The Bureau of Economic Analysis appears set to report tomorrow (Jan. 25) that US output slowed sharply in the fourth quarter after Q3’s unusually strong gain.

But Thursday’s GDP report is also expected to show that growth was moderate in the final three months of 2023 – news that will support the ‘soft landing’ view that’s been popular with some economists.

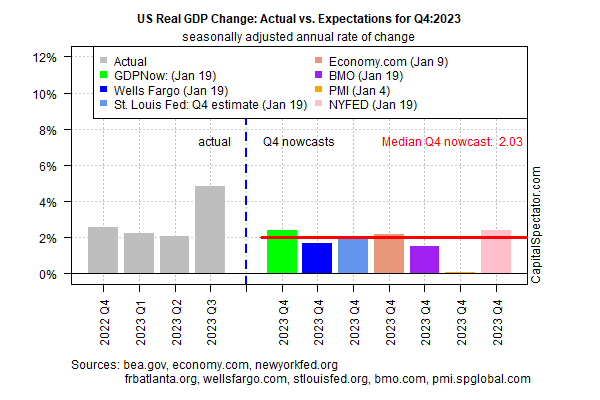

Q4 growth is on track to rise 2.0% (seasonally adjusted annual rate), based on today’s median estimate for a set of nowcasts compiled by CapitalSpectator.com. The estimate contrasts with Q3’s sharply higher 4.9% increase.

Today’s 2.0% nowcast also marks a slightly higher estimate compared with last week’s run of the numbers.

The relatively steady nowcasts on these pages in the 1.5%-to-2.0% range over the past month or so lend support for assigning a high-confidence view that tomorrow’s report will reveal a hefty slowdown in Q4 that falls into the category of a ‘soft-landing’ scenario.

Economists overall seem to agree. Econoday’s consensus point forecast for tomorrow’s GDP release is also a 2.0% increase.

Robust consumer spending is expected to be a key reason for resilient growth in Q4.

Personal consumption expenditures is forecast to rise at an annual 2.5% pace, well down from Q3’s 3.1% gain, according to Econoday’s poll.

But that still reflects robust consumption, which will help keep the economy humming via the Q4 profile.

“Inflation is slowing relatively quickly. Labor markets are slowing, but they’re not slowing as quickly. The net effect of that is going to continue to juice real incomes,” says Neil Dutta at Renaissance Macro Research.

“It’s not an economy firing on all cylinders, but it’s an economy firing on enough cylinders.”