Despite some stabilization, market sentiment is likely to remain shaky into the year-end. The Omicron variant adds to other factors capping bond yields over the coming weeks. The ECB seems relaxed about the upcoming COVID-19 wave but keeps its options open, more than ever.

Markets to remain on tenterhooks

Any news on the Omicron variant has to be taken with the generous helping of salt that befits tentative developments. The simple truth is that it will take weeks to get any form of certainty on the aspects that matter the most—transmissibility and vaccine efficacy.

In this context, it would be understandable if some investors decided to close books early and revert to a defensive risk allocation. The sharp reaction in overnight markets to comments from a Moderna (NASDAQ:MRNA) executive, expecting lower vaccine efficacy against the new variant, is proof that markets keep a negative bias.

Oil has taken Omicron fears on the chin, adding to Bund yield downside

What’s more, while the seriousness of the latest variant may not be known, the measures taken by governments to slow its spread are and are unlikely to be reversed in the coming weeks. They come on top of measures implemented in Europe to combat an already advanced COVID-19 wave.

Add this to the seasonality of previous waves and we doubt there is much scope for sentiment to improve before the end of the year. This makes it all the more likely that year-end distortions, such as collateral scarcity and preference for holding high-rated bonds, will continue to suppress sovereign yields.

The dim near-term outlook should not, however, mask the groundswell of higher inflation. The current COVID-19 wave could conceivably lessen pressure on some central banks to take tightening steps in the near term. For instance, the BoE hike in December might continue to be questioned by markets until the very last minute. Other decisions, such as gradually withdrawing accommodation for the Fed and the ECB, appear less likely to change at this stage.

ECB: relaxed about everything

Consistent with the ‘maximum optionality’ tone heard from ECB speakers over the past weeks, the most recent outings yielded no further insight into the future path of policy. The most notable development however was a relatively relaxed take on the potential effect of the Omicron variant, and of the current COVID-19 wave in general, on economic activity.

The comments could come across as hawkish, but it is worth remembering that, despite abundant coverage, it is too early for central bankers to express an opinion on its potential consequences for policy. VP De Guidos was the one exception, expressing concerns about the Omicron variant in an interview published overnight Monday, but highlighting his view that Europe is in a better position than last year.

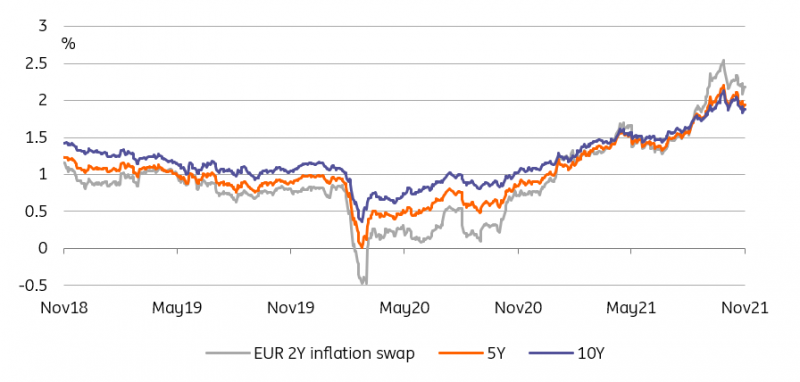

Even after the recent pullback, inflation swaps are still consistent with the ECB hitting its target

Besides COVID-19, the overarching message is that the inflation spike is temporary and that it does not warrant any rate hike next year. Beyond that point, opinions diverge, but 2023 is sufficiently far away in time for officials not to express a definite view. Our own forecast is that inflation will continue flirting with the 2% level in subsequent years, making the case for the withdrawal of monetary support measures.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more