Radius Health, Inc. (NASDAQ:RDUS) posted a loss of $1.32 per share in the first quarter of 2017, compared with a loss of 94 cents per share in the year-ago quarter and wider than the Zacks Consensus Estimate loss of $1.25. The year-over-year increase in net loss was attributable to an increase in general and administrative expenses.

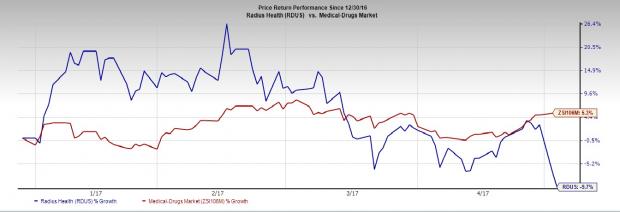

Radius’ share price decreased 9.7% year to date compared with the Zacks classified Medical-Drugs industry’s gain of 5.3%.

Quarter in Detail

Research and development expenses for the reported quarter were $19.5 million, down 28.9% year over year. The decline was attributed to a decrease in Tymlos/abaloparatide-SC, abaloparatide-TD and elacestrant program development costs, partially offset by an increase in RAD140 development costs.

General and administrative expenses for the reported quarter jumped to $38.1 million from $13.6 million. The increase came on the back of growth in professional support costs, including the costs associated with increasing headcount for the commercialization of Tymlos, including the completion of the build out of the commercial organization in the first quarter of 2017. This increase was also driven by an increase in compensation expenses, including stock-based compensation, due to an increase in headcount.

Pipeline Update

On Apr 28, the FDA approved Radius Health’s lead candidate Tymlos (abaloparatide) injection for the treatment of postmenopausal women with high risk osteoporosis for fracture – defined as history of osteoporotic fracture – multiple risk factors for fracture, or patients who have failed or are intolerant to other available osteoporosis therapy. It is currently under review in the EU. The company expects an opinion from the European Medicines Agency’s Committee for Medicinal Products for Human Use in Jul 2017.

The company is also developing abaloparatide-transdermal as a short wear-time transdermal patch. The company posted positive results from the trial in Sep 2016. The company is currently focused on completing the manufacturing, scale up, and other required activities needed to initiate a pivotal study to evaluate bioequivalence to abaloparatide-SC.

The company also completed enrolment in its ongoing phase I studies of elacestrant in advanced metastatic breast cancer. Radius Health reported encouraging results from its ongoing phase I studies. The company plans to take the next steps for the program in the first half of 2017, which would include the design of a phase II trial. Additionally, it anticipates reporting results from its completed phase IIb trial in vasomotor symptoms in the first half of 2017.

Furthermore, the company submitted an investigational new drug application to the FDA for RAD140, which is a selective androgen receptor modulator. The application has been accepted. Moving ahead, it expects to commence a first-in-human phase I study in women with hormone receptor positive breast cancer in 2017.

Our take

The FDA’s approval of Radius Health’s lead candidate, Tymlos, is a significant boost for the company. However, shares were down 9.6% on the company’s wider-than-expected loss in the first quarter as expenses continues to rise. Although the osteoporosis market in the U.S. has great potential as approximately 1.4 million postmenopausal women in the U.S. experience an osteoporotic fracture each year, Tymlos is expected to face significant competition from Eli Lilly & Co's (NYSE:LLY) Forteo and Amgen Inc's (NASDAQ:AMGN) Prolia. Moreover, the approved label carries a boxed warning of osteosarcoma (a malignant bone tumor).

Hence, we expect investors to focus on the drug’s pricing and uptake post launch.

Zacks Rank & Stock to Consider

Radius Health currently has a Zacks Rank #4 (Sell).

A better-ranked stock in the healthcare sector is Heska Corporation (NASDAQ:HSKA) which sports a Zacks Rank #1 (Strong Buy). Heska’s earnings estimates for 2017 have increased to $1.65 from $1.53 over the last 60 days. The company posted positive surprises all the four trailing quarters with an average beat of 291.54%. Its share price has increased 47.2% this year so far.

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Eli Lilly and Company (LLY): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Heska Corporation (HSKA): Free Stock Analysis Report

Radius Health, Inc. (RDUS): Free Stock Analysis Report

Original post

Zacks Investment Research