The UK economy is very strong as of late, but it’s starting to get shaken a little as the Euro-zone looks a little bit weaker, and at home people are starting to wonder how long the good times can go on; a mentality that has come about since the pain of the Global Financial Crisis. With this its of no surprise that there is weakness in the pound, especially as the USD is starting to pick up speed and look stronger.

UK economic data had been pushing the pound higher, but it has been within forecasts as of late. Last nights' data was a good example of this, with industrial production, manufacturing production and GDP estimates all in line with forecasts. Tonight is expected to see unemployment data show a slight decline, this will be priced in by markets, so one should not expect a massive jump if its within forecasts, however, a large jump would occur in the event that it exceeds forecasts and drops to 6.6%.

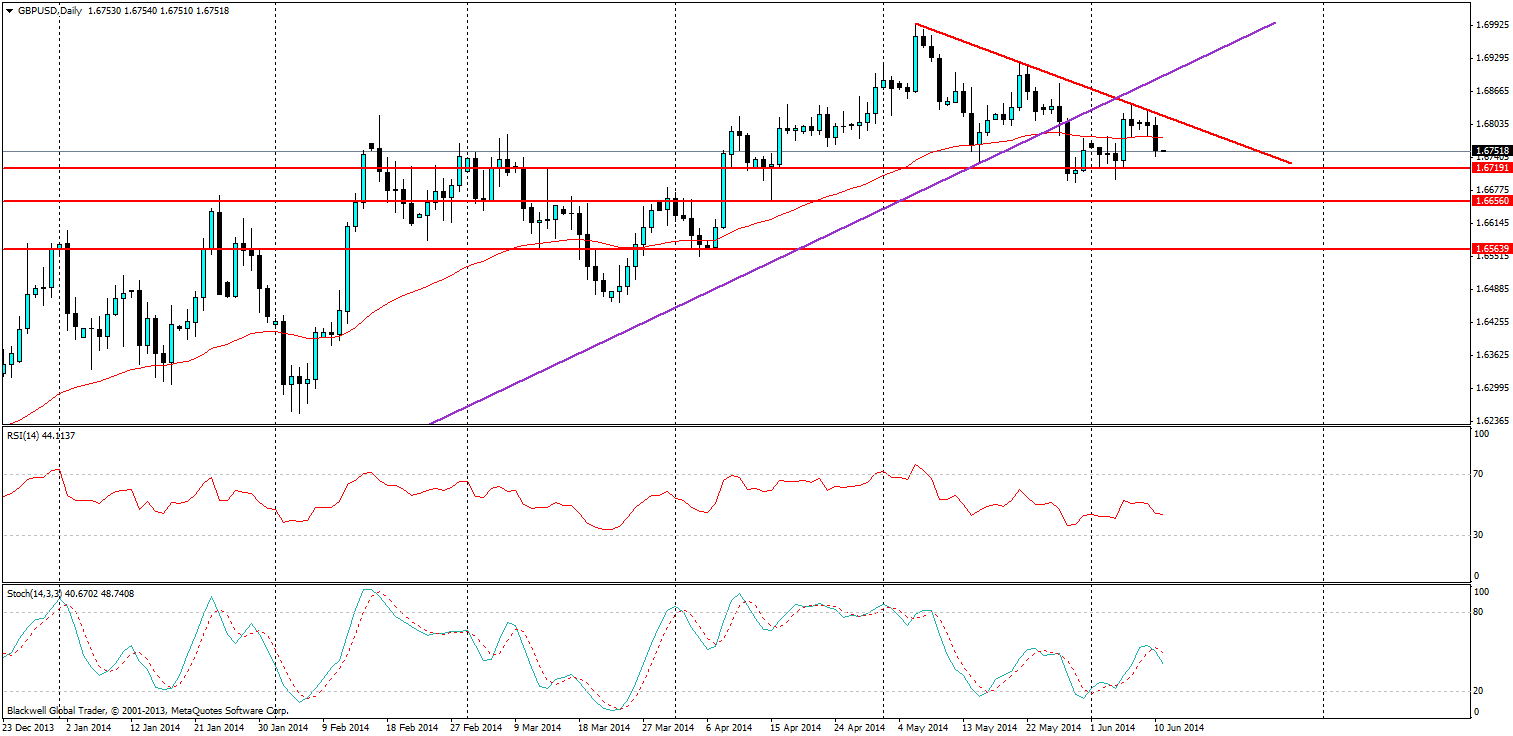

Source: Blackwell Trader (GBPUSD, D1)

With the economic data inline with forecasts, it looks certain that there may be some pull back in the medium term away from the recent highs. The bearish trend line is looking good and last night markets looked to test it briefly before heading south again. The resistance level at 1.6719 is likely to feel a fair amount of pressure, but for the most part it should hold overnight with the UK data. In the long term though it will probably look further down to 1.6656 as the bears take hold.

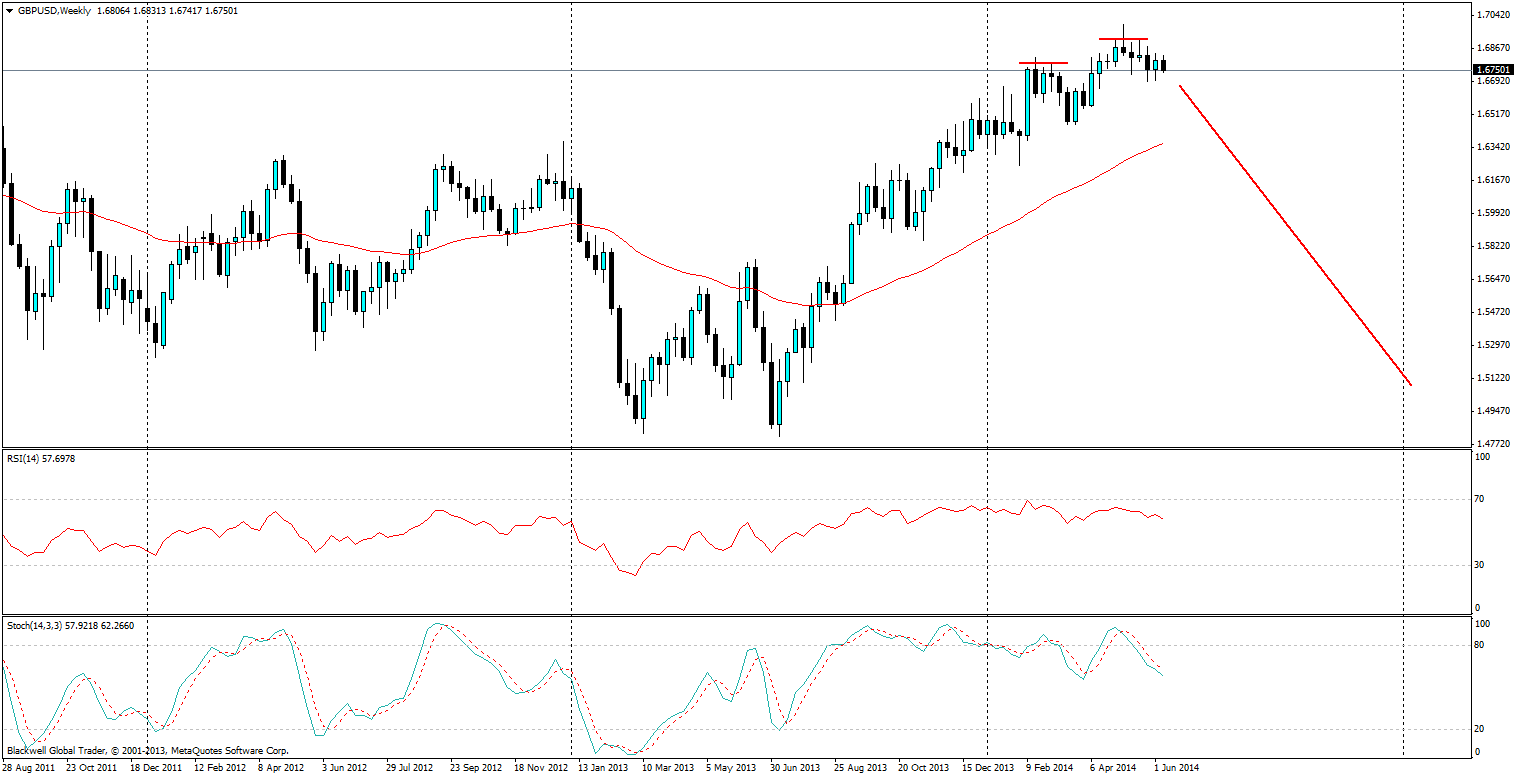

It’s worth watching the weekly chart in the long term, as we could end up with a head and shoulders pattern.

Source: Blackwell Trader (GBP/USD, W1)

Certainly when we look closely the potential for one to form is there, and markets are generally aware and self-fulfilling. So it's worth noting and paying close attention to these developments with the GBP/USD.

Either way you look at it, long term or short term expect to see further falls on the charts in the coming weeks. I personally will be looking to catch lower lows with the GBP/USD after it breaks through key resistance levels, while on the long term weekly chart I will also be paying close attention to the possibility of a head and shoulders pattern forming, or at least looking to form. The bearish trend line should also be paid close attention to, as despite the resilience of it we could see further movements higher in the event of increasingly positive data.