By Benjamin Schroeder & Padhraic Garvey

Financial conditions eased markedly through November, as market rates fell and credit spreads tightened (record month for bond returns). The recessionary tendency in Europe gels with that. The US is looking more and more like it can head there. But it's not there yet. US payrolls next week will be awaited before further moves lower in yields occur

Record Month for Bond Returns Behind Us – Markets Are Loosening Conditions Dramatically

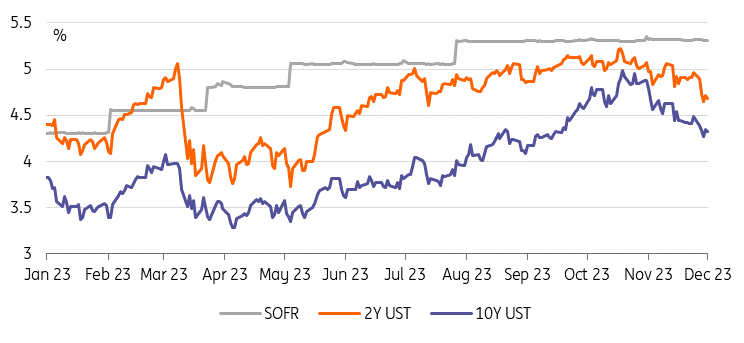

Even as yields have managed to do some ratcheting higher, curve steepening continues (dis-inversion). According to the Fed’s term premium model, there is a term 'discount' of 25bp in the US 2-year, which suggests that it is rich by 25bp versus what’s discounted for rate expectations in the next two years. However, we’d argue that the current rate discount will deepen further once we get to the point where the Fed is actually cutting rates. That leaves us comfortable with the 2-year yield maintaining an implied discount to future rate expectations. That said, for players that believe in the higher-for-longer narrative, then the 2-year yield is too low, by at least 25bp (not our view).

The same Fed model for the 10-year pitches it with a broadly neutral term premium. It was at 50bp when the 10-year Treasury yield was at 5%. The move back down to 4.5% caused the term premium to disappear, and the 10-year yield is even lower now. A zero-term premium does not make a whole lot of theoretical sense, but we’ve been used to implied negative term premiums in recent years, and especially during the years where inflation expectations were knocked down. The 10-year term premium should not be moving negative, which is an argument for some stabilization at or around current levels for a period. Ahead, a further build in the rate cut discount would allow the 10-year yield to ease lower again. That's our preferred structural view as we look into the next couple of months.

Macro data continues to push in the direction of lower inflation risks and higher growth risks. It seems that the preferred narrative from Fed spokespersons is to accept that the funds rate is likely at a peak. The real question is how long it remains there. Friday’s fireside chat at Speelman College in Atlanta featuring Chair Powell will be watched for more, but it’s unlikely he will give too much away. The markets have undone a decent chunk of tightening in recent weeks through lower market rates and tighter credit spreads. November was a record month for bond total returns to boot. No reason for Chair Powell to react in a way that might push things further in that direction; at least not just yet.

Yields Take a Breather After the Recent Rally

Today’s Events and Market View

Today's focus is squarely on the US and the appearances of Fed Chair Powell in particular. Markets have already taken note of Fed officials trying to set the record straight after Waller’s remarks had sparked further rate cut speculation. Today is the final opportunity to steer expectations before the pre-meeting blackout period kicks in.

But it’s still the Fed’s words against the data. Today we will get the ISM manufacturing index for November, where the consensus is looking for a 47.8 reading in the index after 46.7 in October. However, the more important data releases are in the pipeline for next week, culminating in the official jobs report.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more