Rambus Inc. (RMBS) is an intellectual property and technology licensing company. It is engaged in the design, development and licensing of memory and logic interfaces, lighting and optoelectronics, and other technologies. The Company’s primary focus is the creation, design, development and licensing of patented innovations, technologies and architectures that are foundational to all digital electronics products and systems. Its patented innovations and technologies are provided to customers’ products, components and systems offered and used in semiconductors, computers, mobile applications, gaming and graphics, consumer electronics, lighting displays and general lighting.

This is a vol and stock price movement note in a company that was absolutely decimated in Nov of last year.

ANALYSIS

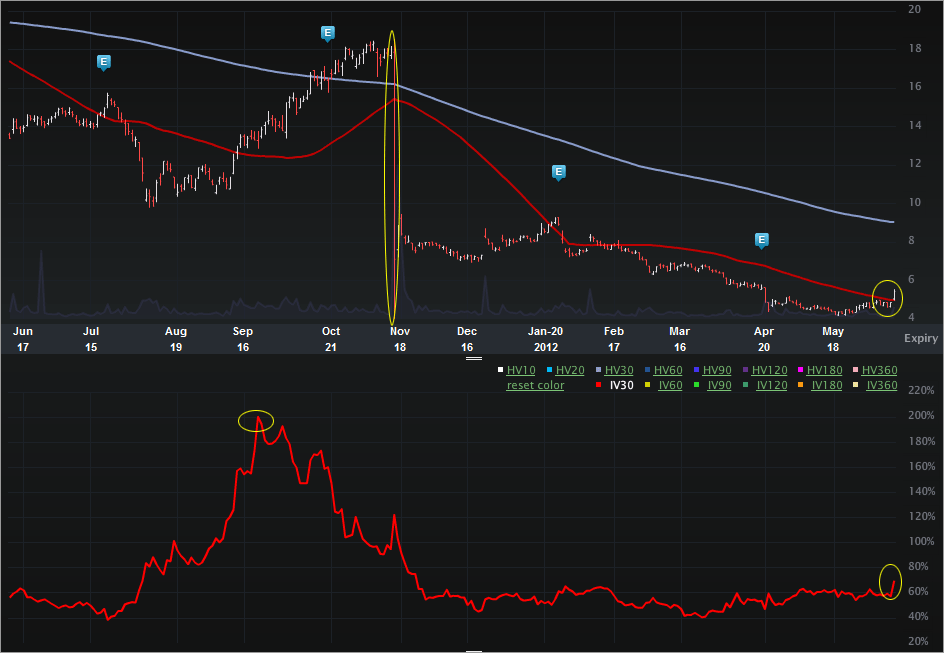

Let's start with the Charts Tab (twelve months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red).

On the stock side, we can see the drop in Nov of last year. Here's the news that drove that cataclysm which saw the price dip from $18.04 to $7.11 (61%) on 11-16-2012.

The long-running legal wars between Rambus and Micron Technology finally reached a verdict. After eight weeks of deliberations and high-level testimonies from industry giants Intel and Dell, a split jury arrived at a "not guilty" verdict and no damage awards.

The jury found that Rambus "did not meet its burden of proving its case against the two defendants," Micron and Hynix. This antitrust case could have resulted in a $4 billion damage award, to be automatically tripled under California law for a total of $12 billion. Instead, Rambus gets nothing.

Of course, this was just the Superior Court in San Francisco County and not the Supreme Court of the United States. Rambus is "reviewing our options for appeal," and I wouldn't be surprised to see one filed very soon. The amount of potential payouts makes this a make-or-break case for the memory patent wrangler. Having pursued this case for seven years already, Rambus isn't likely to just give up at this point.

A Huge Legal Ruling in the Tech Arena, written by Anders Bylund.

I've also highlighted the recent run up in RMBS stock from $4.21 to $5.43 (29%) since 5-18-2012.

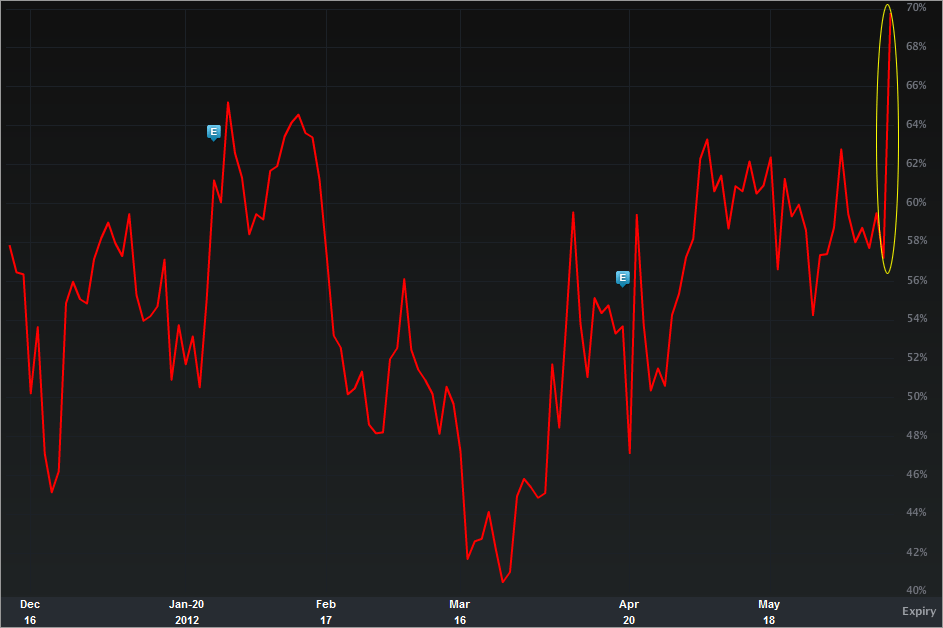

On the vol side, I've highlighted the annual high in the implied of 200.18% on 9-22-2012, as well as the heightened level today. It's difficult to see the rise of late given the scale of the one year chart, so I've included the six month chart (vol only), below.

So, while the level today isn't much to speak of relative to the annual high, it is a six month high as the stock has moved up nearly 30% in less than a month. Oddly, with all this recent movement, I don't really see any news on RMBS to justify it.

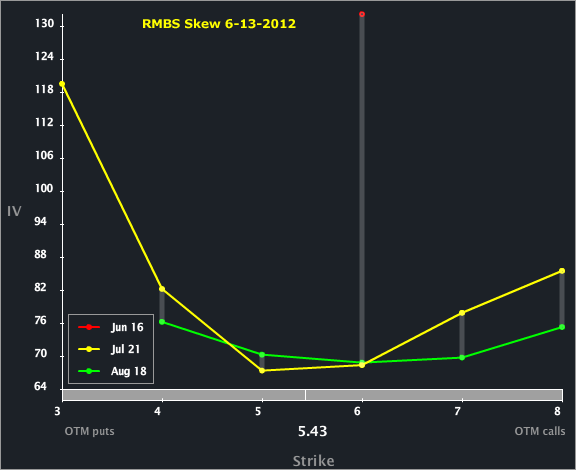

Let's turn to the Skew Tab.

Really not a lot going on here. The front month (which is really 2.5 days) is substantially elevated to the back months, but that's just a single strike and doesn't necessarily mean very much. Ultimately, it's simply a nickel bid in the $6 strike calls. There is a noticeable upside skew in the Jul options relative to Aug. For whatever it's worth, the options reflect greater upside risk (potential) in Jul than they do in Aug.

SUMMARY

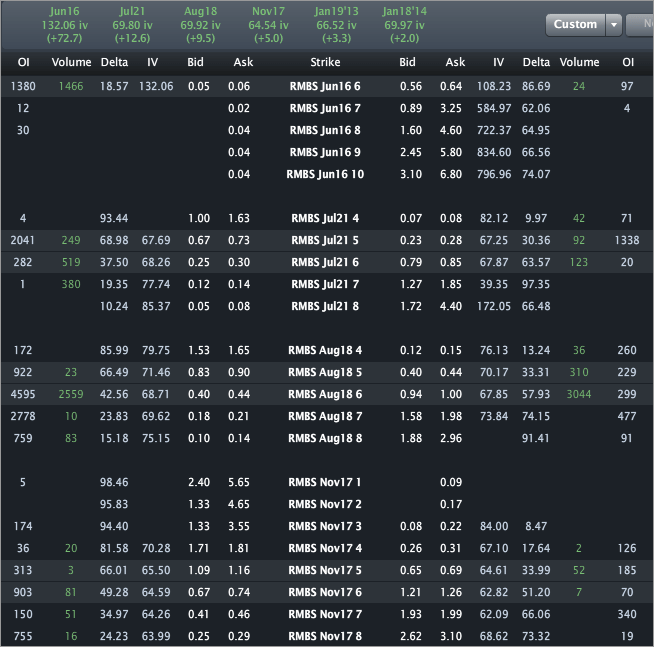

Finally, let's turn to the Options Tab, for completeness.

We can see the vols by expiry across the top. Looking to the actual options chain, we can see that Jul and Aug ATM vol are about equal, but the OTM calls are in fact more elevated in Jul (note the $8 strike, for example).

DISCLAIMER: This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Rambus: Price And Vol Rise; Something Happening In This Decimated Stock?

Published 06/14/2012, 03:12 AM

Updated 07/09/2023, 06:31 AM

Rambus: Price And Vol Rise; Something Happening In This Decimated Stock?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.