your investment identity can influence the way you allocate your portfolio among stocks, bonds, and other investments.

Some recommend portfolio asset allocation by age, under the assumption that the younger you are, the more aggressive you should be with your retirement asset allocation. That may be true to some degree, but some investors are naturally more conservative than others. Plus, some retirees might not be focused primarily on income in retirement but rather plan to pass their assets along to their heirs. Such retirees might want to be more aggressive.

With these caveats in mind, look at the asset allocation by age chart table below to see a general comparison among investor types.

Asset Allocation by Age Chart

The examples in the asset allocation chart are for illustrative purposes only. This asset allocation by age chart is not a recommendation of any specific asset allocation. Asset allocation by age samples are based on income, risk tolerance, investment objectives, and time horizon. Generally, younger investors may be comfortable taking more risk and older investors may prefer less. For illustrative purposes only.

Staples of Asset Allocation

Many investors split their portfolios between stocks and bonds because it’s one way to balance growth and risk versus income and safety. Over the long term, stocks have historically provided growth. However, in exchange for this potential growth, investors assume risks that go well beyond the risks of fixed income investments like bonds. The value of stocks typically moves up and down based on the market and other factors.

Having bonds in your portfolio may help reduce risk because stocks and bonds generally move in opposite directions. It doesn’t happen all the time, but when stock prices fall, bond prices usually rise. Also, bonds typically don’t fluctuate as much as stocks. That’s because they’re designed to provide regular income; price appreciation is a secondary consideration.

Not comfortable deciding how to allocate your portfolio? You may want to consider exchange-traded funds, also known as ETFs. An ETF is a marketable security that tracks an index, a commodity, bonds, or a basket of assets, like an index fund, and trades like a common stock. Keep in mind that all investments involve risk, including the loss of principal invested.

Don’t Set It and Forget It

Allocating your portfolio among different investments shouldn’t be a one-and-done activity. Asset allocation is about finding the blend of investments that works for the current stage of your financial journey. For example, younger and middle-aged investors may have a higher allocation in stocks because they’re often more focused on saving for their first home or their children’s education. Retirees tend to have more in fixed income investments because they want the income to help meet daily expenses.

But you don’t necessarily have to allocate assets strictly by age. After a major life event occurs, such as the birth of a child or a career change, it can be important to review your asset allocation to make sure it aligns with new goals and investment objectives. If it doesn’t, you may want to reallocate your portfolio (shift assets around) to help you stay on track.

The financial markets are another reason to keep an eye on your asset allocation. Market fluctuations can cause your portfolio to become more aggressive or conservative than you intended. For example, perhaps your portfolio has shifted from 60% stocks and 40% bonds to 65% and 35%, respectively. This shift is fine if you’re comfortable with the new weighting and it meets your needs. Otherwise, you may want to rebalance your portfolio so it reflects your target allocation.

Time Well Spent

With so many things competing for your attention, it’s easy to put off reviewing your investments. Don’t put it off any longer. Log in to your TD Ameritrade account and check out the tools and resources available to help you review your portfolio.

A portfolio asset allocation by age strategy can be one of the keys to your financial well-being now and in the future.

Disclosure: TD Ameritrade® commentary for educational purposes only. Member SIPC. Options involve risks and are not suitable for all investors. Please read Characteristics and Risks of Standardized Options.