It’s been a week since the FOMC gave the market everything it wanted. After fifteen months, it finally got a pause in rate hikes. Pauses in rate hikes are always harbingers of the next rate cut being around the corner.

So, why aren’t markets happy?

Why are Fed Funds Futures heavily signaling a rate hike in July?

Because for the first time since this tightening cycle began, the market now fully believes Jerome Powell when he says he’s not happy about what’s going on.

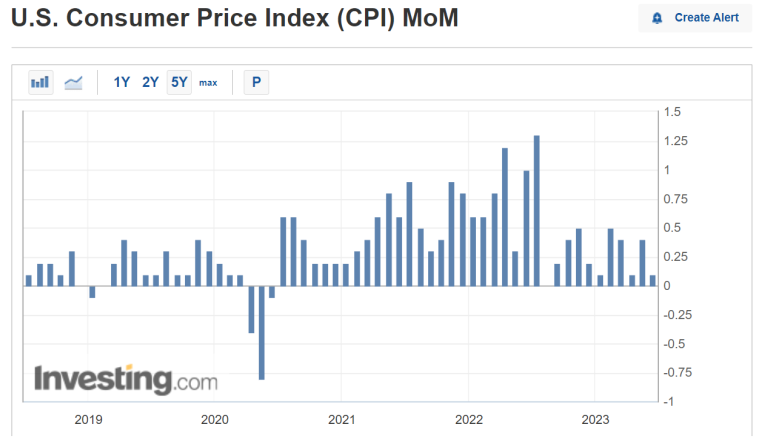

But Powell was smart this month. Baseline effects in the CPI gave him all the cover he needed to pause raising rates. June and July will be even more dramatic.

The June and July 2022 monthly rises were 1.0% and 1.3%, respectively. If we have low prints next month and the month after, the Fed will have ‘Tamed Inflation.’

But Powell short-circuited that argument at the post-meeting presser by noting that core inflation – minus food and energy — which is far more sensitive to credit conditions, hasn’t responded to higher interest rates.

Non-core inflation is what is driving this fall in inflation, as Zerohedge pointed out on CPI Day. So far, credit-based asset prices haven’t fallen significantly. This leaves Powell rhetorical cover to convince markets he can and will raise rates again later this year, defying history, if commodity inflation returns.

At the same time, we’re getting very close to the moment when the credit data catches up with the goods data and begins throwing off real deflationary signals. That’s where things get interesting and where the prediction game gets difficult.

Because will Powell have the strength to hold onto rates at this level as the bankruptcies pile up, the defaults rise, and the political pressure mounts for him to ‘DO SOMETHING!”

If there has been one criticism of my arguments about why Powell is doing what he’s doing, it has been this. Will he stand up to the pressure as the crises multiply?

And fair cop. I’ve never argued that he would or he wouldn’t. I don’t know his mind any more than anyone else does.

Interest rates are a demand-side tool, making the cost of credit higher doesn’t solve shortages of goods. The best it can do is prevent hyperinflation by slowing the multiplier effect of more money chasing fewer goods.

If you accept that cost-push inflation cannot be solved with the application of demand-side tools, and you should, as even Powell just admitted publicly, then it begs the question, why even start?

Dogma? No.

He could have put up the token resistance, brought rates to 1.5% or 2% slowly, and called it a day when Silicon Valley Bank broke.

He didn’t, and now we’ve reached a critical moment.

When you factor in the Biden Administration’s draining of the Strategic Petroleum Reserve into the domestic market along with sanctions and complications in the global oil shipping markets, it becomes pretty clear that most of this dramatic drop in the CPI is due to manipulations of the energy markets, not anything the central banks do.

And this has been my point for nearly two years now.

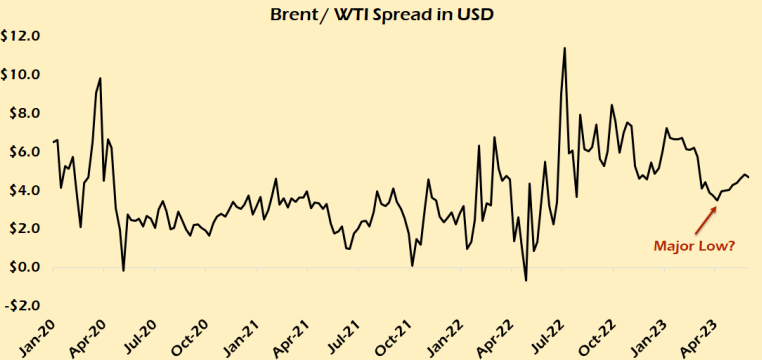

The Brent/WTI spread his a high near $5 per barrel last week. It’s been as low as $3.48/bbl in late April. This was after a rebalancing of the Brent futures contract to include 25% WTI weighting.

So, this manipulation of energy prices is ultimately the main driver of headline CPI, and it’s reaching its end state.

“Biden” is running out of the Strategic Petroleum Reserve to hold down oil prices. In fact, what you have to say about a rising Brent/WTI at this point is that Brent is rising versus WTI despite all of these attempts to hold it down. This points to much higher demand internationally for oil than it looks like by just looking at the Brent crude ‘price.’

Then let’s add in the planned OPEC+ production cuts, the shifting geography of the supply and demand, and the greater inefficiencies introduced over the past 18 months, and there is little to no argument that oil demand versus supply is going to be negative coming into the rest of 2023.

So, to me, Powell pausing here is what he needed to do. Give the markets time to digest the rate shock he’s induced, and allow markets some time to gain their footing. Companies, households, and banks get a chance to reorganize their balance sheets, liquidate bad investments, let go of unwanted/unneeded stuff, downsize their lives, and prepare for the new world.

Just the act of going through with this ‘pause’ has loosened up conditions a bit. There’s a lot less fear right now than there was a week ago.

To Powell, the job isn’t finished. The first act of this drama is over. Then the next act is coming. The mid-point turn of the story will be determined outside of the Marriner-Eccles building.

The ECB came out swinging the next day because it had to be destroyed. So, Lagarde got her moment to act hawkish when she didn’t want to be, while Powell was magnanimous in victory.

Conclusion

Because I was asked about this multiple times this morning, we should get a pause this month from Powell. Not raising rates here is how he beats “Biden” and Yellen. Let the inflation story go his way.

Let their desperation to beat down oil prices give him cover to keep doing QT in the background, shrinking the balance sheet.

“See, Look! We tamed inflation, we can remove the COVID balance sheet expansion.” We can allow the market to re-establish normalcy in UST trading. Blah blah blah.

Time is on Powell’s side here. Because the markets are already signaling that inflation will come roaring back the second wholesale gasoline prices in the US break back above $2.60 per gallon.

And then they’ll have real problems in DC. Because Powell will have to raise rates in the fall to ‘tame inflation again,’ the USD futures market is mispriced to the high heavens, and Yellen will have to issue a ton of USTs draining liquidity from the economy to absorb them.

They think they have him by the short and curlies here because the incipient credit contraction will break something else forcing him to ‘pivot,’ but with commodity prices still very high historically and only gasoline coming down to temper inflation, control over US inflation is out of the Fed’s hands and lowering interest rates won’t bring it back.

In short, the CPI coming down ISN’T a proxy for improved oil supply and demand. In fact, it’s the exact opposite. Powell forces Yellen to supply the world with USTs to soak up those dollars that aren’t settling trade anymore, reloading their balance sheets to defend their currencies during the next USD bull wave, while also creating a virtuous cycle for domestic banks to offer good returns on savings.

This is why I think there will be stronger foreign demand for USTs than is currently being accounted for in a lot of analyses out there.

The key from here will be the last point I made then, will the foreign demand for longer-dated USTs hold up enough to keep things from unraveling too quickly?

You know Powell’s enemies are sharpening their swords. There’s another ‘crisis’ around the corner that will be advertised as ‘the end of the world.’

The question is, “For whom?”