UK consumer prices rose by 2.5% in April, the second-biggest monthly gain in the indicator’s history since 1988. Annual inflation jumped from 7% to 9%, unseen in the indicator’s history.

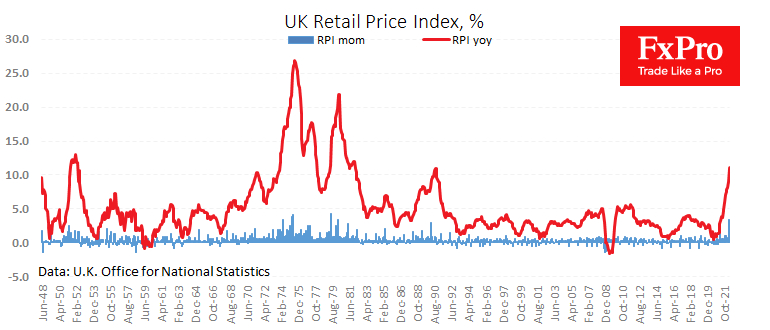

The longer-established retail price index last saw a high annual growth rate (11.1% y/y in April) in 1982, while such big monthly jump (3.4% m/m) was last observed in 1980.

However, despite the horror that these figures represent, there are still indications that the UK’s peak annual rate of inflation will be much lower than in the 1980s (22%) or 1970s (27%).

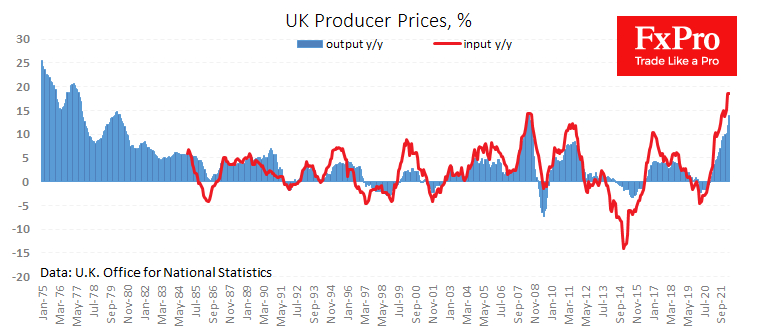

While Output Producer Prices are showing an acceleration in the annual growth rate, rising to 14%, Input PPI has slowed from 19.2% to 18.6%. Although remaining volatile in recent weeks, oil and gas have regularly retreated from highs, limiting upward pressure on prices. Metals have withdrawn from the highs.

At the same time, there are growing questions about final global demand, which will constrain producers in shifting costs to consumers.

Early hints that UK inflation may be slowing in the coming months may allow the Bank of England to raise the rate by 25 points at its next meeting in mid-June and not copy the Fed’s 50-point move.

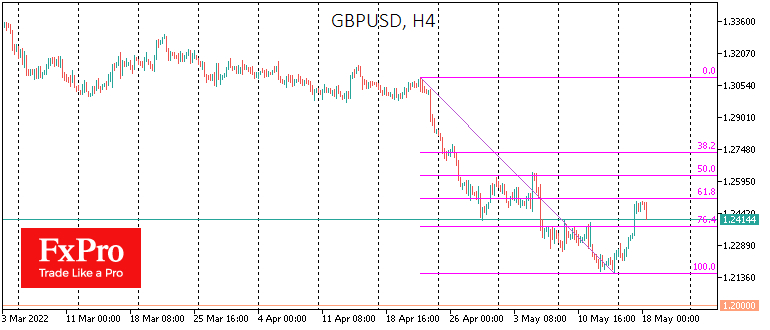

This is moderately negative news for the British currency, which started to retreat from the $1.25 area on the data after a 2.9% rally from last Friday’s lows. Short-term traders should pay particular attention to the 1.2350 area.

A dip lower already this week would suggest that the brief period of recharging dollar bulls has ended. In this case, GBP/USD could quickly fall below 1.2000, making the 1.1500 area a potential ultimate target for this attack.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Record-Breaking But Near-Peak Inflation In The U.K.

Published 05/18/2022, 05:18 AM

Updated 03/21/2024, 07:45 AM

Record-Breaking But Near-Peak Inflation In The U.K.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.