Here are today’s top Wall Street analyst ratings where finbox.io’s unbiased fair value estimates support the recommendation.

Top Upgrades and Buy Ratings

- Robert Baird reiterated PayPal Holdings Inc (NASDAQ:PYPL) at Outperform along with a $48 price target implying 22% upside. The price target is in line with finbox.io’s $48 fair value estimate which is derived from 8 unique cash flow analyses.

- Keefe, Bruyette & Woods upgraded DR Horton Inc (NYSE:DHI) from Market Perform to Outperform. Seven valuation models imply an intrinsic value of $35.50 per share representing 21% upside.

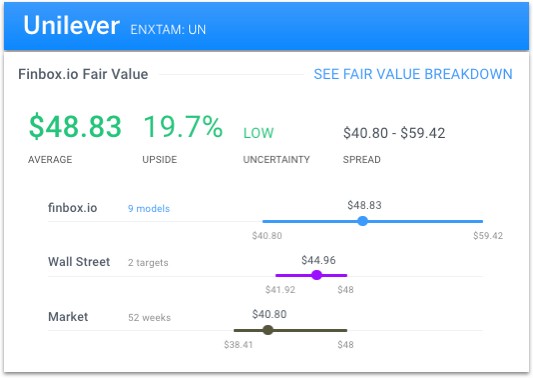

- Jefferies Group upgraded Unilever (NYSE:UL) from Hold to Buy. Nine valuation models imply that the company’s shares are 20% undervalued.

- Aegis initiated coverage on Yelp Inc (NYSE:YELP) at Buy and set a $47 per share price target. The price target is generally supported by the company’s fundamentals.

Top Downgrades

- Morgan Stanley downgraded Southern Copper Corp. (NYSE:SCCO) from Equal Weight to Underweight. Shares are currently trading at a large premium.

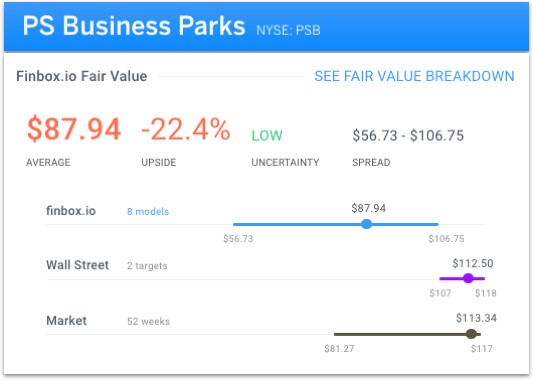

- Citigroup downgraded PS Business Parks (NYSE:PSB) from Neutral to Sell. Eight cash flow models imply the stock is 22% overvalued.

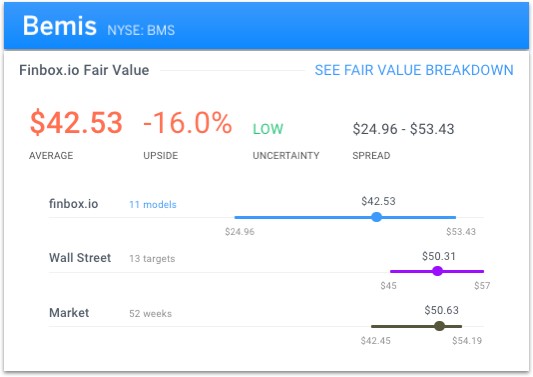

- RBC Capital Markets downgraded Bemis (NYSE:BMS) from Sector Perform to Underperform. Fundamentals support the rating change.

- Citigroup downgraded CBL & Associates Properties Inc (NYSE:CBL) from Neutral to Sell. Five separate valuation analyses conclude that the company currently has a negative 15% margin of safety.