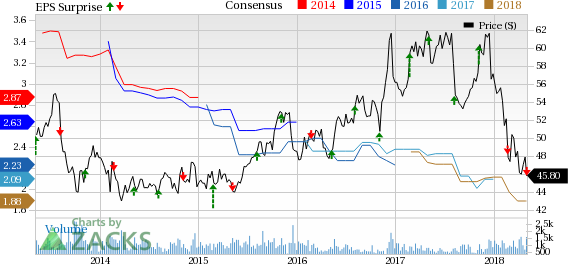

ProAssurance Corporation’s (NYSE:PRA) first-quarter 2018 operating earnings per share of 40 cents missed the Zacks Consensus Estimate by 6.9%. Also, the bottom line declined 35.5% year over year.

ProAssurance’s quarterly operating revenues grew 1.9% to $211.9 million from the prior-year quarter on the back of higher premiums as well as other income. However, the top line lagged the Zacks Consensus Estimate by 2.8%.

Quarterly Operational Update

Gross premiums written grew 5% year over year to $243 million, primarily driven by higher premiums in Specialty P&C Insurance and Workers' Compensation segments. Also, net premiums earned rose 2.3% year over year.

Net investment income declined nearly 5% year over year to $22 million.

Total expenses increased 5.4% year over year to $192.6 million. This rise in costs mainly stemmed from higher net loss and loss adjustment expenses as well as underwriting, policy acquisition and operating expenses.

Quarterly Segment Results

Specialty P&C Insurance Segment

Total revenues of $117.5 million rose 2.9% year over year.

Gross premiums written were $140.5 million, up 2.7% from the year-ago quarter.

Total expenses of $112.8 million increased 11.8% year over year.

Workers' Compensation Segment

Total revenues of $58.8 million rose 6% year over year on the back of higher net premiums earned.

Gross premiums written were $91.3 million, up 8.5% over the prior-year period.

Total expenses of $55.9 million, increased 6.5% year over year.

Lloyd's Syndicate Segment

Total revenues of $13.5 million declined 12% year over year.

Gross premiums written were $12.4 million, down 2.8% from the year-earlier quarter.

Total expenses of $15.7 million inched up 0.1% year over year.

Corporate Segment

Total revenues of $11.4 million plunged 70% year over year.

Operating expenses of $4.7 million decreased 43.7% over the year-ago quarter. Interest expense of $3.7 million declined 10.4% year over year.

Financial Position

As of Mar 31, 2018, ProAssurance’s total investments were $3.5 billion, down 5.1% from the number registered at year-end 2017.

As of Mar 31, 2018, the company’s total assets were $4.7 billion, down 5.1% from the level at year-end 2017.

As of Mar 31, 2018, the insurer’s shareholder equity was $1.6 billion, down 1.6% from Dec 31, 2017.

Share Repurchase & Dividend Update

The company did not buy back any shares in the reported quarter. As of Apr 30, 2018, it had approximately $110 million of shares available under its board-authorized stock repurchase program.

In March 2018, the company’s board approved a regular dividend of 31 cents, paid in April.

Notably, within a span of almost 11 years, the company has been able to return more than $2 billion to its shareholders through regular and special dividends.

Zacks Rank

ProAssurance carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other players from the insurance industry having already reported first-quarter earnings, the bottom line of The Progressive Corporation (NYSE:PGR) , MGIC Investment Corporation (NYSE:MTG) and RLI Corp. (NYSE:RLI) surpassed the respective Zacks Consensus Estimate.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

MGIC Investment Corporation (MTG): Free Stock Analysis Report

RLI Corp. (RLI): Free Stock Analysis Report

ProAssurance Corporation (PRA): Free Stock Analysis Report

The Progressive Corporation (PGR): Free Stock Analysis Report

Original post

Zacks Investment Research