What is Wall Street to do after gorging on cheap money, supplied in abundance by the U.S. Federal Reserve ever since they slammed the brakes on heavy losses caused by the 2008/09 financial crisis?

Purge, of course...as evidenced by the following 10 major technology stocks...all of which are currently in the MicroSectors™ FANG+™ Index 3X Leveraged ETN (NYSE:FNGU) basket of stocks.

Judging by the massive hemorrhaging that has occurred this year, it seems that the respective values of these stocks were wildly over-inflated by pure speculation, based solely on cheap money supply...not on the actual value of these stocks and their products/services.

You'd think that the Fed would have learned their lesson by now and not fueled another stock market bubble, as they've done in the past.

There's no telling where these and other stocks will end up over the next months, but with the Fed pulling the plug on their latest (failed) money-printing experiment, it appears that consumers are finally dictating what their priorities are...and spending their ever-shrinking dollars on basic necessities, and not the 'latest and greatest shiny baubles.'

As long as inflation continues to rage and the global supply chain keeps on sputtering and breaking, with talk of impending recession swirling in the mix, I doubt we'll see equity markets race to new highs over the next several years.

Instead, volatility will continue to remain at the forefront of short-lived plunges and spikes in both directions...and indecision will plague market players.

Therefore, I still stand by my market assessment described in my post of Mar. 8.

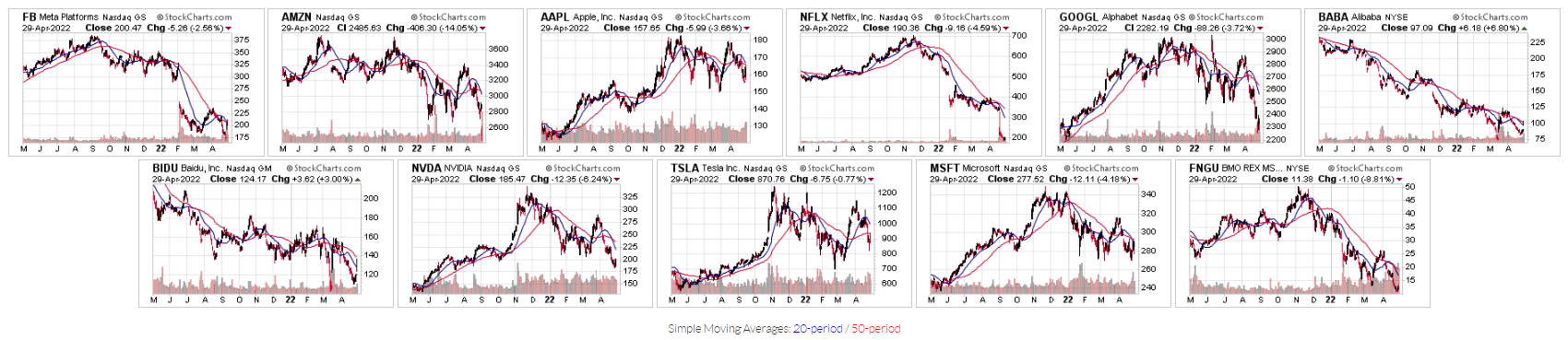

The following one-year charts of the 10 tech stocks that are within the FNGU ETN basket exemplify the volatility that has plagued equity markets since the beginning of the year, and, in some cases, for a year, or more.

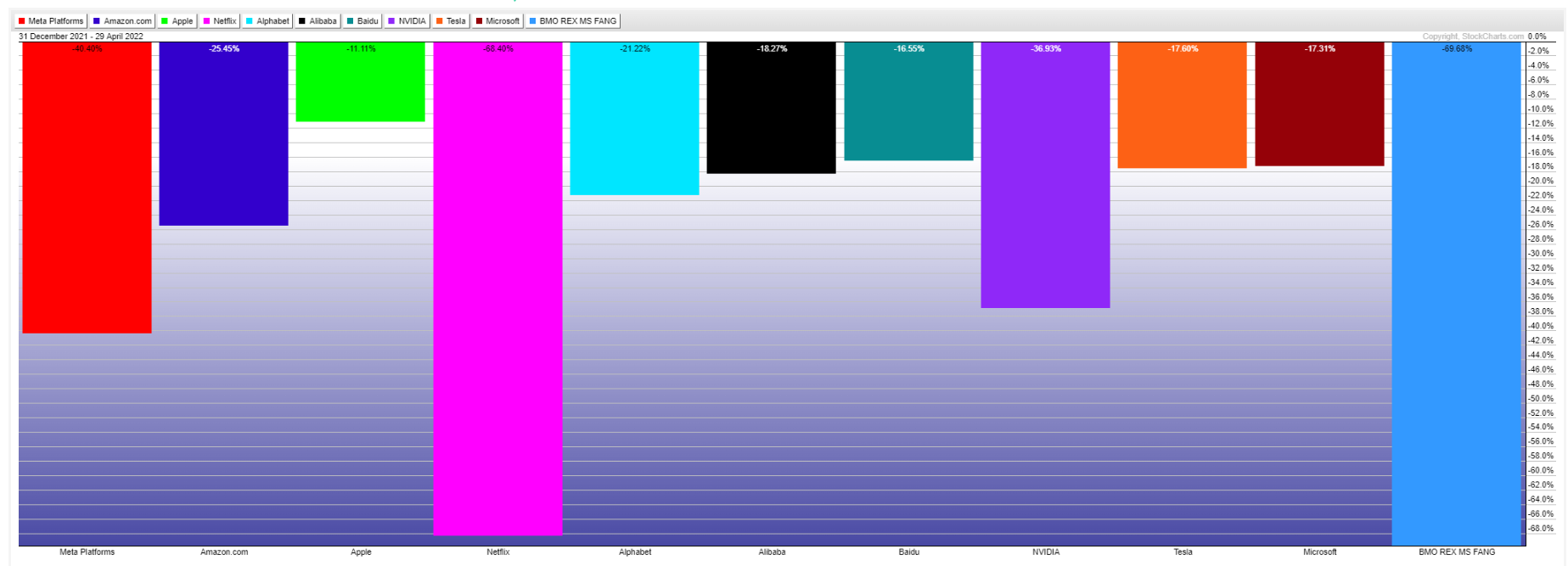

The following graph shows the percentages that these stocks have lost year-to-date.

To add a little more perspective on a couple of these stocks, the following charts compare longer-term monthly price action of Netflix (NASDAQ:NFLX)with FNGU and Amazon (NASDAQ:AMZN) with FNGU.

I'd say that they, and especially FNGU, portray the gluttony and purging described above.

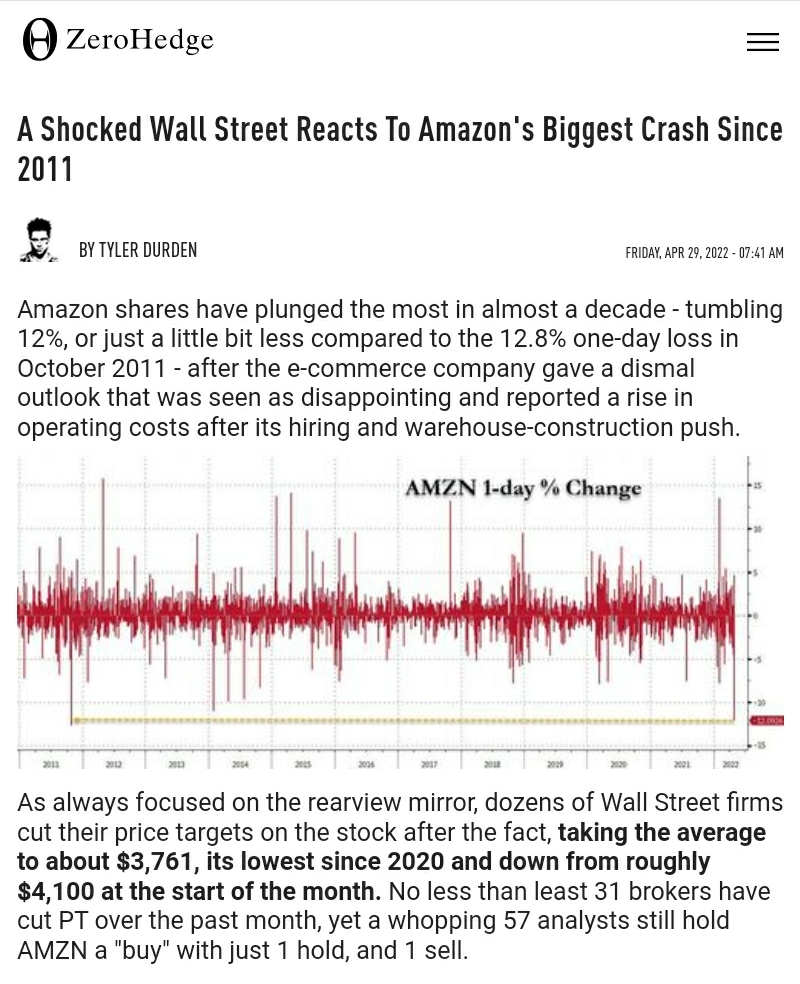

Some additional details regarding AMZN's poor performance are provided in the following ZeroHedge article.

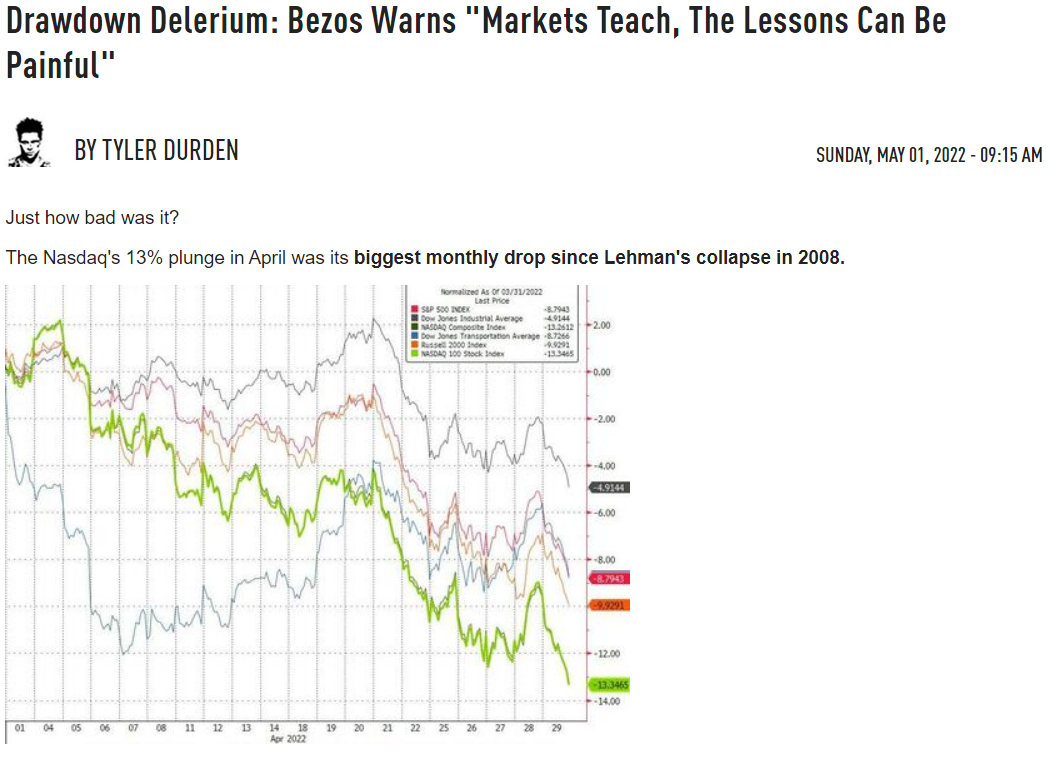

And, there's this ZeroHedge market analysis...

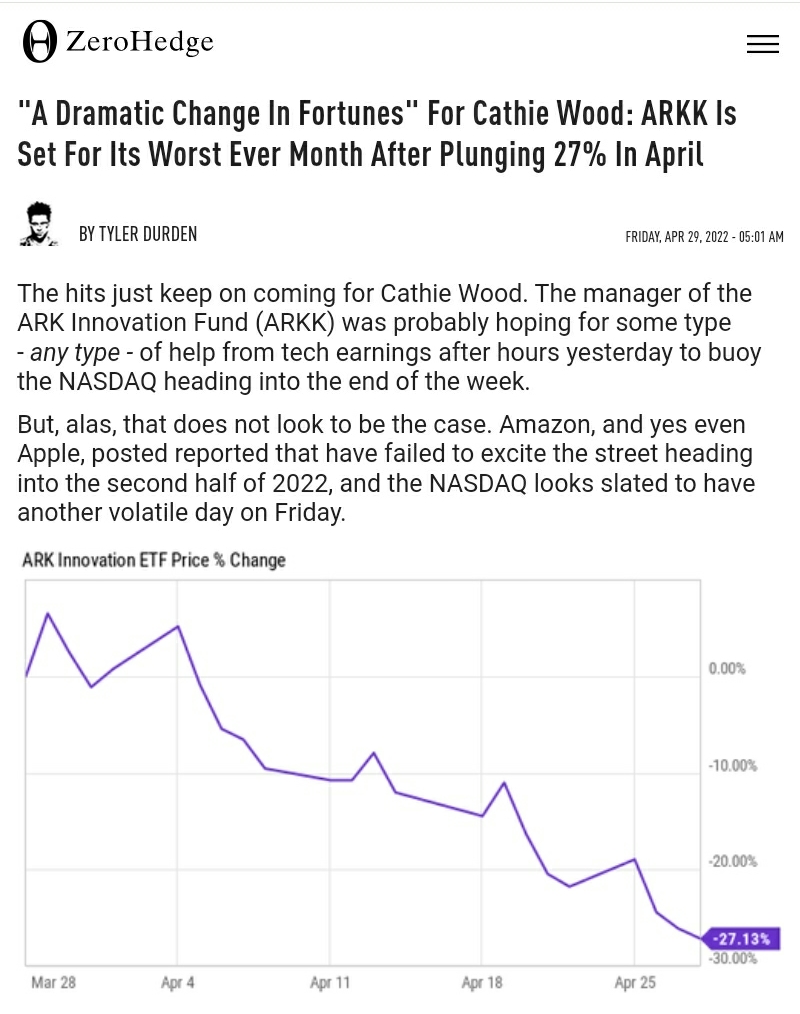

As an aside, another example of this gluttony and purge scenario is the ARK Innovation ETF (NYSE:ARKK), (containing 141 stocks), as shown on the following monthly chart comparing it to FNGU. You can see that it has traded lock-step with FNGU over the years.

ZeroHedge has provided a bit more 'color commentary' on this ETF, as follows.

P.S. To repeat what I said in March..."Best of luck...it's crazy 'out there'...and rumors are flying everywhere!"