We track a lot of Indices around the World. One of the Indices we track is DJUSRE (Dow Jones US Real Estate Index) which provides a guideline for housing properties in the U.S. Buying real estate is always a good way to invest and make money. For years, investors use the real estate sector as one avenue of investment. There is an aspect which many people miss which is the timing. During the 2002-2006 period, prices of properties skyrocketed around the world and many people were able to make a quick profit and cash thousands of dollars out of the investment.

However, there were also many people who got trapped at the top and defaulted on the home loan because of the rapid decline in value and the obligation to the bank. When it comes to real estate, timing is everything and the method of buying also plays a role. There are two ways to buy properties, either using cash or bank’s mortgage. The difference between the two is the interest on the loan, either with a higher monthly payment or with an early penalty that can cost thousands of dollars.

The worst case scenario for an investor is buying at the peak using bank’s loan. During the 2008 – 2009 credit crisis, a lot of home owners owe the bank more than the value of their homes as prices collapse driven by speculative buildup of houses and subprime mortgage. If we drove around in 2010, we were able to see a lot of empty houses and buildings. Most of the buildings belong either to banks or associations.

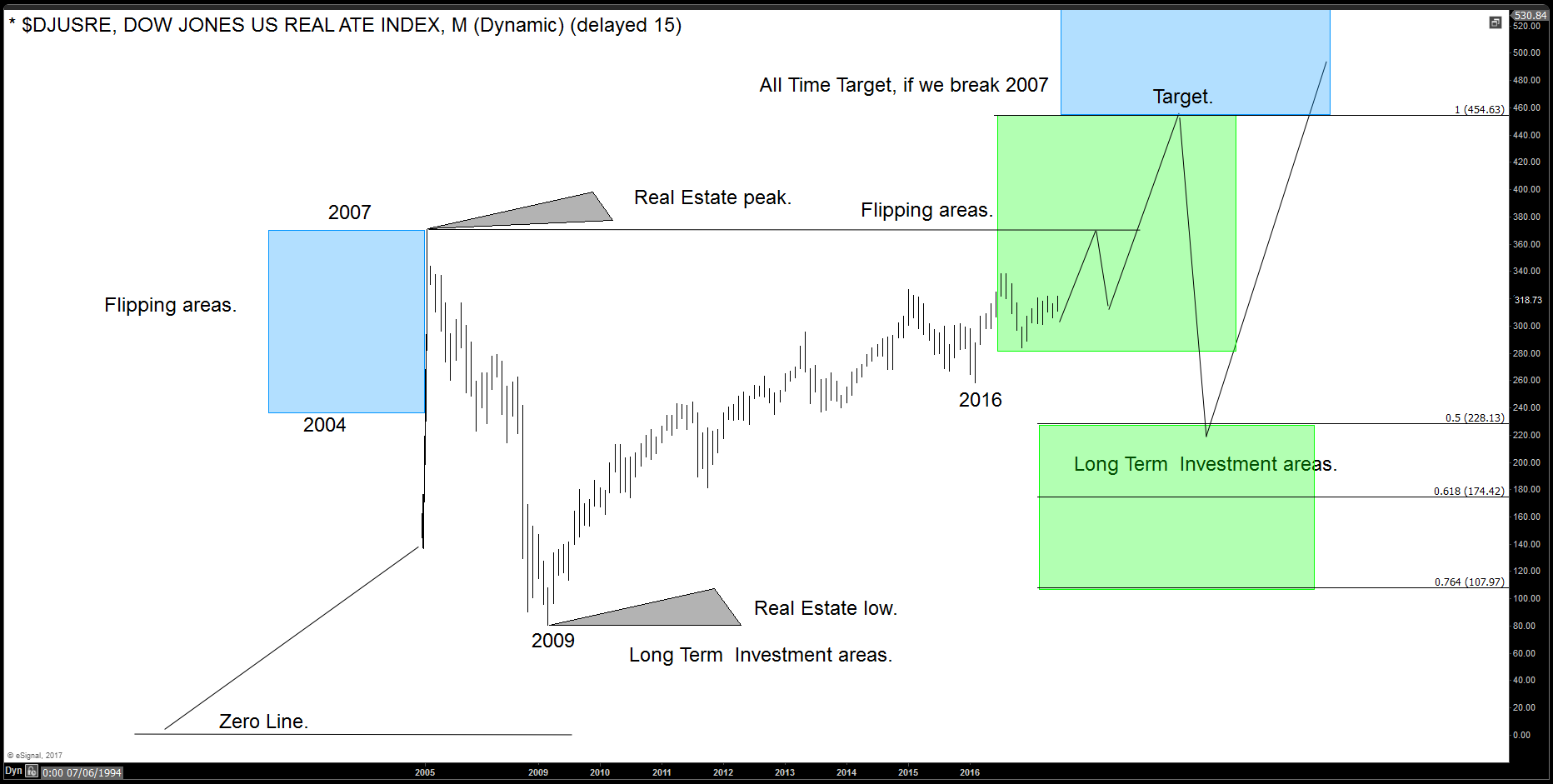

DJUSRE (Dow Jones US Real Estate) Long Term Chart

Looking at DJUSRE chart above, current real estate price is around the price in 2004-2005. When buying real estate you can do it for a flip or a long term investment. For a flip means that the investor will bet in a fast increase in value and then sell the property for a quick cash. Timing will play a big role when buying for a quick gain as it needs to be done at the proper time. Improper timing can leave investors with a bad investment or like many like to call under the water.

Listening and looking around we can see an increase in TV advertisement on real estate promoting real estate company and sites. These are warning that the crowd has started again to buy properties. Even when the housing boom can last for another couple of years, we can be entering soon into areas when a biggest correction can happen. The increase in advertisement as well as the signs on the streets which is a reflection of the crowd environment is calling for the top to be forming soon.

When looking at DJUSRE Index chart above, if it manages to break above 2007 peak, it’s possible to reach 454 level. This level is when the rally since all-time lows to 2007 will equal to the rally from 2009. When looking at other indices around the world, we believe this could be the scenario in real estate market. When DJUSRE Index breaks above 2007 level, it will drive properties even to new all-time highs, but investors need to know that if they want to buy home now, it is for a quick gain (flip) and not for long Investment.

We need to understand the differences between the two and invest accordingly, otherwise we can get caught in the wrong side. The real estate correction which should happen around the year of 2020 should be bigger than the correction in 2008 and consequently the damage can be even worse. We recommend investors who want long term investment to wait. Regular buyers need to understand that property will revisit these 2009-2010 levels again sometimes in the future so do get any cash out of the property so not to be under the water.

The path we expect for Dow Jones US Real Estate Index is a path to 367 then a turn lower to 320 before last push higher to 454. The Index should then see a huge correction and prices could drop to the levels of 2010 again around 160 when huge buying chances will happen. In reality, Market has two sides and many people who bought in 2009-2010 lows as investment will be selling soon and the market will switch from buyers’ market to sellers’ market again and follow the cycles of the Market.

Understanding the timing is key to enter the real estate market. Current situation is similar to the year of 2004 and the market has 3 or more years to rally when flippers will be able to cash some money. The closer we get to 454 or the year 2020, the danger will increase. Buy now if you a Flipper and wait if you are a long term investor, because there will be a better chance down the road.