Leading upstream player Pioneer Natural Resources Company (NYSE:PXD) recently completed its previously announced deal with Devon Energy Corporation (NYSE:DVN) to acquire about 28,000 net acres in the Midland Basin – part of the Permian Basin in West Texas and New Mexico – from the latter for $435 million.

The acreage is spread across Martin, Midland, Upton, Reagan, Glasscock, Andrews, Dawson, Gaines and Howard counties. It has a current net production of about 1,400 barrels of oil equivalent per day (BOEPD), of which about 65% is oil. Almost the entire acreage is held by production.

The majority of the 28,000 net acres is situated in the core of the Midland Basin, where Pioneer already owns some of large positions. Of the core acreage that has been purchased, about 15,000 net acres are in the Sale Ranch area in Martin County and northern Midland County where Pioneer has drilled its most productive Wolfcamp B wells.

In concurrence with the completion of this deal and the company’s improving outlook for oil prices, Pioneer announced plans to utilize three horizontal rigs to drill the newly added Sale Ranch area locations. Also, the company intends to begin the title work immediately and expects to start the initial production from the first half of 2017.

Irving, TX-based Pioneer is an independent oil & gas exploration and production company, the asset base of which is anchored by the Spraberry oil field located in West Texas, the Hugoton gas field in Southwest Kansas and the West Panhandle gas field in Texas Panhandle.

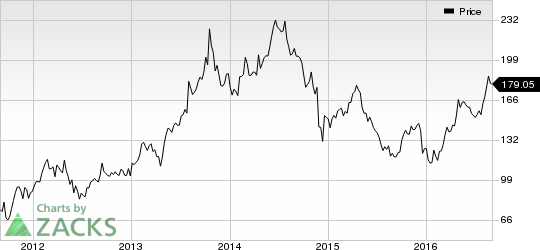

PIONEER NAT RES Price

The company has a large oil-weighted reserve base and drilling inventory with significant resource potential, which are catalysts to unlock value for shareholders. Also, the company offers a deep inventory of high-return, liquids-leveraged drilling opportunities.

However, results for the company are directly exposed to oil and gas prices, which are inherently volatile and subject to complex market forces. This, in turn, has adversely affected Pioneer’s cash flows in recent times.

As a result, Pioneer currently carries a Zacks Rank #3 (Hold), implying that it will perform in line with the broader U.S. equity market over the next one to three months.

Some better-ranked players in the broader energy sector are Gulfport Energy Corp. (NASDAQ:GPOR) and Enbridge Energy Partners, L.P. (NYSE:EEP) . Both these stocks sport a Zacks Rank #1 (Strong Buy).

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

ENBRIDGE EGY PT (EEP): Free Stock Analysis Report

DEVON ENERGY (DVN): Free Stock Analysis Report

PIONEER NAT RES (PXD): Free Stock Analysis Report

GULFPORT ENGY (GPOR): Free Stock Analysis Report

Original post

Zacks Investment Research